AVAX price could present another buying opportunity despite 424% gains in under two months

- AVAX price has registered a whopping 424% gain in just 56 days.

- This rally is likely to see a quick retracement to key support levels – $41.54, $37.79, $34.34 or $34.04.

- Invalidation of the bullish thesis will occur if Avalanche produces a weekly candlestick close below $20.68.

Avalanche (AVAX) price shows exhaustion on both the higher and lower time frames. Investors can expect the next week to start with a correction that will be a buying opportunity before AVAX price kickstarts its next leg.

Also read: AVAX price is at an inflection point as Avalanche fills three-day FVG

AVAX price likely to pause its uptrend

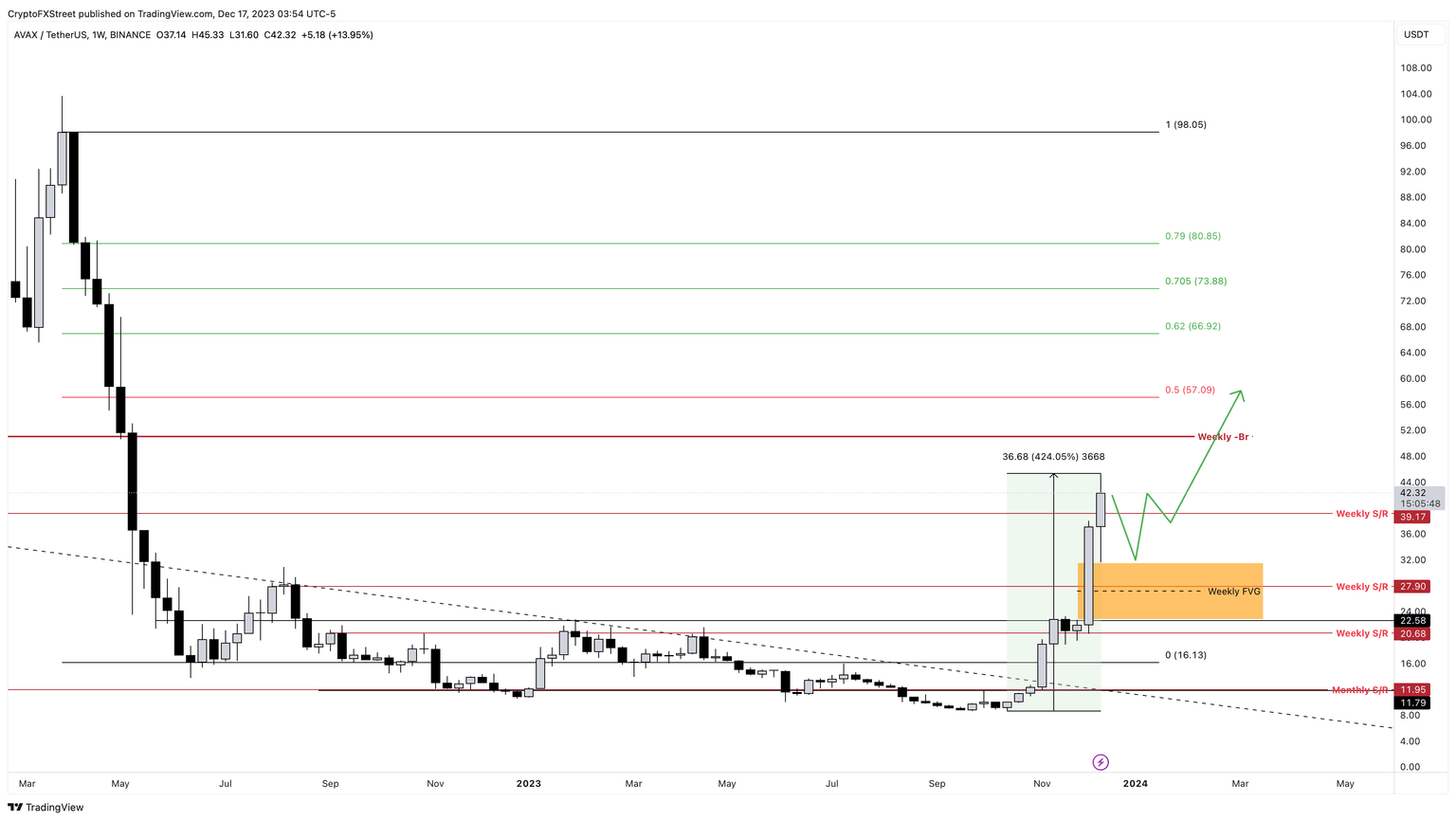

AVAX price set up a local top this week at $45.53 and currently trades at $42.13. The uptrend that led to this move created an imbalance on the weekly chart, extending from $31.60 to $22.74. This surge in buying pressure is likely to stay flat until next week, which would push Avalanche price into consolidation and likely tag the aforementioned imbalance. This range is a key area for long-term holders to accumulate.

Despite rallying 424% in just 56 days, AVAX price has not even retested the $57.09, which is midpoint of the 86% crash witnessed between March and June 2022. Hence, an intervention of the sidelined buyers could catalyze , AVAX price to kickstart the second leg of the uptrend and tag $57.09.

From the imbalance’s upper limit of $31.60, this move would constitute roughly 80% gain.

