AVAX Price Prediction: Avalanche set to crash by 30%

- Avalanche price drops 5% in ASIA PAC trading after Macron secures a second term.

- AVAX price sees investors fleeing into safe havens, with dollar pressure weighing on markets.

- Investors fear more disappointments as the earnings season comes under speed, shedding risk assets.

Avalanche (AVAX) price was set to jump significantly on Monday morning, but instead, a counterintuitive move occurred as short-term pressure was in the spotlight with the forecasted French election outcome in the background. Investors fear that earnings season this week might hurt the Nasdaq index substantially, as big tech companies are reporting. In the spillover, cryptocurrencies could get hurt even more with the correlation to the Nasdaq and the flight to a safe-haven dollar as double bearish pressure.

AVAX price unable to withstand double bearish pressure

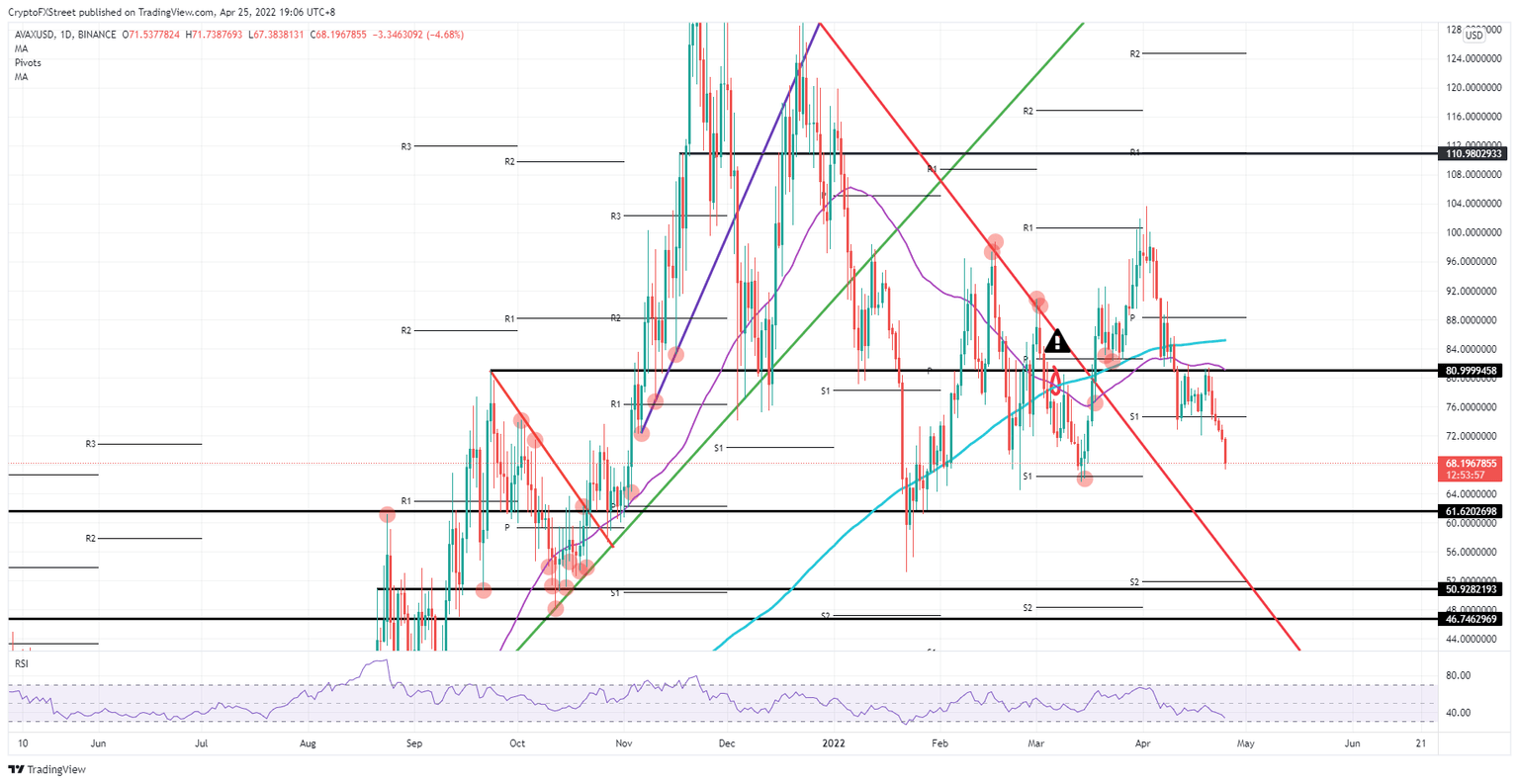

Avalanche price looked promising last week with another test of $80.99, set to jump above both the 55-day and the 200-day Simple Moving Average (SMA). But instead, the 55-day SMA proved to be a big gap to the upside and pushed price action back down towards $72.00. That last level broke to the downside and lost roughly 5% as investors fled to safe havens, with the spotlight quickly shifting away from the French elections and the discovery of some big tail risks for the week.

AVAX price will first look for support at around $61.62, amounting to 14% of incurred losses. But that level has not had the best track record yet for catching any falling knives or nosedive moves, as seen at the beginning of the year. Expect rather, a continuation towards $50.92, which looks a bit stronger and holds another support level at $46.74, perfect for a fade-in trade.

AVAX/USD daily chart

Earnings could surprise to the upside and see investors scramble to rebuild long-positions in Nasdaq quickly. With the already-mentioned correlation, a tailwind could pull cryptocurrencies up and see a revisit of $80.99 before jumping possibly even to $110 in case earnings remain surprising to the upside throughout the week. That would mean a 60% profit on the table if that scenario materialises.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.