Axie Infinity price at risk of losing 30% in market woes

- Axie infinity price breaks below a critical threshold.

- AXS price hangs by a thread and could drop below $40 if another round of dollar strength kicks in.

- Expect to see AXS drop towards $30 again before bulls can step in – with the RSI then also oversold.

Axie Infinity (AXS) is rolling over this Monday morning as the sigh of relief quickly switches to a sigh of panic from investors. As traders prepare for the week to come, a six-fold risk event has been identified, with big tech reporting this week and investors making similar assumptions based on the market’s reaction to Netflix's earnings. With that negative mood overshadowing markets, expect dollar strength to lead to further declines in AXS price towards $30, printing a new low for the year.

AXS price sees bearish mood weighing with tail risks mounting

Axie Infinity price dropped nearly 10% in the ASIA PAC session today as investors reassessed the situation following the French elections, which now no longer present a tail risk for the altcoin. Where a bullish tone was expected, what positivity there was, turned out to be short-lived as dollar strength came in and pushed almost every cryptocurrency onto the back foot. Investors look absent as with the earnings season this week, big tech names are on the docket to report.

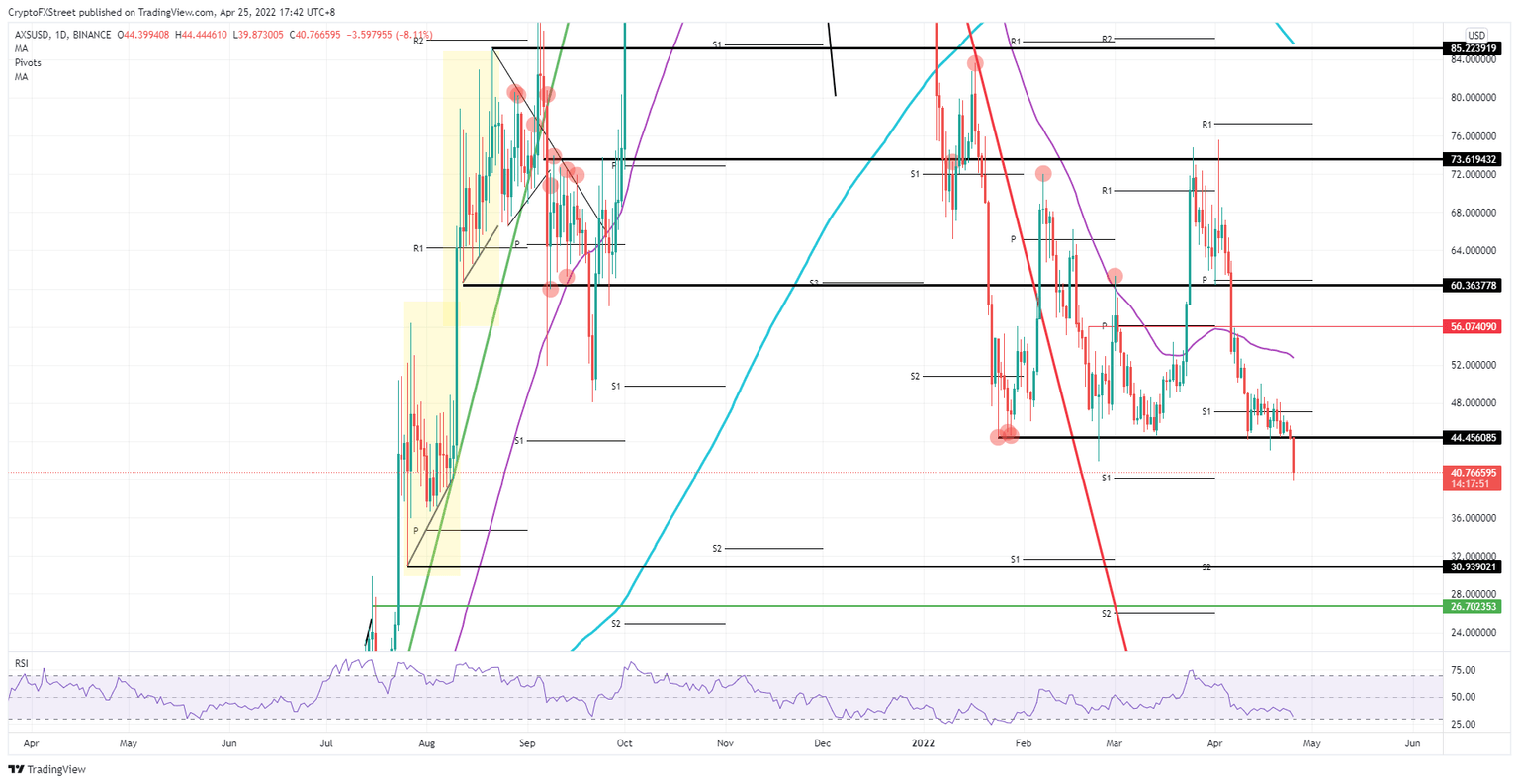

AXS price pierced through $44.45, the support underpinning any bullish move in 2022, and with that, opened the door for a more profound drop. Although new lows have been printed for 2022, expect to see more new lows with $30.93 on the cards as the monthly S2 support level coincides with that low of July 26. That level is due for another support test, and with the Relative Strength Index (RSI) firmly in oversold territory, expect to see an uptick at that level from the bulls.

AXS/USD daily chart

Big tech names in the Nasdaq could still create a tailwind in cryptocurrencies given their correlation. Should any of the big tech stocks report solid and good earnings in contrast to what Netflix reported last week, expect to see investors shaking off their concerns and pushing price-action back above $44.45. Another jump could see gains towards $52.00 and $60.36, should other tech stocks later this week print good earnings.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.