Altcoins lead crypto market crash as liquidations hit $73 million

- Bitcoin price has dropped for third consecutive day, triggering a flurry of liquidations.

- The total liquidations in the last 24 hours hit nearly $73 million.

- Altcoins like Bitcoin SV, Bitcoin Cash and Aave are leading the collapse.

Bitcoin (BTC) price shot up nearly 10% between September 27 and October 2 and created a local top at $28,613. This move caused many altcoins to pause their downtrend and trigger a bullish breakout, but the last two days have proven that investors need to be cautious.

Also read: Bitcoin Weekly Forecast: BTC recovery rally could be bull trap in disguise, here’s why

Crypto market takes a hit

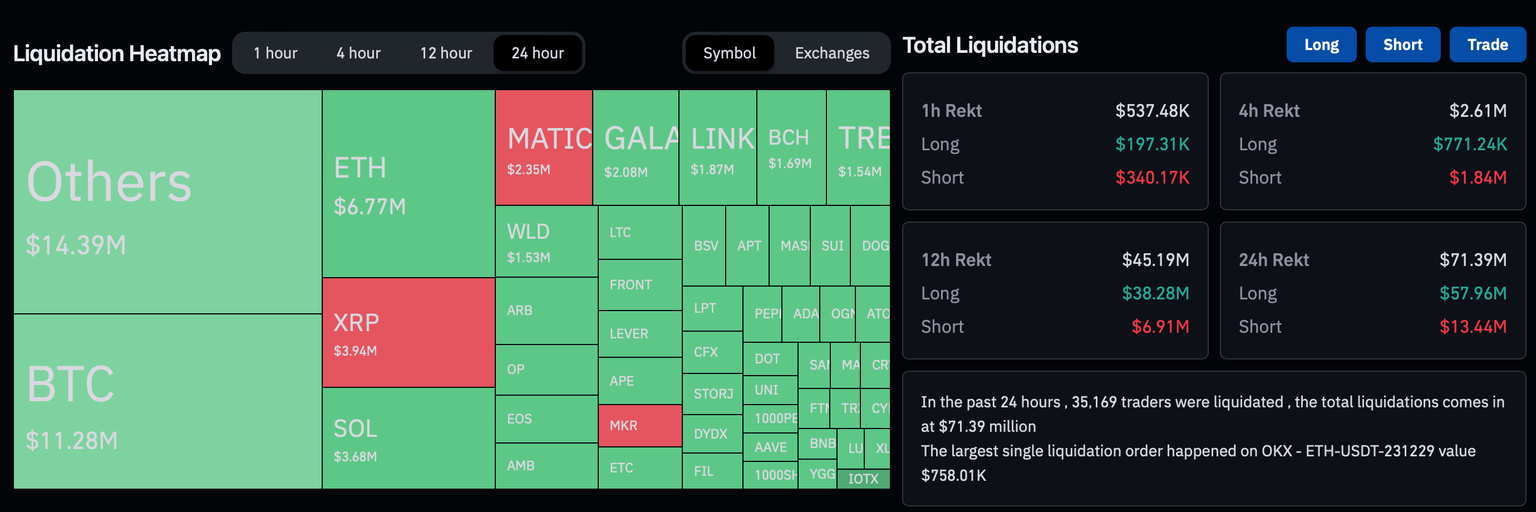

The sudden spike in Bitcoin (BTC) price was no doubt alluring, but the sudden reversal knocked BTC down by 5.21%. This caught greedy bulls off guard, leading to liquidations worth $73 million in the last 24 hours, according to CoinGlass.

Crypto liquidations

Investors panic-sell altcoins

Bitcoin SV (BSV) price has shed nearly 10% in the last 24 hours, followed by Aave (AAVE) and Bitcoin Cash (BCH), which have lost 7% and 5.60%, respectively.

Also read: Bitcoin SV price rises by 30% in a day as CEO resigns amid controversy

Out of the $73 million liquidations, only $11.28 million came from Bitcoin longs, while the rest of the liquidations came from altcoins.

With a disappointing start to the first Ethereum futures ETF, it makes sense that ETH liquidations hit a whopping $6.77 million.

Read More: Ethereum ETFs fail to live up to hype: combined trading volume amounts to just $1.7 million

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.