AMD can be supportive for Bitcoin: Elliott Wave analysis

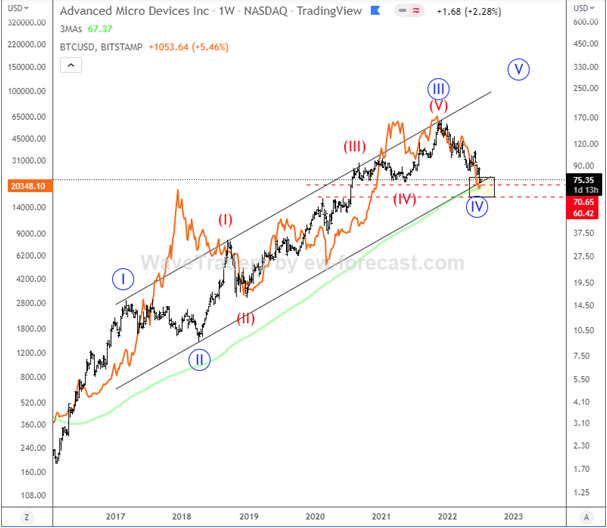

Hello traders, today we will talk about AMD, its price action from technical point of view and wave structure from Elliott wave perspective. We will also compare it to Bitcoin, as both assets belong to technology sector.

Advanced Micro Devices – AMD is an American multinational semiconductor company that develops computer processors, graphic cards and related technologies for business and consumer markets. We know graphic cards are used for cryptocurrency mining and this is the reason why there's positive correlation between AMD and Bitcoin.

If we take a look at the weekly chart, we can clearly see bullish trend and from Elliott wave perspective, we still see it unfolding five waves up. Current decline from the highs, looks slow, choppy and overlapped which indicates for wave IV correction. So, we believe that AMD is now approaching important and strong support at the former wave (IV), EW channel support line and 200-Week moving average.

Well, if we are on the right path, then AMD could start bouncing and recovering within wave V soon and if we respect a positive correlation, then Bitcoin could easily follow.

Get Full Access To Our Premium Analysis For 14 Days. Click here!

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.