Biggest ETF outflow: At this rate, Grayscale will be out of Bitcoin in four months

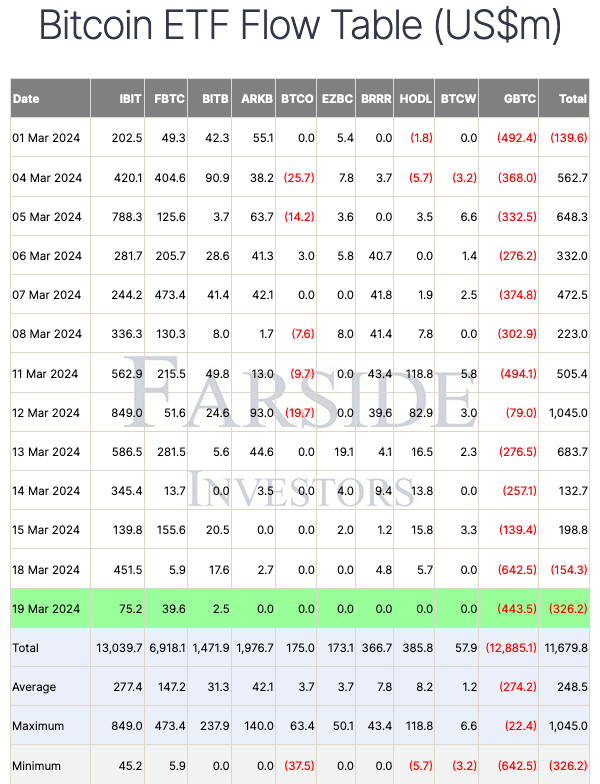

United States spot Bitcoin (BTC $63,179) exchange-traded funds (ETFs) have witnessed their largest day of joint outflows on record, with a total of $326 million being shed from the 10 funds on March 19.

As of March 19, Grayscale reported that its Bitcoin Trust (GBTC) had over $23.7 billion in assets under management. If its outflows continue at the current rate, it could be out of assets by as soon as late July.

Grayscale’s GBTC saw $443.5 million net outflows on the day, with BlackRock, Fidelity and Bitwise’s ETFs being the only funds to post net inflows, according to Farside Investors data.

Combined, the three funds generated $117.3 million in net inflows, the second-lowest inflow day for the nine new Bitcoin ETFs — excluding GBTC.

BlackRock’s iShares Bitcoin Trust (IBIT) boasted the day’s largest net inflows at $75.2 million, while the Fidelity Wise Origin Bitcoin Fund (FBTC) saw $39.6 million.

The Bitwise Bitcoin ETF (BITB) attracted just $2.5 million in net inflows — its lowest day on record — excluding the days it witnessed zero new inflows.

Flows for all 10 U.S. spot Bitcoin ETFs, green row highlights March 19. Source: Farside Investors

The ETF outflows were more than double the amount of the previous record outflow day, which stood at $158.3 million on Jan. 24 and marks the second straight day of net outflows for the funds.

The sizeable outflows came as the price of BTC fell as low as $62,400 on March 19 during U.S. trading hours, continuing its decline after touching a new all-time high of $73,835 on March 14.

In the last 24 hours, Bitcoin has fallen 5.4% and is trading at $61,173, just above its intraday low of $60,872, per Cointelegraph Markets Pro.

March 18 saw GBTC’s largest net outflow day of $642.5 million. Overall, the fund has witnessed nearly $12.9 billion in outflows in the 49 trading days since Jan. 11, when it converted from a trust to an ETF.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.