Aave Market Update: LEND may be the most undervalued token in the world

- Aave is currently the biggest DeFi protocol by total value locked in.

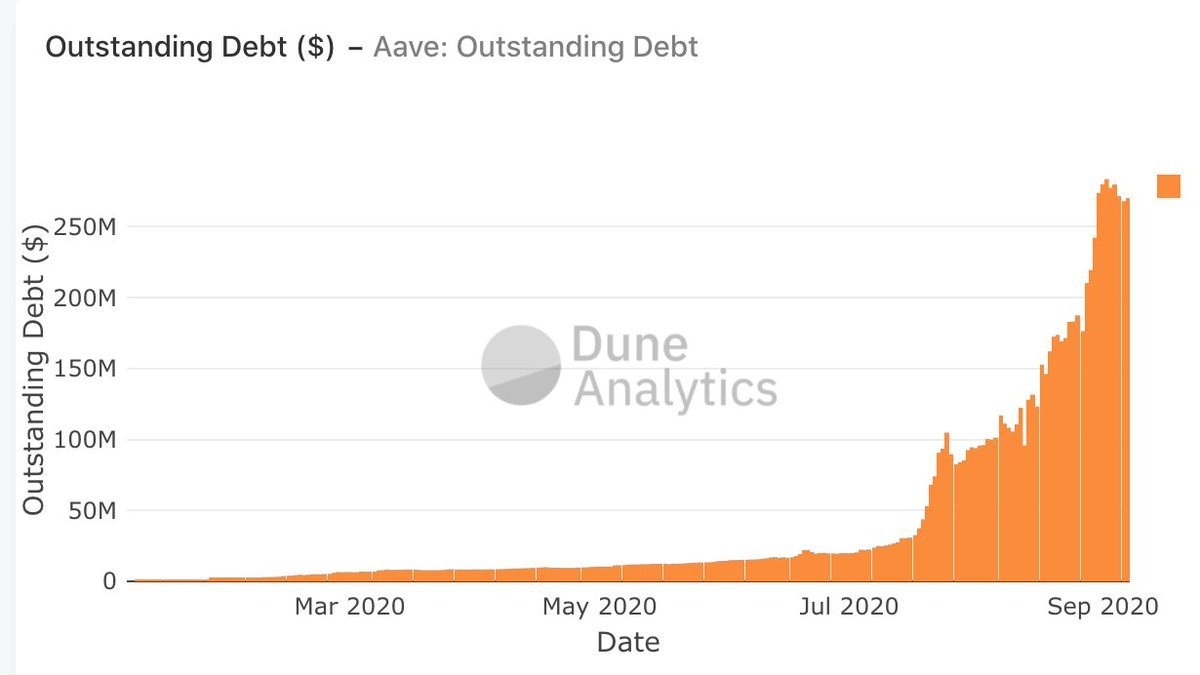

- As per dune analytics, the outstanding debts in Aave have been steadily increasing daily.

- LEND/USDT sellers have stayed in control for three consecutive days.

As per many analysts, Aave may be the most undervalued coin in the market right now. In this case, we will see why that's the case.

Aave sub billion dollar market cap

With a marketcap of $785 million, Aave still happens to be in the sub-billion dollar category. That in itself doesn’t sound that remarkable. After all, only 12 coins have a >1 billion dollar market cap. However, what’s interesting to note here is the TVL:marketcap ratio.

As per DeFi Pulse, LEND is the biggest protocol in the market right now, with around $1.48 billion locked in (TVL). This means that the ratio comes to approximately 0.53. In other words, the total value locked up is almost double that of the marketcap. So what does that tell us?

- People are willing to invest in the Aave protocol.

- The marketcap shows that there is plenty of space for the coin to grow.

Aave participation

A significant factor behind Aave’s supposed undervaluation is the network participation concerning its valuation. There are two metrics that you should check here.

