Avalanche Price Prediction: A sharp decline in the making?

- Avalanche price rallies towards the $32 target zone.

- AVAX price has printed a subtle bearish divergence.

- Invalidation of the downtrend scenario is a breach above $34.75.

Avalanche price shows a potential sell-off underway, and key levels have been identified.

Avalanche price headed south?

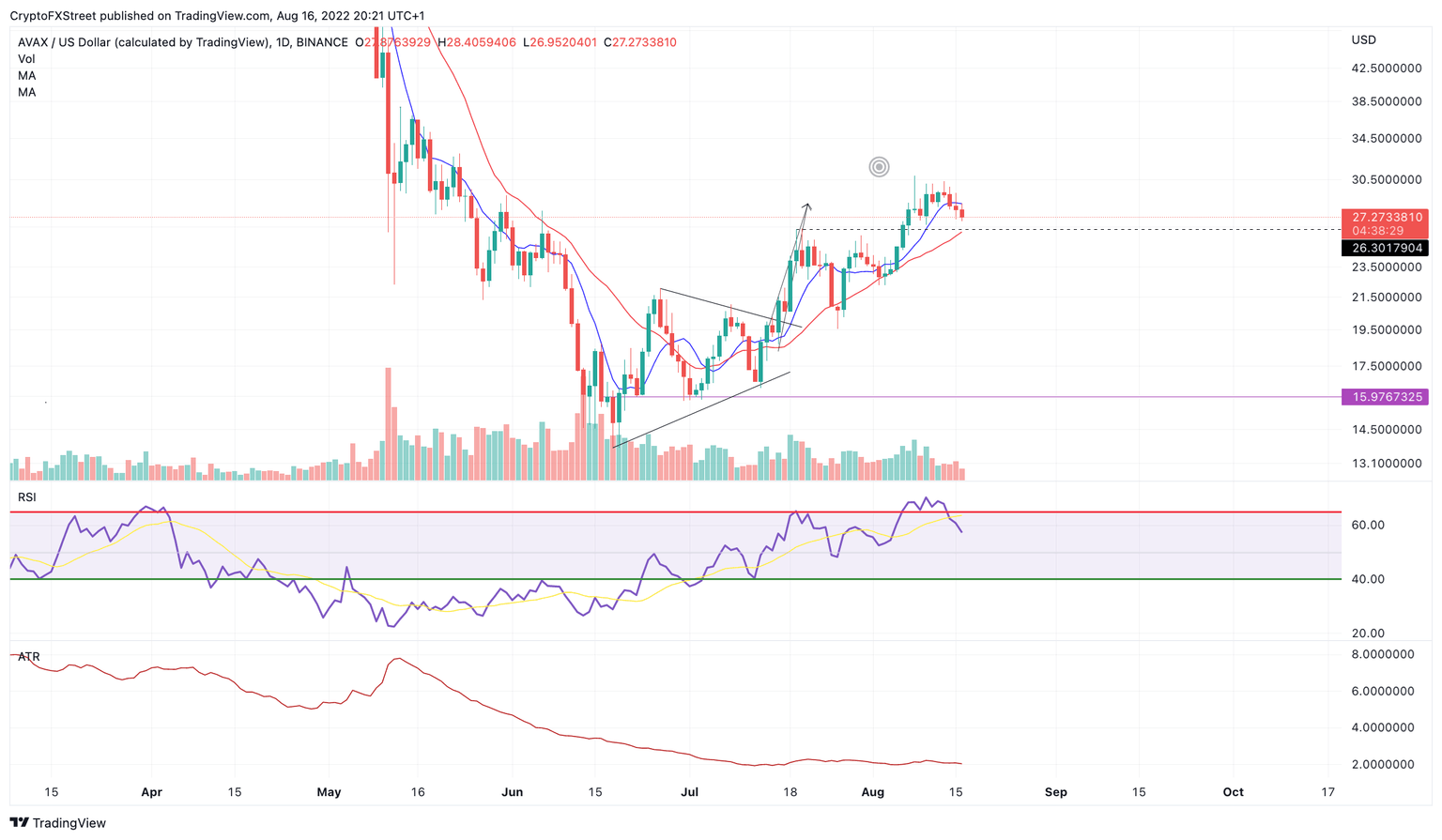

Avalanche price could be depicting early evidence of liquidation underway as the technicals show subtle bearish cues. AVAX price has rallied 90% since July 1st, printing a new monthly high at $30.86. The Relative Strength Index displays a subtle bearish divergence near the newfound August daily highs. Such a cue could be overlooked by traders scalping the AVAX price on smaller time frames. If the technicals are correct, a sharp decline could result from the RSI reading targeting $18.

Avalanche price currently trades at $27. As a profit-taking consolidation is beginning to tip over in the bear’s favor, sellers willing to take a risk can enter the market now as the bulls have lost support from the 8-day simple moving average. A safer entry could be to wait for a break and retest the 21-day simple moving average, which currently hovers just below $26.12.

AVAX/USDT 1-Day Chart

Using the Average True Range indicator, the bears can place their invalidation level for the bearish scenario at $34.75. If the bulls breach this level, an additional hike towards $40 could result in a 48% increase from the current AVAX price.

In the following video, our analysts deep dive into the price action of Avalanche, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.