Bitcoin Cash Price Prediction: Bears in control as price looks to dip below $250 – Confluence Detector

- BCH bears have remained in control after price charted an evening star pattern.

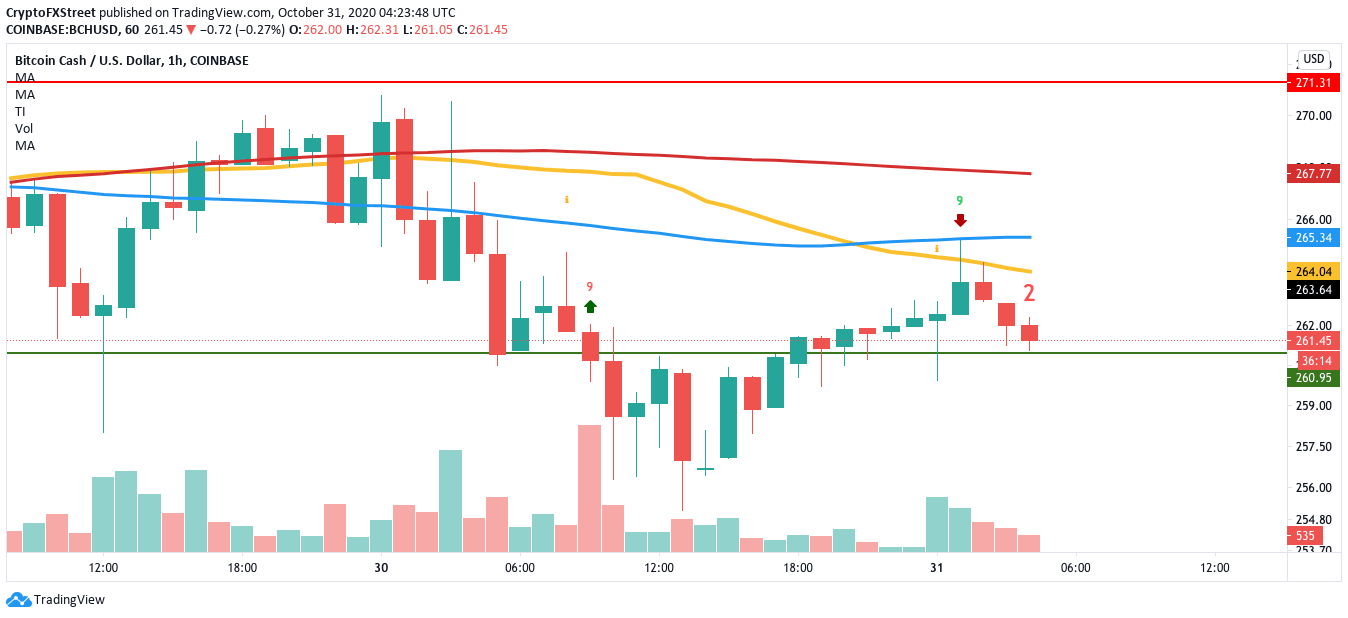

- The hourly chart has flashed the sell signal with a green nine candlestick in the TD sequential indicator.

