ApeCoin price disintegrates as the NFT token now qualifies as a high risk asset

- APE price has declined 17% this week.

- ApeCoin price does not show any changes on the volume indicator.

- Invalidation of the bullish thesis is above $7.50.

The NFT-inspired token price could continue declining as the technicals show no change in the overall downtrend.

ApeCoin price is a high risk asset

The ERC-20 governance and utility token has declined 17% since the weekend rally. The bulls have yet to step in with any retaliatory force, which warrants the idea that smart money is unwilling to negotiate at the current price levels.

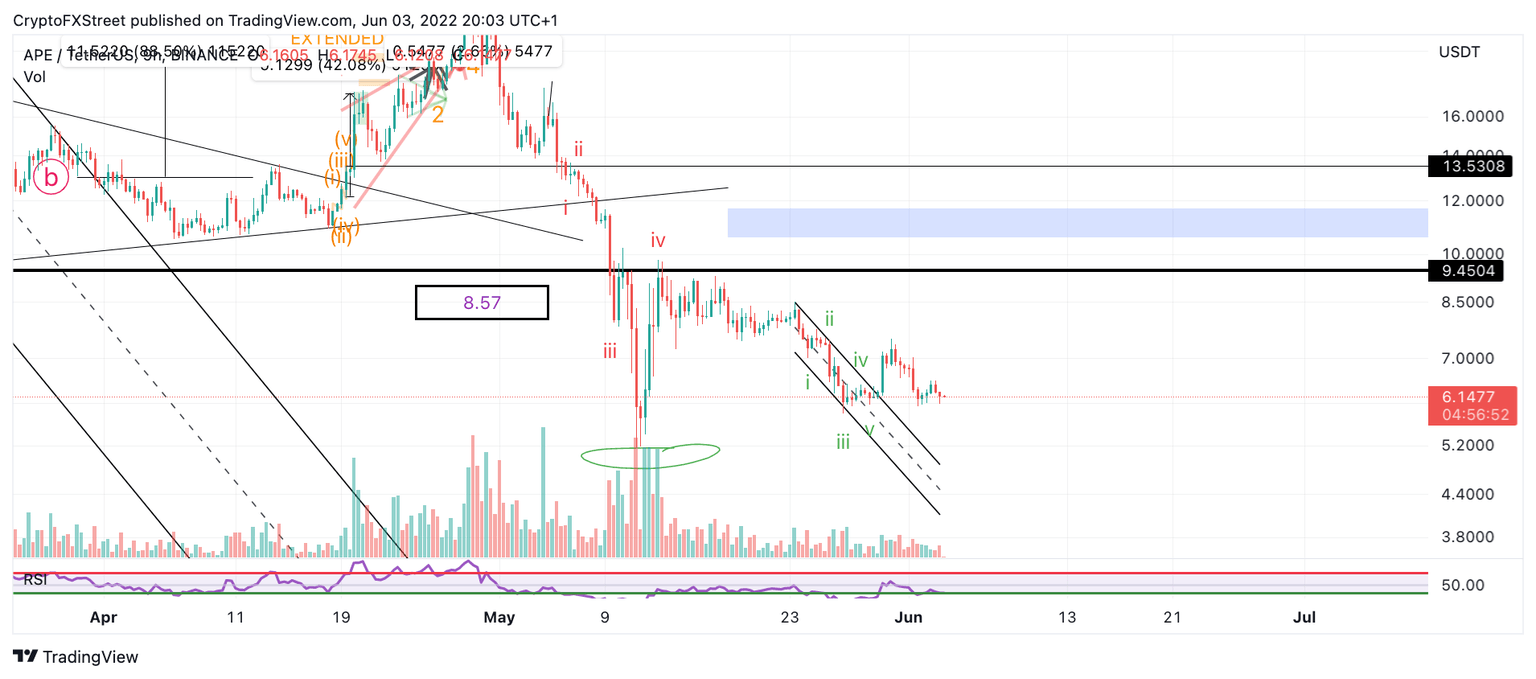

ApeCoin price is now trading at $6.12. The volume profile indicator signals no change in the overall downtrend, which started in early May. Investors should consider staying away from the APE price until the $5 target is reached. It is worth noting that analysts have forecasted $2 targets in previous reviews of the popular NFT token which deems ApeCoin a high risk asset until further notice.

APE/USDT 9-Hour Chart

The invalidation for the bearish thesis is a breach above $7.50. If the bulls breach this level, $8.50 will be the next target resulting in a 37% increase from the current ApeCoin price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.