Axie Infinity price recovers from two flash crashes, hints at a 15% breakout

- Axie Infinity price looks ready for a quick 15% run-up as its recovery strengthens.

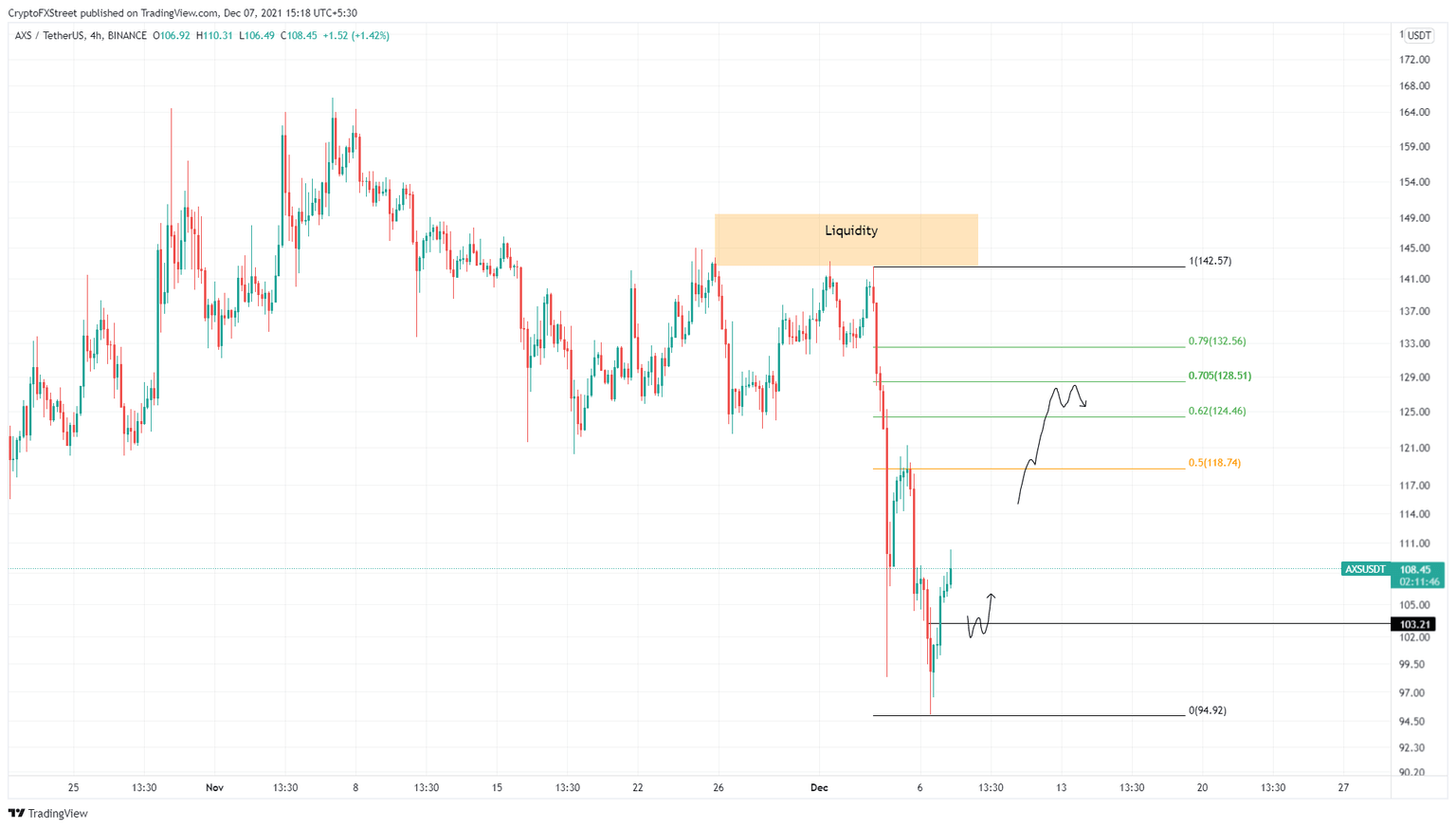

- The December 6 swing low collected liquidity below the December 4 swing low, which adds credence to the bullish outlook.

- A breakdown of the range low at $94.92 will invalidate the bullish thesis.

Axie Infinity price is recovering from its steep downtrend and is showing signs of improvement. Investors can expect AXS to pierce through the trading range’s midpoint and move higher.

Axie Infinity price eyes higher highs

Axie Infinity price has rallied 13% over the past 24 hours and is currently grappling with the December 6 swing high at $108. A swift move above this level is likely, but investors should expect a minor retracement to $103 before the upswing narrative solidifies.

Regardless of the downswing, Axie Infinity price is ready for a 10% upswing to retest the trading range’s midpoint at $118. A decisive close above this level will indicate bulls’ intentions to venture higher. In this situation, AXS could retest the 62% and 70.5% retracement levels at $124 and $128.

This move would constitute a 20% move in total. In case of a massive spike in buying pressure, however, there is a chance Axie Infinity price could retest the 79% retracement level at $132, after a 24% upswing from $106.

AXS/USDT 4-hour chart

While the conditions are looking highly viable for a move higher, Axie Infinity price needs first to flip the $118 hurdle into a support level. If AXS fails to rise past the December 6 swing high at $108 and proceeds to retest the range low at $94, it will indicate that the buyers are either unwilling or unable to push AXS higher.

A 4-hour candlestick close below this level will create a lower low and invalidate the bullish thesis for Axie Infinity price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.