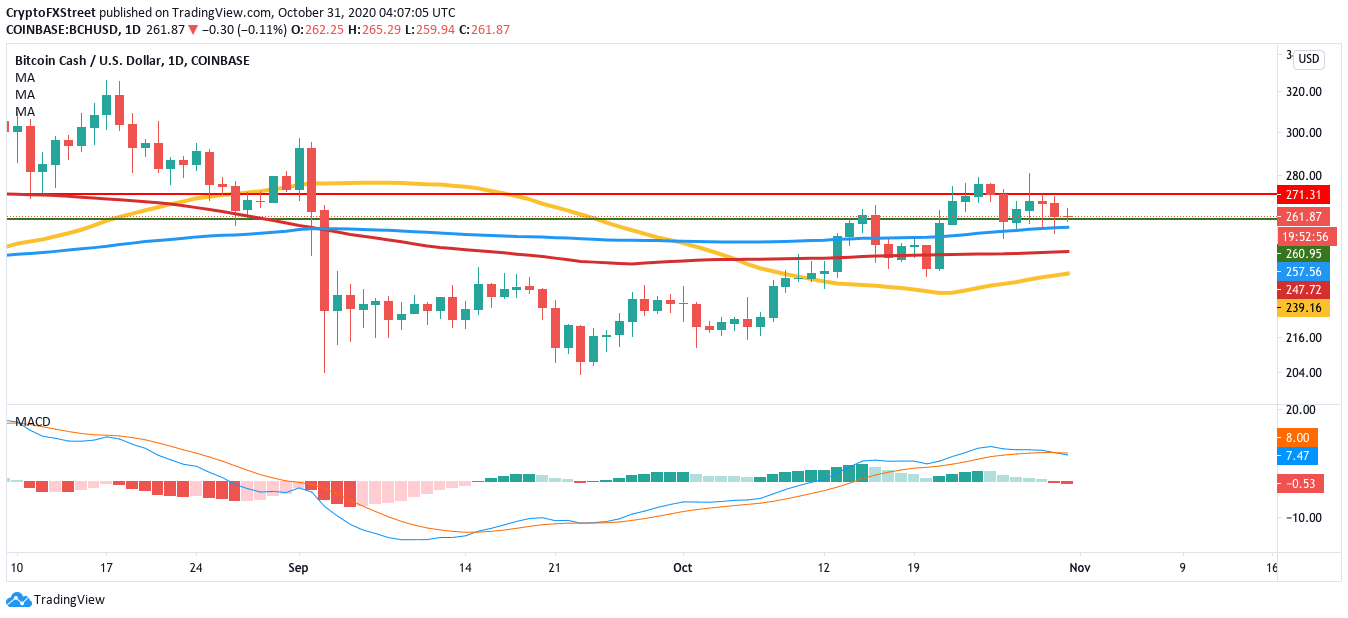

Bitcoin Cash went up from $208 on September 23 to $276 on October 24. Following this move, the bulls and bears have engaged in a tug of war for control over the market, with the price jumping up and down. At the time of writing, the Bitcoin fork charted an evening star pattern and is now trading for $262. The MACD shows increasing bearish momentum, so a further break is expected.

BCH/USD daily chart

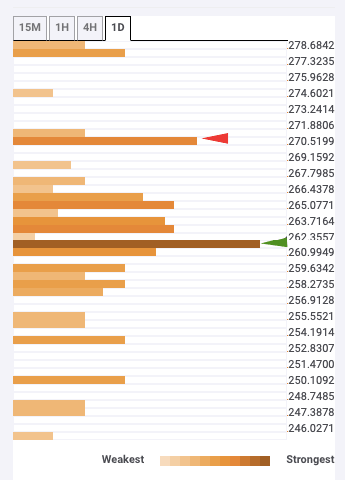

The confluence detector helps visualize strong areas of support and resistance. As you can see, $261 has critical support, which is holding the price up. BCH will look to break below this level to continue the downward trend. The 100-day SMA ($257.50), 200-day SMA ($248) and 50-day SMA ($239) provide further support on the downside.

BCH daily confluence detector

The hourly chart adds further credence to this grim outlook. As can be seen, the hourly BCH price charted a morning star pattern n October 30 and flew up from $256.60 to $264. However, at this point, the price flashed a sell signal in the TD sequential indicator, in the form of a green nine candlestick. Since then, the price has dipped under constant selling pressure.

BCH/USD hourly chart

Can the bulls flip the script?

While the overall outlook looks very bearish, the bulls can still salvage something. The key here is the $261 support wall. If it holds strong, the buyers will be able to bounce up from it and take the price to the $271 resistance line. Breaking past that barrier should take them to the $300 zone.

Key price levels to watch

For both the buyers and the sellers, the $261 support line is the key. By breaking below this level, the bears will aim to go below the $250-mark. To do so, they must break below the 100-day SMA ($257.50).

They will look to bounce up from this support and break past the $271 resistance barrier for the bulls. By doing that, they should reach the $300-mark.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.