Axie Infinity presents buy opportunity before AXS hits $170

- Axie Infinity price action develops an insanely powerful and rare early bullish reversal pattern.

- Corrective Wave in Elliot Wave Analysis complete.

- Downside risks remain but are limited in scope.

Axie Infinity price action completes an A-B-C Corrective Wave in Elliot Wave Analysis, giving strong credence to an established low. An increase of more than 60% is projected from these current lows.

Axie Infinity price prepares for a mega bounce

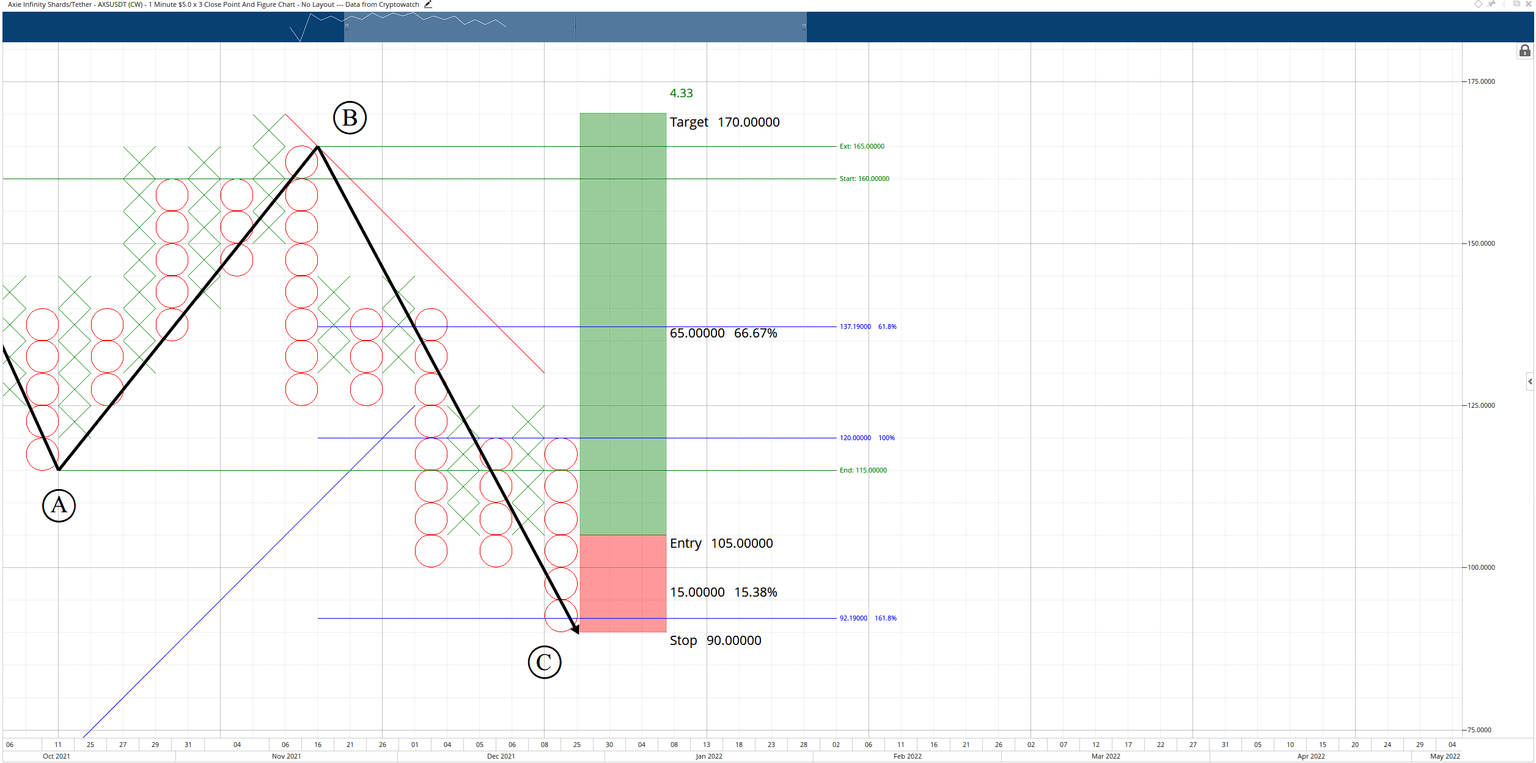

Axie Infinity price action has an outstanding bullish early entry opportunity coming up. An A-B-C Corrective Wave was likely completed when Axie Infinity hit the 161.8% Fibonacci retracement near $90. That move simultaneously created the conditions necessary for one of the most sought-after bullish reversal patterns in Point and Figure Analysis: the Bullish Shakeout.

The Bullish Shakeout pattern is only valid if an instrument is already in an uptrend – which Axie Infinity is. Additionally, the pattern is only valid if two to three Os form below, at minimum, a triple-bottom – which Axie Infinity has.

The theoretical long entry is a buy stop order at $105, a stop loss at $90, and a profit target at $170. The trade idea represents a 4.33:1 reward for the risk. A three-box trailing stop would help protect any implied profit post entry.

AXS/USDT $5.00/3-box Reversal Point and Figure Chart

The trade idea is invalidated if AXS moves to $80. However, it can move as low as $85 before the entry triggers and remain valid. Traders should expect some resistance near the bear market trend line at the $125 value area.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.