Axie Infinity continues to drift lower to test $65

- Axie Infinity price struggles to hold $100 as support.

- Profit-taking in the metaverse and gaming token space to continue.

- Upside potential exists despite a bearish short-term outlook.

Axie Infinity price continues to trade lower, entering into significant bear market structure within the Ichimoku Kinko Hyo system. As a result, profit-taking is expected to continue as speculators look to other cryptocurrencies with better long opportunities.

Axie Infinity price action is very bearish; Volume Profile suggests a swift drop could occur

Axie Infinity price is trading against two key resistance levels. The first is the Tenkan-Sen at $106.50; the second is the Chikou Span facing resistance at $101.50. The near term support is just a sliver of a high volume node in the Volume Profile at $101.

The volume profile thins out considerably below $93. When it falls into a thin volume profile, an instrument's general behavior is generally a swift move through that zone and to the next high volume node. For Axie Infinity price, that next high volume node is at $65.

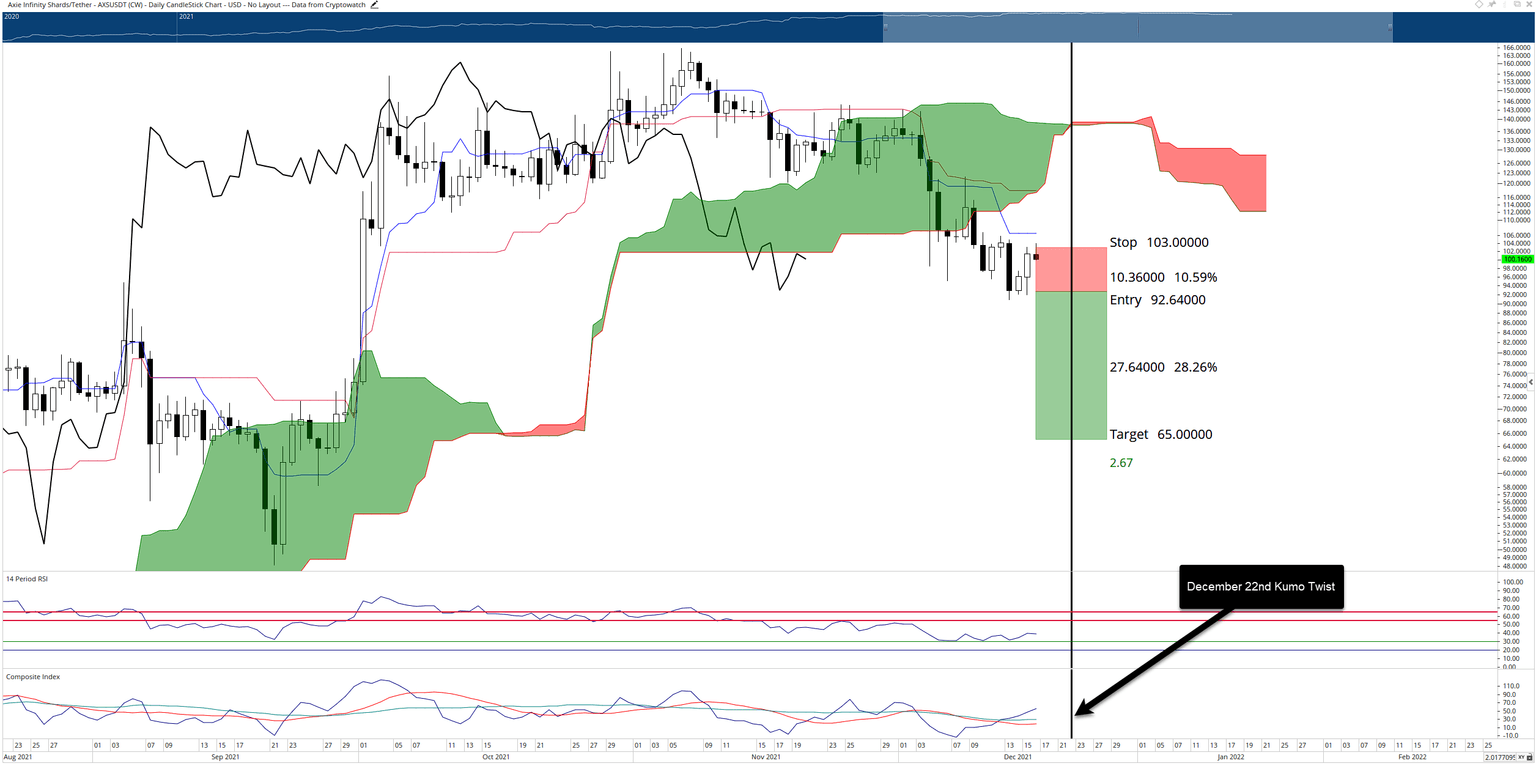

A theoretical short opportunity exists if a daily close occurs below the December 13 close. The short idea would be a sell stop order at $92.64, a stop loss at $103, and a profit target at $65. The theoretical short entry is only valid if the daily close is at, or slightly below, the $92.64 price level.

AXS/USDT Daily Ichimoku Chart

However, traders should watch out for the Kumo Twist coming up on December 22. Kumo Twists can often be turning points for any instrument that has been trending as it approaches the date of the Kumo Twist. Axie Infinity has most certainly been trending lower and at an accelerated rate. Therefore, a bounce on December 22 to test the Kijun-Sen near the $110 - $115 value area is the likely move around that date.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.