Are investors selling the news, or is Uniswap primed for higher highs?

- Uniswap unveils v3 of the protocol ahead of the mainnet launch in May.

- The upgrade gives liquidity providers more control and access to new flexible and efficient features.

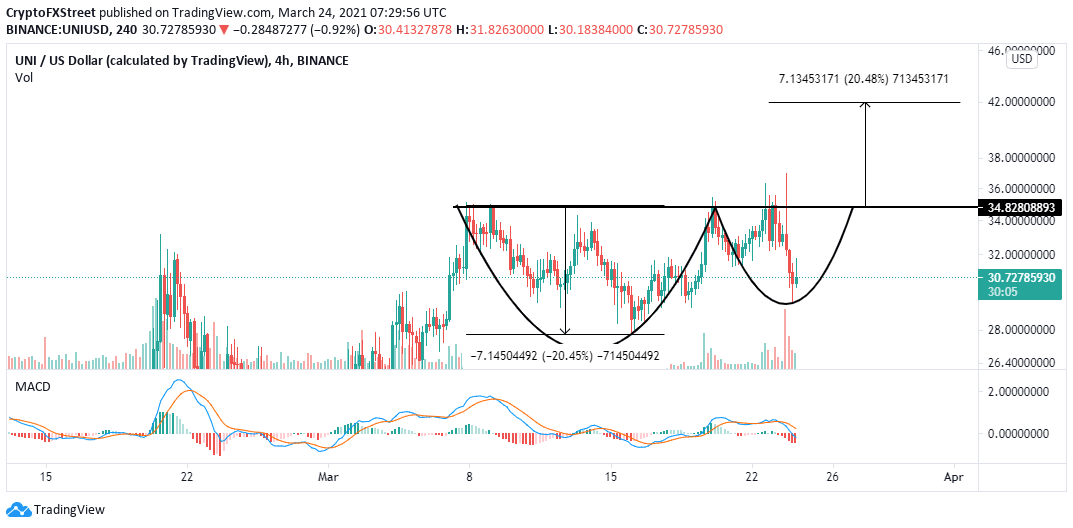

- Uniswap forms a cup and handle pattern, hinting at a 20% upswing to $42.

Uniswap is moving closer to the launch of version 3 (v3) of its protocol. The upgrade has been designed to make Uniswap one of the most flexible and capital-efficient protocols. At the time of writing, the Uniswap v3 is live and open to the public. However, the mainnet is expected to launch on May 5.

Uniswap v3 overview

According to details released by the Uniswap development team, the upgrade focuses on concentrated liquidity, allowing "individual liquidity providers (LPs) granular control over what price ranges their capital is allocated to." All the individual positions are then grouped into a single pool that creates a combined curve for all participants to trade against.

Simultaneously, the Uniswap v3 ensures that the LPs are compensated for the different degrees of risk they take. Some of the features that make Uniswap v3 the most flexible and efficient for automated market makers (AMMs) include 4,000x capital efficiency for LPs, low slippage trade execution, and allowing LPs to increase their exposure to their selected assets.

Uniswap v3 has made the process of integrating oracles cheaper and easier. Moreover, "the gas cost of v3 swaps on Ethereum mainnet is slightly cheaper than v2." The news regarding the launch has been received well by the community, with some members believing that it is the best-decentralized exchange (DEX) in the market.

Uniswap v3 is now public, after eighteen months of research and development: https://t.co/V0BRXgCtnI

— Dan Robinson (@danrobinson) March 23, 2021

I think it’s the best DEX design on the planet.

If you've heard me cryptically address a problem by saying that "Uniswap v3 fixes this," now I can finally explain why.

1/

Uniswap rebounds from the dip

Uniswap is exchanging hands at $30 following a bounce from the recently traded all-time high of $36. Support around $30 played a key role in stopping further losses—meanwhile, a cup and handle pattern on the 4-hour chart points toward a potential 20% breakout. A break above the resistance at $35 will confirm the impending upswing to $42.

UNI/USD 4-chart

The Moving Average Convergence Divergence (MACD) indicator shows that the uptrend is still in jeopardy and may get sabotaged or delayed in the short -term. This indicator tracks the asset's trend and measures its momentum. A signal to sell appears when the MACD line (blue) drops below the signal line. For now, Uniswap's least resistance path is downwards.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren