Aave price is just a few dollars away from $100, while technicals spell trouble

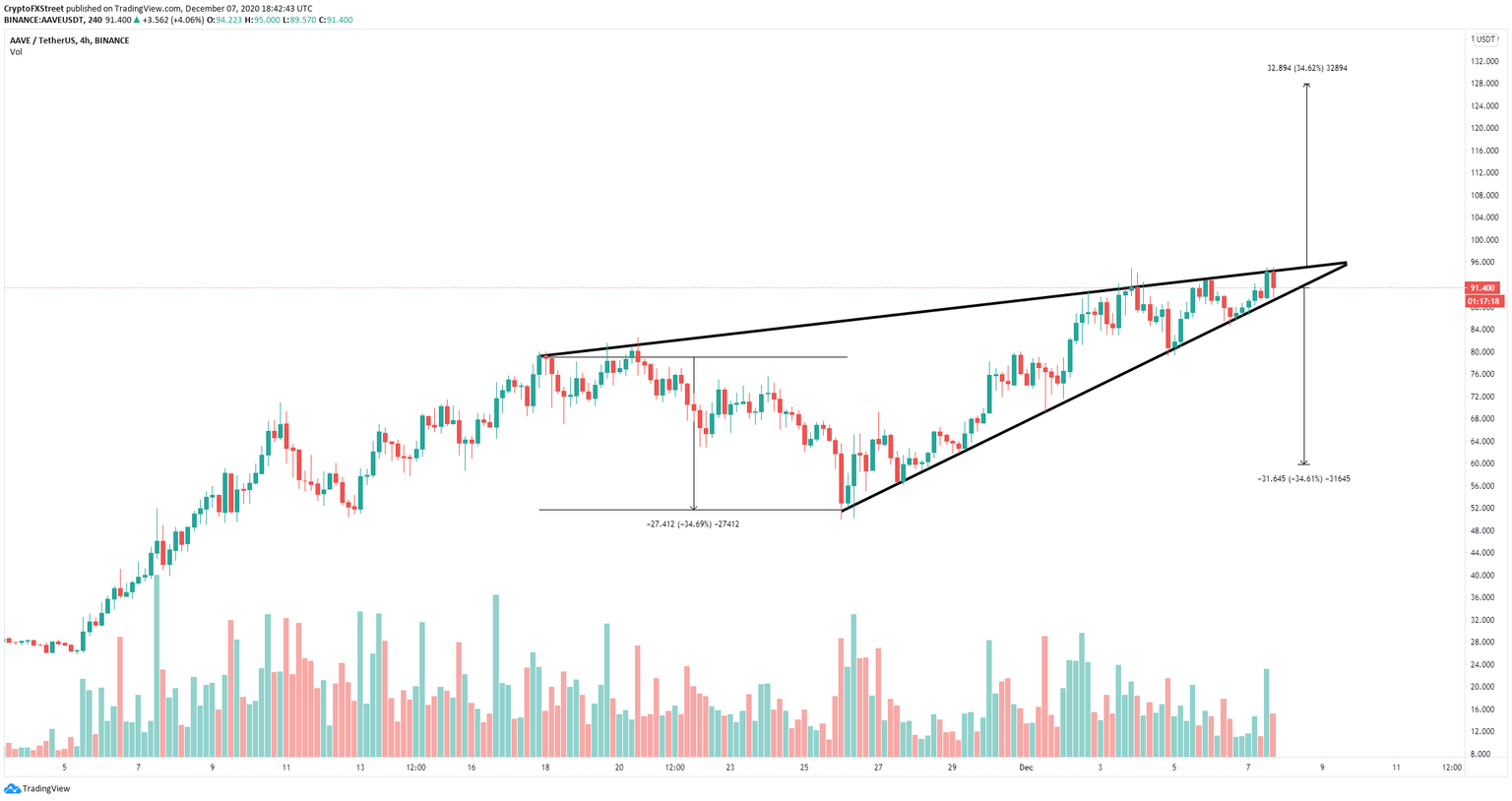

- Aave price seems to be contained inside an ascending wedge on the 4-hour chart.

- The digital asset is close to hitting $100 but some indicators show it might be poised for a pullback first.

Aave has been inside a robust uptrend since its token swap from LEND to AAVE on October 20. The digital asset is now on the verge of hitting $100 for the first time since its swap but there is one indicator that suggests it could be on the verge of a correction.

Aave price is on the cusp of a breakout or breakdown

On the 4-hour chart, Aave has established an ascending wedge that is on the verge of a breakout or breakdown. The current Aave price of $91 is right in the middle of the pattern which doesn’t favor either side.

