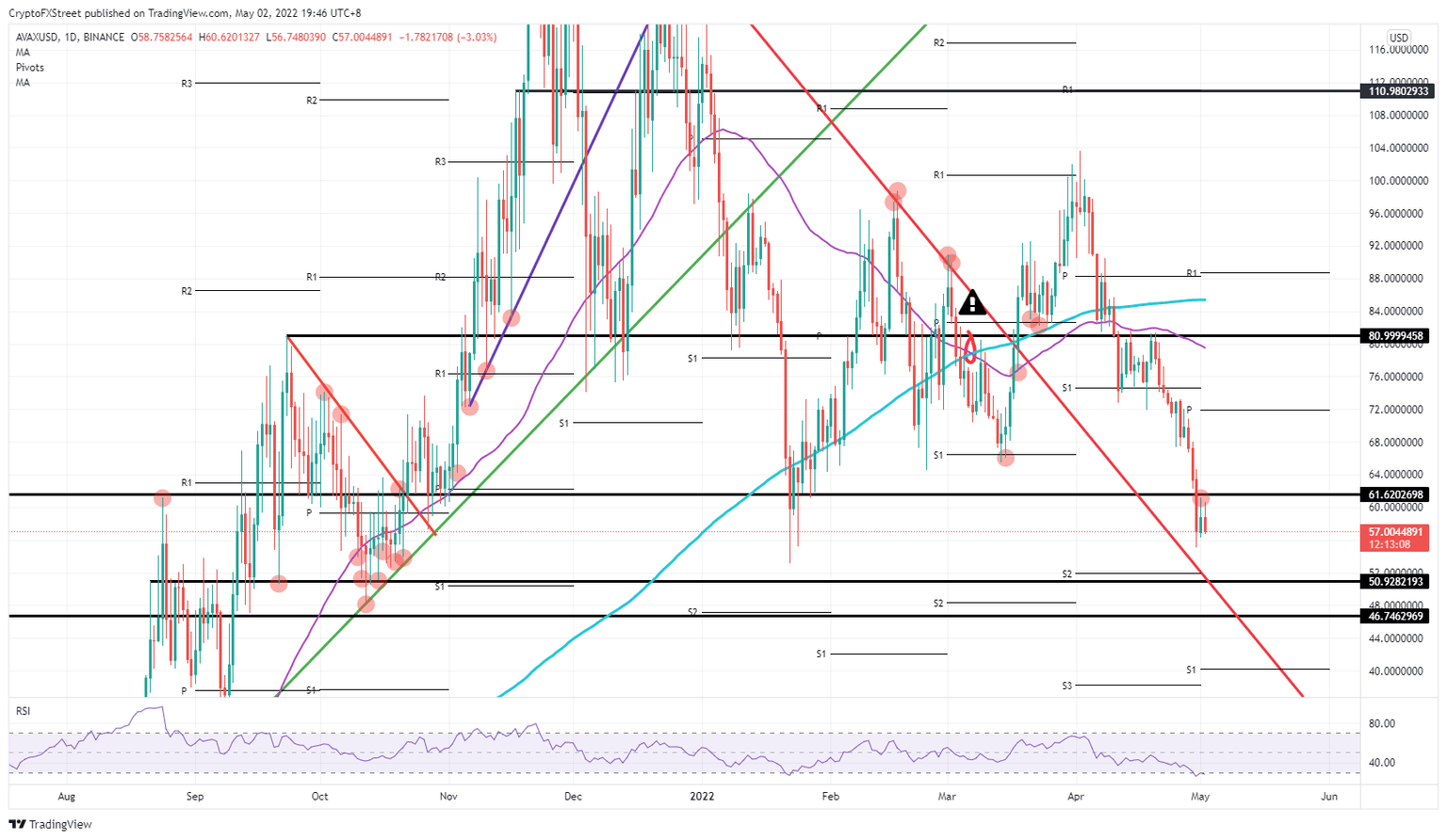

AVAX price prediction: 57% pop forecasted once Avalanche price hits rock bottom at $50

- Avalanche price sees a bitter rejection on the topside on Sunday.

- AVAX price sheds near 3% in ASIA PAC session.

- Expect a further dip towards $50 before AVAX price sees a rally kicking off.

Avalanche (AVAX) price is not in good shape, certainly not with the strong rejection bulls got on the topside at the highs on Sunday at $61.62. From that point on, AVAX price has been tanking again, shedding 3% of its value already or $1.7 on intraday trading during the ASIA PAC session. A floor does not look to be present nearby, and although the Relative Strength Index (RSI) is trading oversold, expect to see yet another push lower towards $50.93, which could be the turning point for the downtrend into an uptrend.

AVAX price needs to shed 18% before gaining 50%

Avalanche price is set to drop like a stone as the recovery on Sunday from bulls was a move that got cut short quite quickly with a firm rejection against $61.62, which is a historic pivotal level. Although the RSI is trading below 30 in oversold territory, AVAX price does not have any supportive handles nearby to bounce off, or to at least gather some effort from bulls to overhaul the selling power of bears. It looks as if Avalanche price will first need to look for solid support, before it can spark a turnaround.

AVAX price first needs to dip lower to look for a level where bulls can present a united front, joining forces and generating the volume needed to overtop the selling pressure that currently weighs. Once AVAX price hits $50.93 expect to see a turnaround. That level coincides with the red descending trendline and a pivotal historical level, ideal for a bounce and rally back up towards, first $61.62, and then subsequently $81.

AVAX/USD daily chart

Already this first trading day of the week, a few heavyweight headlines came out of Germany committing to cut its dependency on Russian gas, but on the back of that, Hungary is set to veto that move, possibly adding to more unresolved issues and no new sanctions to come from the EU bloc as division only enlarges its weaknesses. That tail risk is set to grow further as the Russian squeeze on Ukraine persists. Expect the dollar to further gain weight and weigh on AVAX price like gravity on people, pulling price action towards $46.75.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.