Aave Price Analysis: AAVE to retest all-time high if support at $80 holds

- Aave token is listed on Coinbase Pro amid growing DeFi popularity.

- The token price is poised for a strong recovery, once the $89 barrier is out of the way.

Aave (AAVE) is the 27th digital asset with a current market capitalization of $1 billion. The native token of the pioneer DeFi protocol focused on decentralized lending bottomed at $70 on December 11 amid the sell-off on the cryptocurrency market and recovered to $85.6 by the time of writing. The coin has gained over 4% in the past 24 hours; however, it is still down 5% on a week-to-week basis.

AAVE comes to Coinbase Pro

The leading US-based cryptocurrency exchanges listed AAVE tokens on Coinbase Pro, the platform focused on professional traders. The head of listings on Coinbase, Zach Segal, announced the news on Twitter, saying that 2020 was the year of DeFi:

It’s been a huge year of growth in #DeFi. Excited to be listing three more DeFi tokens on Coinbase Pro today! https://t.co/UDOliy1Xep

— Zach Segal (@zosegal) December 14, 2020

Currently, users can transfer the coins to their accounts. However, the trading functionality will be unlocked at 9 AM PT on Tuesday, December 15, provided that the token gathers enough liquidity.

Once a sufficient AAVE supply is established on the platform, users will be able to trade the token against BTC and several fiat money, like USD, EUR, and GBP.

The trading functionality will be rolled over in three phases: post-only, limit-only, and full trading.

The upside is the path of least resistance for AAVE

AAVE price hit bottom at $25 on November 5 and has been gaining ground ever since. The price completely recovered from the September-October sell-off and hit a new all-time high at $96.5 on December 3 before the correction started.

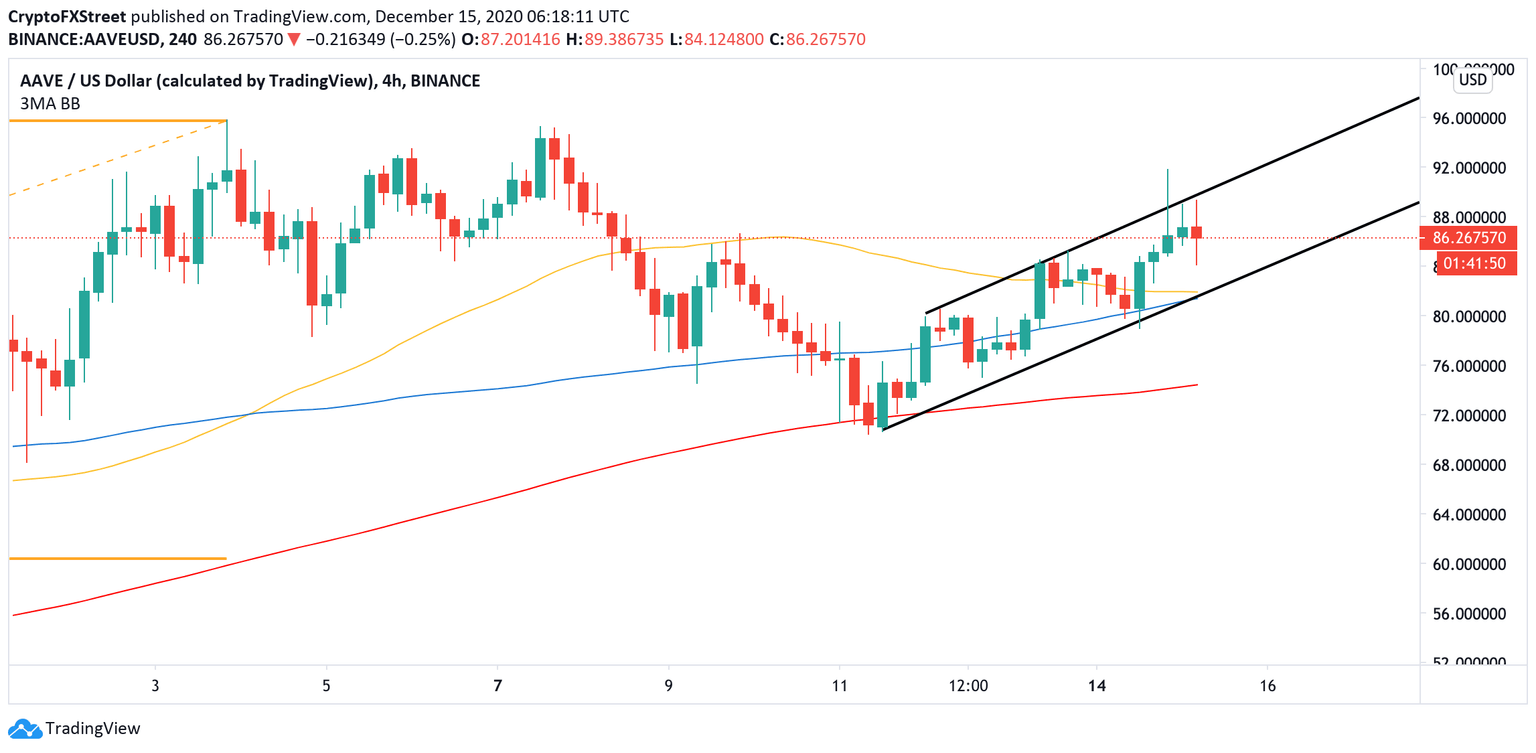

On the intraday charts, AAVE is moving within an upside-looking channel with the channel support at $81. This barrier is reinforced by a combination of 4-hour EMA100 and EMA50. Once it is broken, the sell-off may be extended towards EMA200 on the same timeframe and local bottom of $70 hit o December 11.

AAVE/USD, 4-hour chart

%2520Analytics%2520and%2520Charts-637436104859759178.png&w=1536&q=95)

AAVE's In/Out of the Money Around Price data

Meanwhile, the In/Out of the Money Around Price data confirms strong support on the approach to the $81 area. Over 336 addresses purchased over 800,000 coins between $81 and $83.6. If it gives way, the sell-off may continue towards $74.

The way to the north is a bit less cluttered with the resistance areas. The IOMAP cohorts show that there is an insignificant barrier above the current price, with 700 addresses holding only 100,000 coins.

Author

Tanya Abrosimova

Independent Analyst