Uniswap Price Forecast: UNI on the verge of new all-time highs

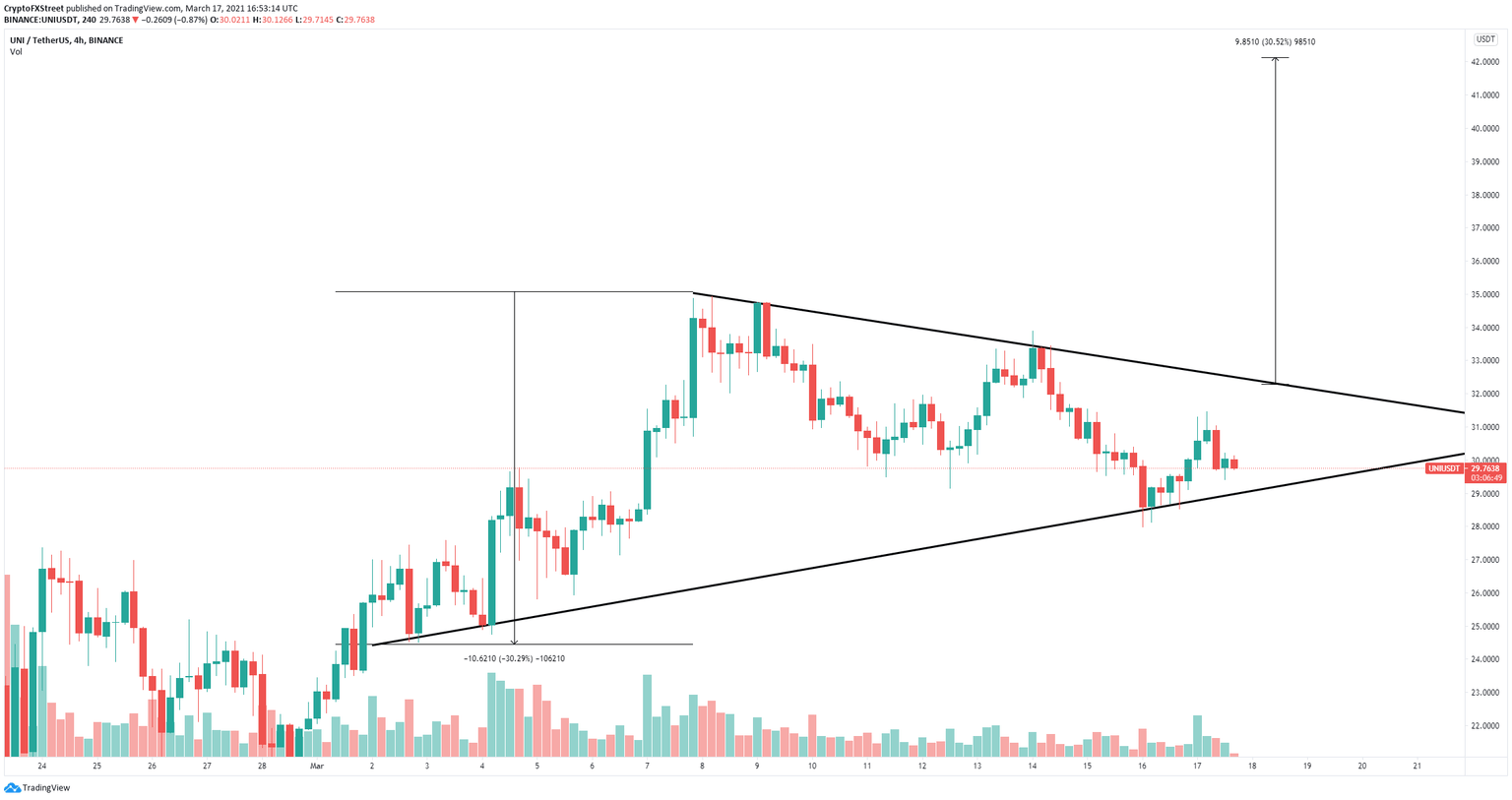

- Uniswap price is contained inside a symmetrical triangle pattern on the 4-hour chart.

- The number of tokens inside exchanges has continued to significantly drop in the past several months.

- A key indicator shows Uniswap faces practically no resistance on the way up.

Uniswap has been trading inside a tightening range since the beginning of March while the supply on exchanges has continued to decrease despite the significant price rise of the decentralized exchange.

Uniswap price aims for a huge 30% breakout with no resistance ahead

On the 4-hour chart, Uniswap price has established a symmetrical triangle pattern with the key resistance trendline formed at $32.3. A breakout above this key point would drive Uniswap price up by 30% towards $42.

UNI/USD 4-hour chart

Since December 11, 2020, Uniswap price has climbed from a low of $3 to an all-time high of $33. However, in the same time period, the percentage of Uniswap tokens on exchanges decreased from a high of 7% to 6.14% currently.

UNI Tokens on Exchanges

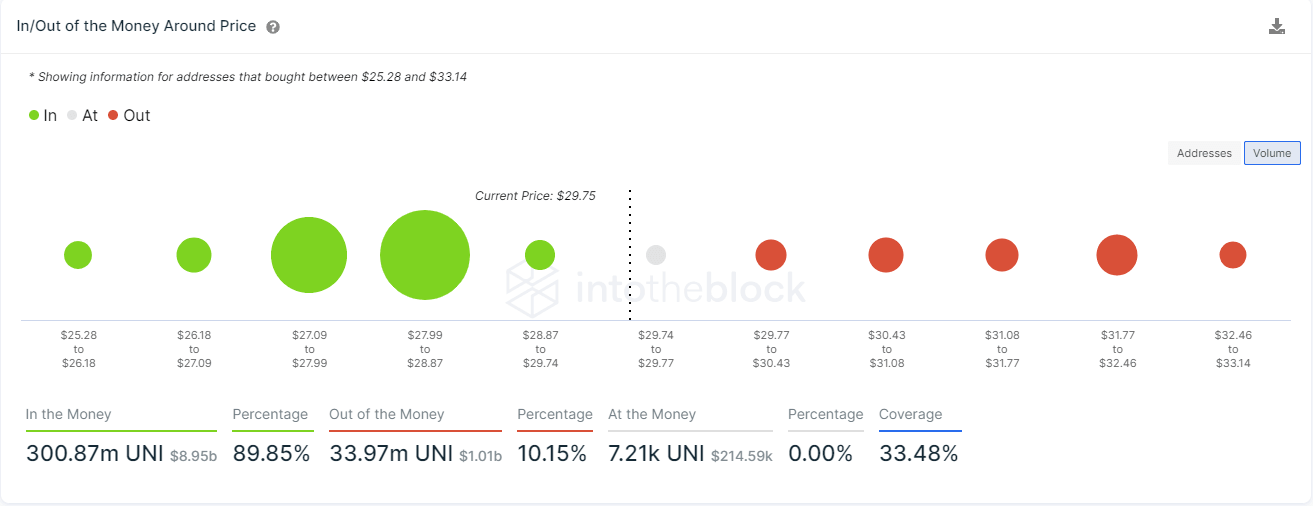

This indicates that investors are not looking to sell UNI despite its performance, awaiting even more gains. The In/Out of the Money Around Price (IOMAP) chart suggests that bulls face practically no strong resistance above $30 with a lot of support on the way down.

UNI IOMAP chart

The strongest support area is located between $28 and $29. A breakdown below this point would confirm a break from the symmetrical triangle pattern with a price target of 30% towards $20.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B17.53.25%2C%252017%2520Mar%2C%25202021%5D-637516006646809690.png&w=1536&q=95)