Algorand Price Prediction: ALGO vies for 85% advance upon the breach of its consolidation

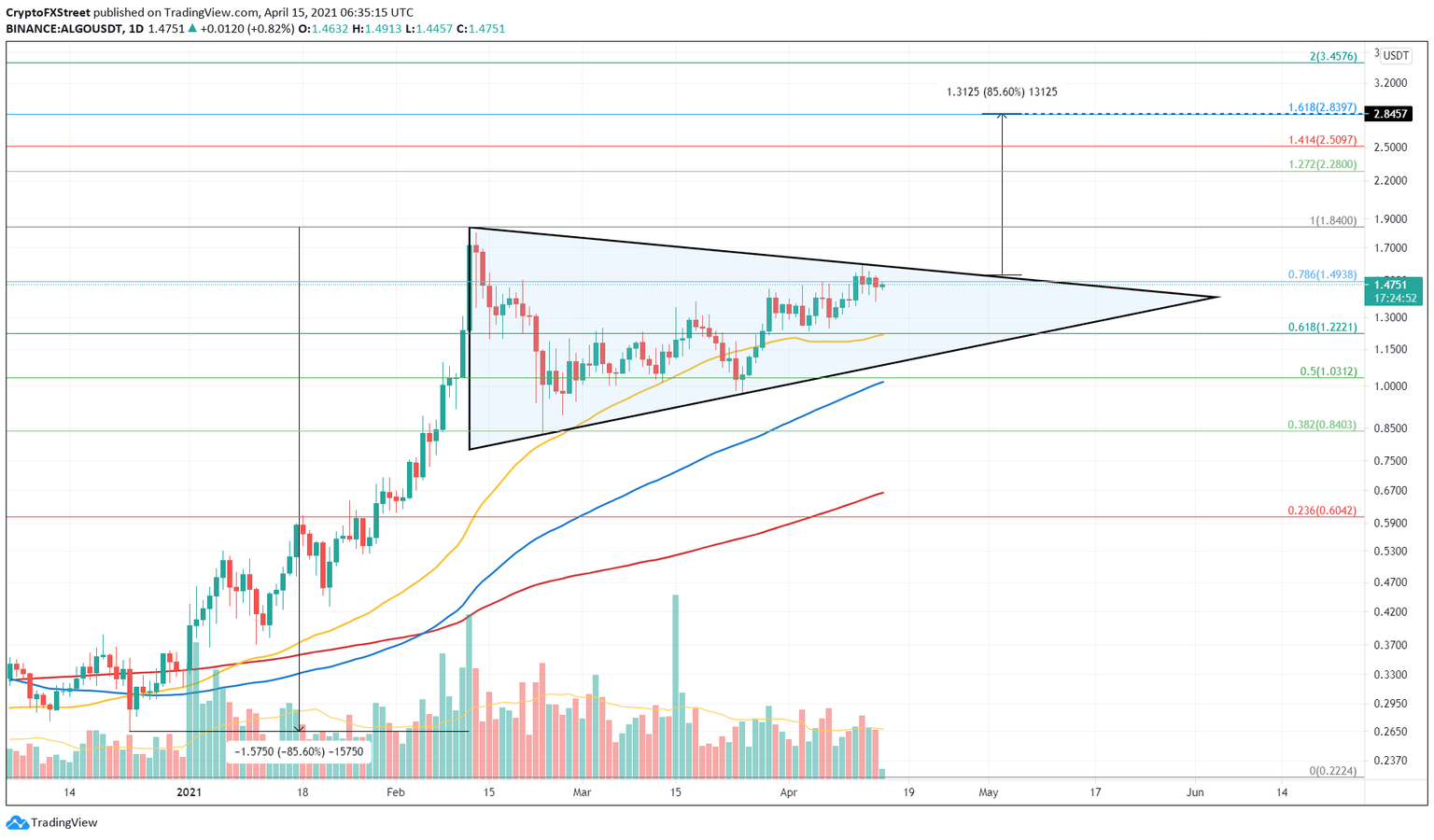

- Algorand price is traversing a bullish pennant, hinting at an 85% upswing to $2.83.

- A decisive close above $1.53 will signal a breach of the pennant’s upper trend line.

- ALGO will kick-start a new downtrend if it slices through the 50% Fibonacci retracement level at $1.03.

Algorand price is trading inside a bullish consolidation pattern that forecasts massive gains.

Algorand price edges closer to breakout

Algorand price has been consolidating in a bullish pennant, composed of an initial burst in the market value followed by the formation of lower highs and higher lows connected using trend lines.

The continuation pattern projects an 85% advance to $2.83, determined by adding the flagpole’s height to the breakout point at $1.53.

ALGO is currently trading around the upper boundary at $1.48 and could break out now or head lower to produce another swing low. A drop to the 50 Simple Moving Average (SMA) on the daily chart coinciding with the 61.8% Fibonacci retracement level at $1.22 seems likely if the selling pressure spikes.

Either way, a secondary confirmation of the breakout will arrive after ALGO creates a higher high above $1.84. This move might signal to sidelined investors to jump on the ALGO bandwagon, pushing the price higher.

The 127.2% and 141.8% Fibonacci extension levels are the areas of interest before the buyers push the Algorand price to $2.84. Interestingly, the intended target coincides with the 161.8% Fibonacci extension level, a frequently visited level during the bull runs.

ALGO/USDT 1-day chart

A breakdown of the 50% Fibonacci retracement level at $1.03 will signal the bullish thesis’s invalidation and the start of a new downtrend. In such a case, investors can expect ALGO to drop 17% to the next support barrier at $0.84.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.