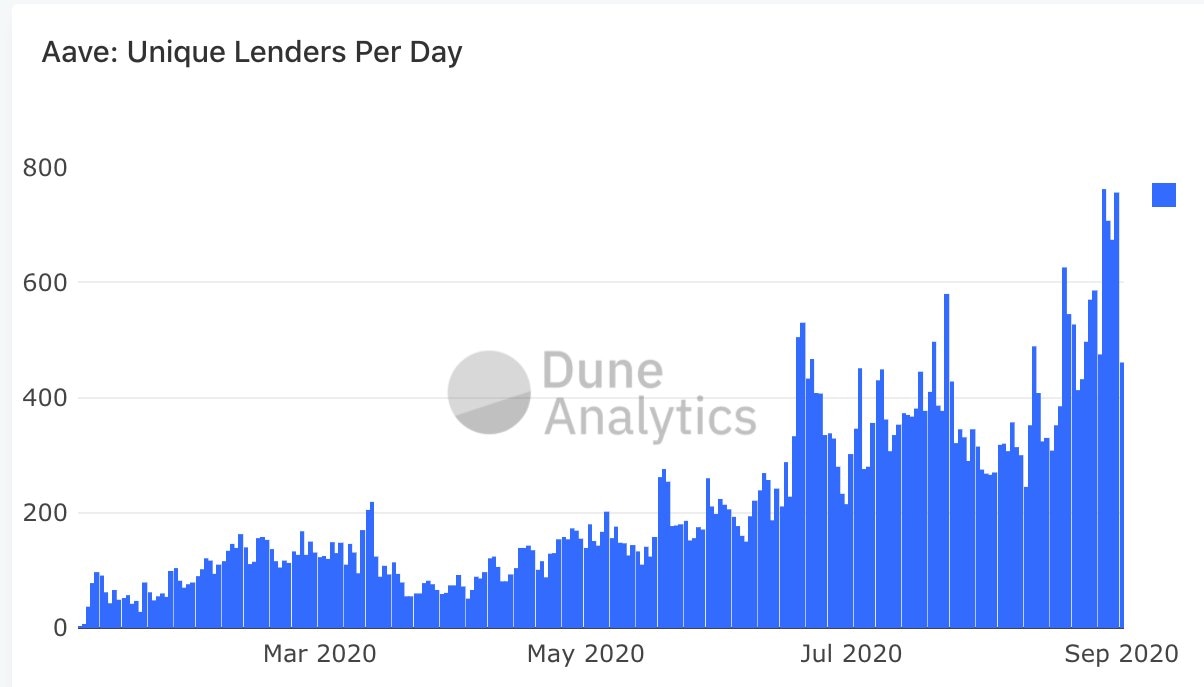

Firstly, we have outstanding debt. It is the total principal and interest amount of a debt that has to be paid back to the lenders. As per dune analytics, the outstanding debts have been steadily increasing in the protocol. However, how many lenders are these debts owed to? Is there one “super lender” who is giving out all these loans? Or are there many lenders interacting with the system? The latter will be a healthier and more democratic protocol.

Thankfully there is some good news on this front as well.

As per Dune Analytics, the number of daily unique lenders in the protocol has been steadily increasing, as well.

Aave Flash Loans

So, what is it about Aave that makes it so unique? The feature that has made it immensely popular is the flash loan feature. With flash loans, you don’t require any capital to execute a liquidation. Simply borrow funds from Aave and pay back the debt on behalf of the borrower. Collect the deposit, execute your trades and return the borrowed assets to Aave with a small fee. Using this, third-party developers can generate profits or leverage them to offer new features or services to their users. Removing the need to hold capital helps democratize the market significantly and lowers barriers to entry.

LEND/USDT daily chart

After failing at the 0.7596 resistance line, the price has been dropping steadily. Over the last three days, the price has dipped to 0.5939. Currently, the upward trending line needs to hold firm to prevent further downward movement. Thankfully, there seems to be some good news in that regard.

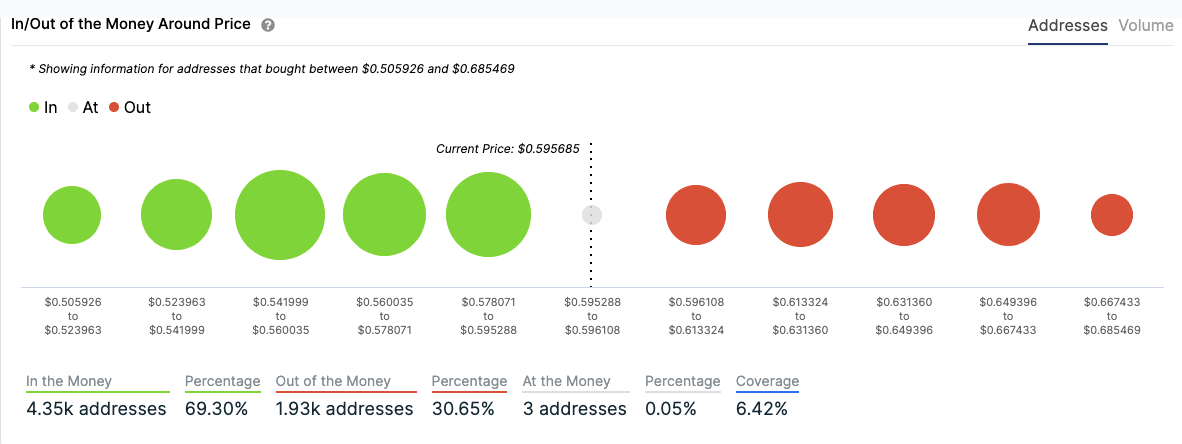

LEND IOMAP

LEND is currently sitting on top of healthy support. The bears have the space to drop the $0.578 before encounter strong support. However, if the buyers were to take back control, they face a moderate-to-strong resistance level up ahead. They should take the price up to at least $0.615 if they play their cards right.

However, the chances of the bulls making a comeback look bleak for now.

LEND/USDT hourly chart

The hourly LEND/USDT chart shows us that the price is dropping in a downward channel formation. Currently, the sellers are making a charge for the 0.578 support line. The MACD shows increasing bearish momentum, so they may have the energy required to break below this level.

Check out our report to gain more insight into the cryptocurrency market.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

-637358124889064980.png&w=1536&q=95)

-637358125856115719.png&w=1536&q=95)