AAVE/USD 4-hour chart

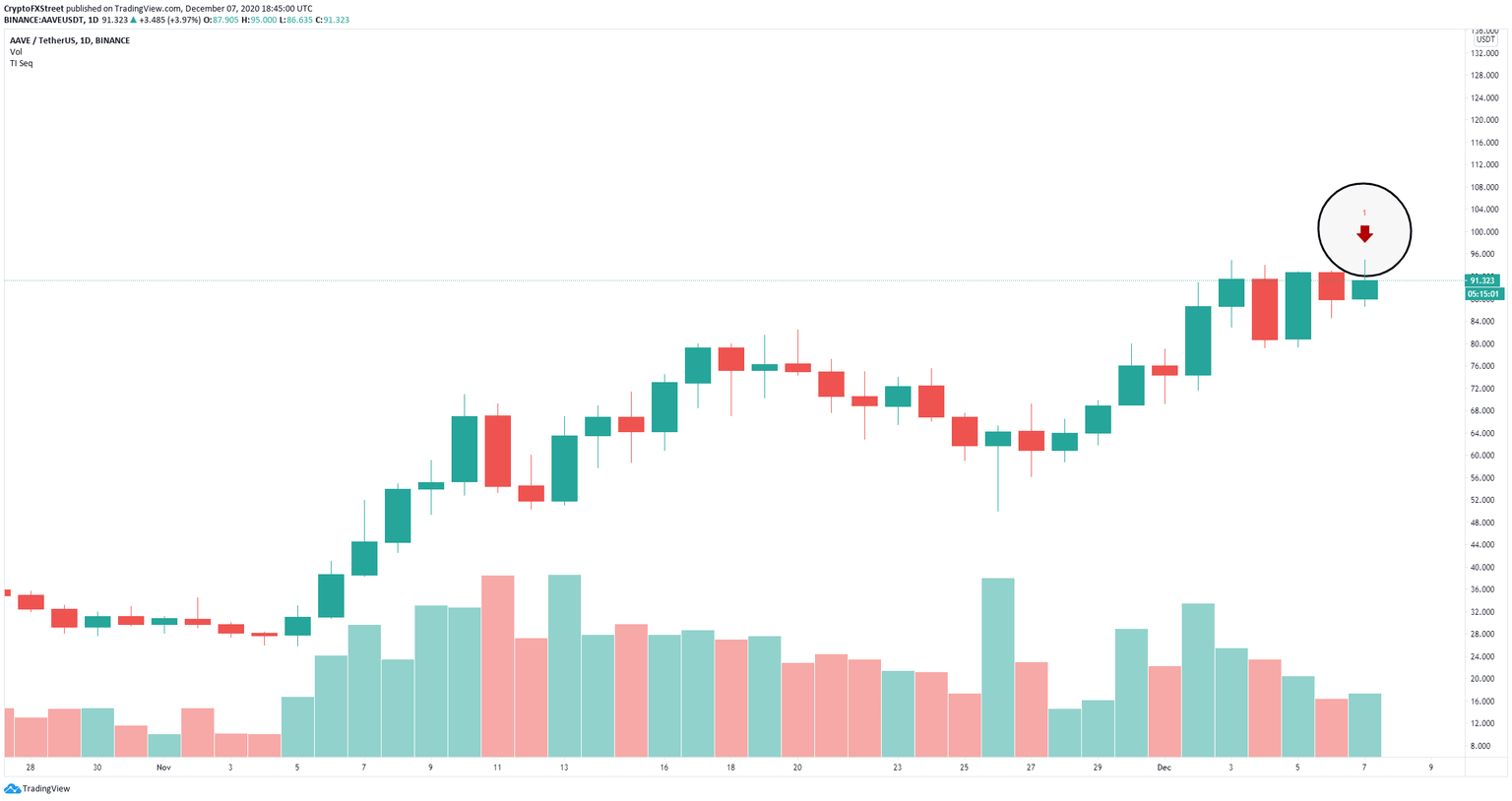

Unfortunately, it seems that the TD Sequential indicator has presented a sell signal on the daily chart for the first time since the swap. A breakdown below the lower trendline of the ascending wedge at $90 would quickly drive Aave price towards $60.

AAVE/USD daily chart

On the other hand, a breakout above the upper boundary of the pattern can push Aave price towards and above $100 and potentially to a high of $130 as a long-term price target for the bulls.

AAVE new addresses chart

The chart of new addresses joining the network shows a massive influx in this number in the past week, jumping by 237%. This metric shows that new investors are extremely interested in the digital asset which translates into buying pressure.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.