Axie Infinity Price Forecast: AXS bulls hints at 60% upside

- Axie Infinity price is still under pressure as moving averages tripped bulls.

- AXS still delivers bullish signs as the fade remains contained.

- Expect a bullish breakout soon that could lead to a major rally by April.

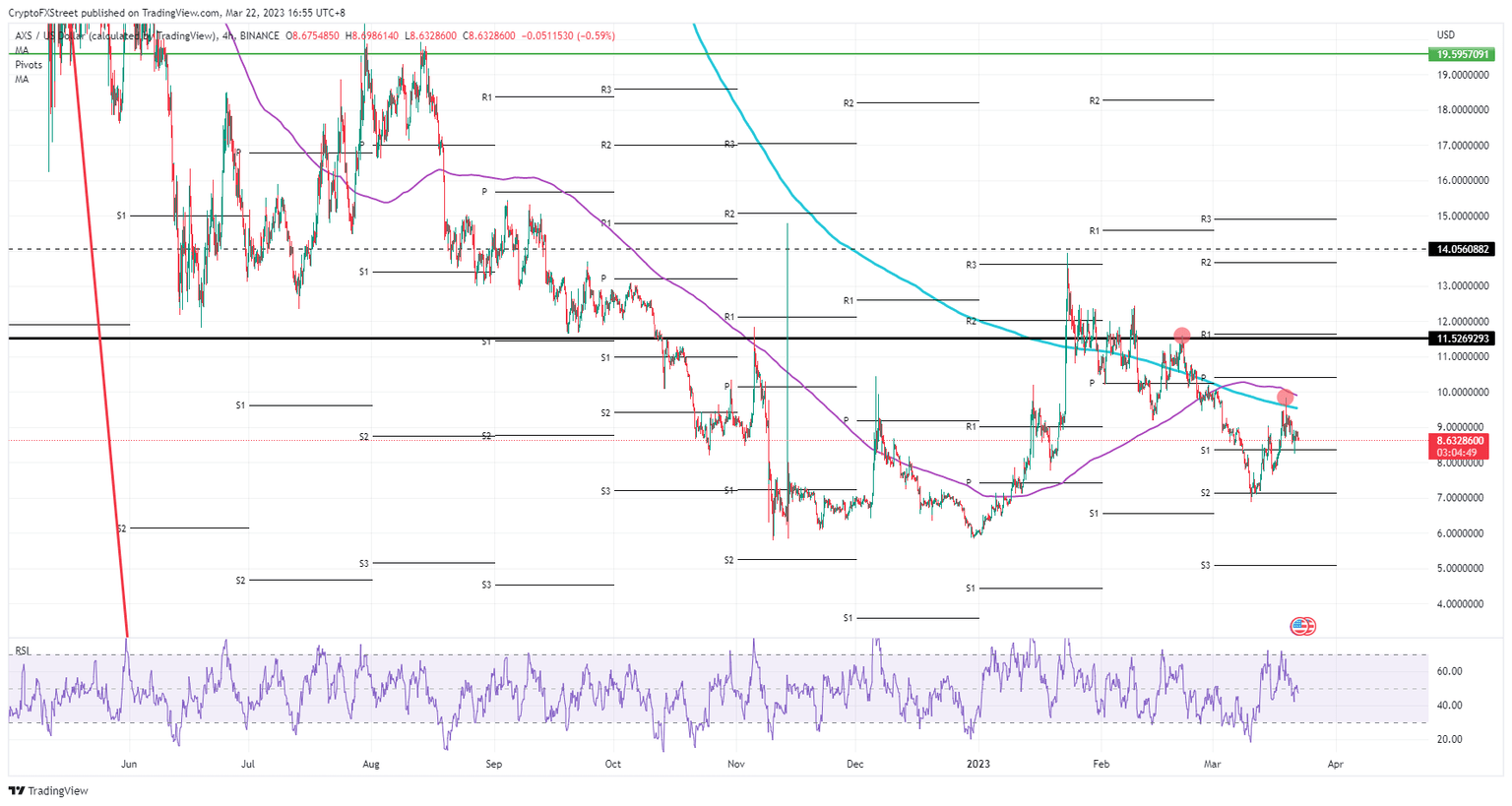

Axie Infinity (AXS) price is still selling off on the back of a bull trap that formed on the back of the breakout above the 200-day Simple Moving Average (SMA). Although this is a severe blow for bulls, the fade still remains limited. A clear consolidation is ongoing with bulls and bears being pushed toward each other and could see a breakout soon that elevates Axie Infinity price toward $14.05.

Axie Infinity price set to stage a Usain Bolt rally

Axie Infinity has been sliding lower since mid-February after price action nearly peaked at $14.05. What followed was a long slide lower with its turning point in early May. Since then higher lows have been printed in daily performances, and a clear consolidation is happening as we speak.

AXS is thus primed to soon test the waters again at that 200-day SMA near $9.55 and $9.91 for the 55-day SMA. With the ASEAN Gaming Expo ongoing this Wednesday and later this week, some broad investor inflow could be seen filtering in on the back of that. Quite quickly AXS could be hitting $11.52 where a break above would see a very quick push higher toward $14.05, as seen in February.

AXS/USD 4H-chart

The bigger risk to the downside in the near term is that AXS is very cyclical. Proof of that can be found in the Relative Strength Index (RSI) where Axie Infinity price clearly each time goes through a downtrend cycle with a bounce toward an uptrend cycle. Seeing where the RSI is now, a drop lower toward $7 could be the initial outcome before the upswing gets underway later this year.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.