In a highly bullish case, where Bitcoin price does not retrace 20% to 30%, altcoins are going ot enjoy prolonged bull rally. This would mean AVAX price could extend the rally and tag 62% and 70% retracement levels at $66.92 and $73.86, respecitvely.

AVAX/USDT 1-week chart

Avalanche bulls likely to remain flat in the short-term

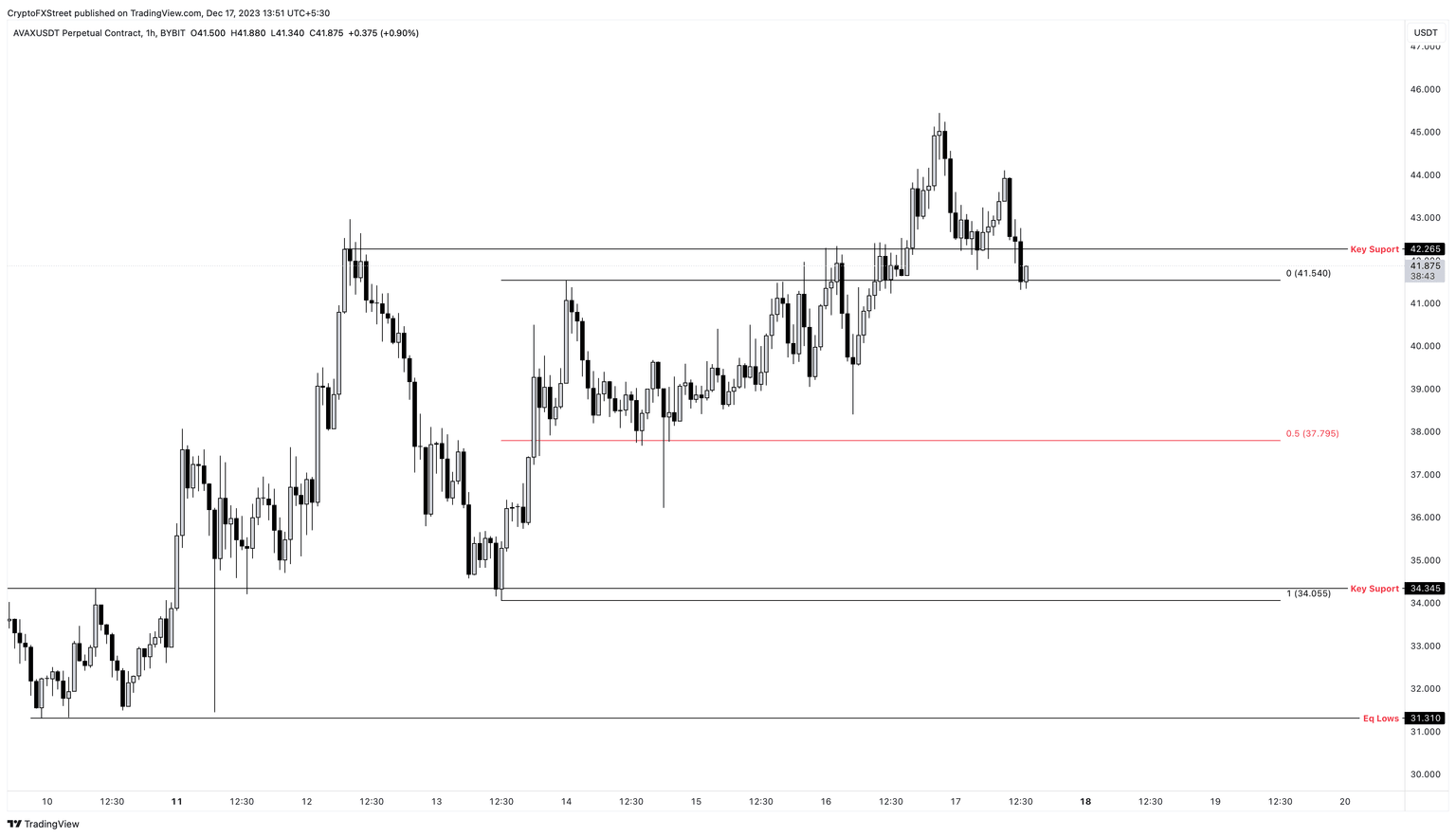

The one-hour chart of AVAX price shows it is hovering between two key support levels $42.26 and $41.54. A flip of the latter barrier into a resistance level would confirm that bulls are taking a break. In such a case, Avalanche price would likely consolidate between the $41.54 to $34.05 range.

This sideways could see AVAX price revisit the range’s midpoint at $37.79 or even sweep the range low at $34.05. In extreme cases, patient buyers could get an opportunity to accumulate at the sweep of the equal lows formed around $31.31.

Interestingly, this level coincides closely with the weekly imbalance’s upper limit at $31.60, making it a high probability reversal zone.

Read more: Avalanche Price Prediction: AVAX could rally 40% if it overcomes this barrier

AVAX/USDT 1-hour chart

On the other hand, if AVAX price produces a weekly candlestick close below $20.68, it would create a lower low and break the bullish market structure. This move would invalidate the bullish thesis, allowing bears to target a retest of the support level at roughly $12.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.