Arguing the case for a Cardano price pullback to $0.35

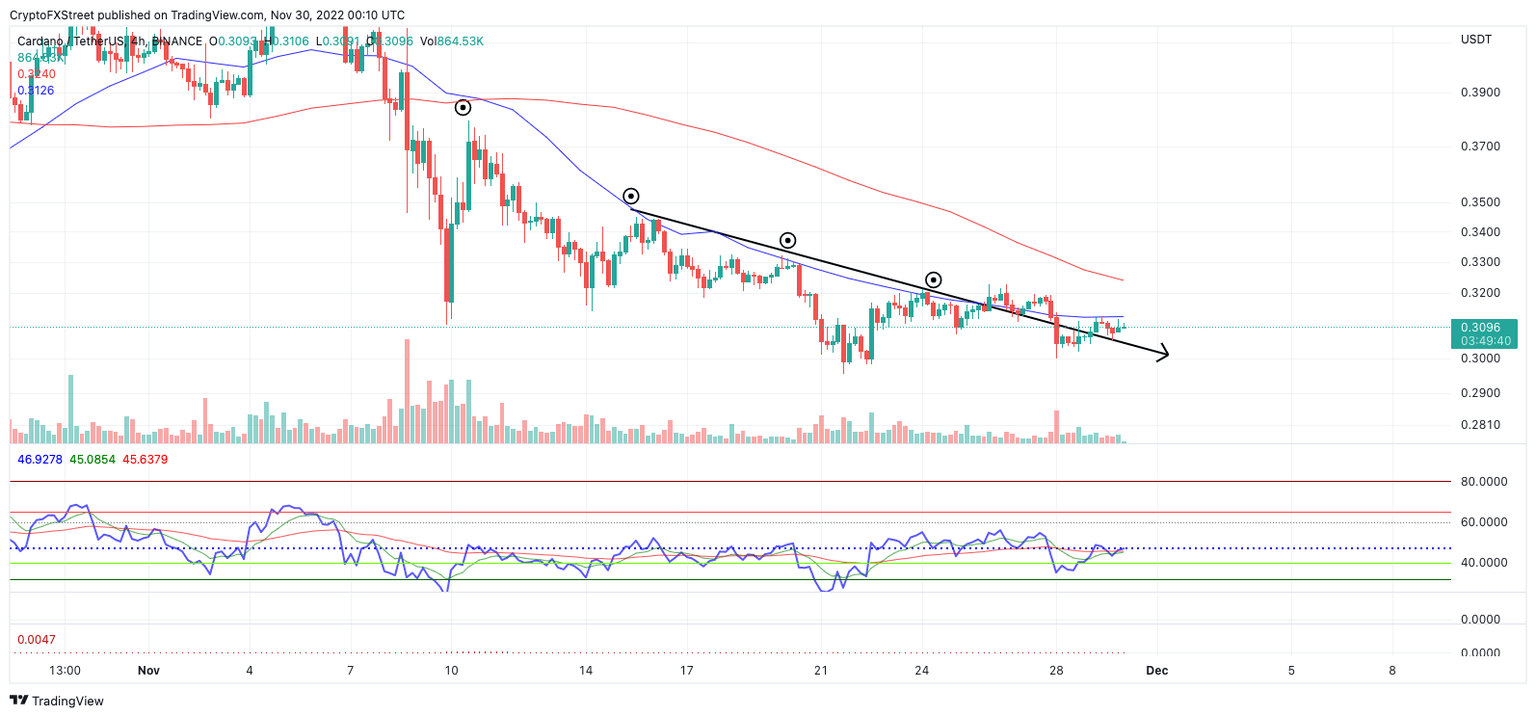

- Cardano price has produced four lower highs throughout the month, with three connected by a recently breached trendline.

- A hurdle above $0.322 could create an additional 12% upswing.

- A four-hour candlestick close below the $0.304 level would invalidate the bullish potential.

Cardano price shows unbreached liquidity levels within arms reach of the current auctioning price. Traders should keep their eyes on the ADA price action as a profitable opportunity could present itself in the coming hours.

Cardano price is likely to return to $0.350 eventually

Cardano price may be able to retaliate against the bullish onslaught that has persisted throughout November. During the month, the bears produced four rejections, each at a lower price than the previous. The consistent win rate portrayed by the bears has likely enticed retail traders to join the trend and creates significant liquidity above each swing high.

Cardano price currently trades at $0.309, below the most recent swing high at $0.322. The bulls have failed their first attempt to hurdle the 8-day exponential moving average, but the rejection has provoked a retest of a trendline that connects the last three swing highs.

If the ADA price stabilizes above the aforementioned level, the subsequent retest of the 8-day exponential moving average could induce a much larger counter-trend rally.

ADA/USDT 4-Hour Chart

The first target to aim for will be the 21-day simple moving average at $0.323. A 4-hour candlestick closes above the moving average could induce a rise toward the third swing high established on November 15 near $0.35. The bullish scenario creates a potential for the Cardano price to rise by 11%.

Still, the technicals are subject to evolve and remain bearish. A 4-hour candle stick close below the retesting trend line would create a potential for an 11% decline targeting the $0.280 price zone.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.