Build additional deposits for continued growth

Through various marketing efforts, and perhaps even a promotion, the firm has acquired deposits from new traders. While that accomplishment can provide some immediate income and a sense of accomplishment, it means little when considering the long-term profitability of the brokerage.

Hot money burns quickly. Without active engagement, the trader is likely to make a single deposit, then be gone quickly, meaning a short-term benefit for the firm, but little in terms of sustained profitability.

The key to sustained growth is acquiring not just the first deposit, but the second and subsequent deposits. The more funds traders have with a firm, the less likely they are to take their business elsewhere.

https://www.optimove.com/blog/retention-rates-need-a-boost-combine-real-time-and scheduled-campaigns

Identifying the Optimal Time Frame for Repeat Deposit

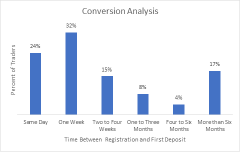

While the quicker the firm can acquire those additional deposits, the better the trader’s lifetime value and the firm’s profitability, the firm’s marketers need to realize that not all traders are ready to make an additional deposit right away. They might need to wait until the next paycheck; until other financial obligations are met; or see how you handle their initial business before they are ready to provide your firm with additional funds.

Overmarketing to the trader about additional deposits can annoy the trader, sometimes even to the point of moving future business elsewhere. But waiting too long can means potential missed opportunities to acquire additional deposits sooner.

Trader Data Identifies Optimal Marketing Opportunities

To identify the optimal time to communicate with the trader about additional deposits requires having the right data. You need seamless access to unified historical, real-time, and predictive data, enabling the identification of the next-best cross-sell opportunity for each individual trader. Discover powerful trader insights with purpose-built trader explorers and AI tools, allowing for informed decision-making and strategic planning within the volatile forex market environment.

With the right data, you can implement targeted programs and measure their impact, enabling you to make quick adjustments (if needed) to messaging and campaigns to boost long-term retention, revenue and profitability.

Trader Data, Marketing Tools Drive Personalization

The right trader data enables efficiently understand your traders on a personal level, which is crucial for developing personalized trader journeys. While some traders may seem similar on the surface, a more granular analysis often reveals very different paths.

Leverage the Power of AI

AI and Generative AI (GenAI) helps identify key trader touchpoints across all channels, enabling marketers to map these diverse journeys from the trader's perspective. This detailed mapping allows for the delivery of truly personalized experiences that drive engagement, moving beyond superficial approaches.

The technology and dynamic content capabilities can personalize messages in real time, enabling marketers to immediately adapt messaging so that each one feels relevant. Consumer preferences and habits change for a variety of reasons – new channels enter the mix; a trader has a financial gain or loss changing discretionary income or something else. Personalized email campaigns, dynamic website content, and tailored promotions can all contribute to a more engaging trader experience. Data-driven segmentation enables marketers to target different trader groups that resonate based on past behavior, demographics, or even current needs.

Craft Personalized Experiences

Today’s traders want to be recognized as individuals. Mass emails or SMS messages sent to anonymous recipients are not only ignored, they are regarded as spam and will likely result in the prospect/trader blocking further messages. Most marketers have moved away from mass messaging. However, many still use the “one-to-few” method; sending the same message to all prospects/traders matching a particular demographic profile, such as people at certain income levels, people with young children in the household, people who drive certain types of cars, etc. While certainly more personalized than the full blast messaging approach, this method still doesn’t provide the benefits and trader-building benefits of a one-to-one messaging approach, which a marketer can deploy if using a CRM platform that offers fully integrated CDP and MMH capabilities.

Orchestrate Campaigns Across Channels

Traders use a growing number of channels. Trader journeys today often start in one channel and finish in another, sometimes with other channels involved as well. The platform needs to facilitate cross-channel coordination so that marketing messages can traverse between different channels without interruptions in the interactions. The trader expects a seamless experience regardless of the channel(s) used. They need to be able to continue journeys from where they left off when changing from one channel to another, rather than needing to re-enter information or go through other redundant steps. Marketers must provide relevant experiences as the trader moves from channel to channel.

A Positionless Marketing Platform Provides the Power of AI, Personalization

Dynamically personalize your forex website and mobile app with a Positionless Marketing Platform. For example, it can leverage over 20 unique AI recommendation models, enhancing user experience and trading efficiency without additional resources. Additionally, optimize promotional spend while boosting trader response rates with self optimizing AI models that personalize promotion amounts to each trader.

Stay In Compliance

Industry marketers have the additional burden of staying in compliance while communicating with traders about deposits and other business. The right marketing platform enables you to seamlessly adhere to regulatory requirements specific to the forex industry across different regions while maximizing engagement opportunities.

Positionless Marketing can ensure trading activities remain compliant and secure, providing robust data security and privacy measures aligned with stringent forex industry standards including GDPR and CCPA regulations as well as ISO 27001 and SOC2 Type II certifications.

With Positionless Marketing, firms can confidently deliver personalized, compliant, and timely experiences that drive second deposits and long-term trader value.

Promoted content