WTI outlook: WTI Oil retests pivotal barriers on Venezuela uncertainty

WTI oil rose further on Tuesday, following US action in Venezuela, which caused uncertainty over country’s oil production and boosted demand.

Although it is still early to estimate what consequences will US unprecedented action cause on production in the country which has the biggest oil reserves, markets reacted with caution, assuming potential output disruption.

From the other hand, market observers expect sufficient oil supply in 2026, even without any intervention from OPEC, as production is expected to remain steady, while demand is likely to remain weak as most large economies struggle to accelerate economic growth.

This points to scenario that oil price would remain under pressure (unless big and unexpected changes occur) from supply and demand perspective, but very vulnerable geopolitical situation requires caution.

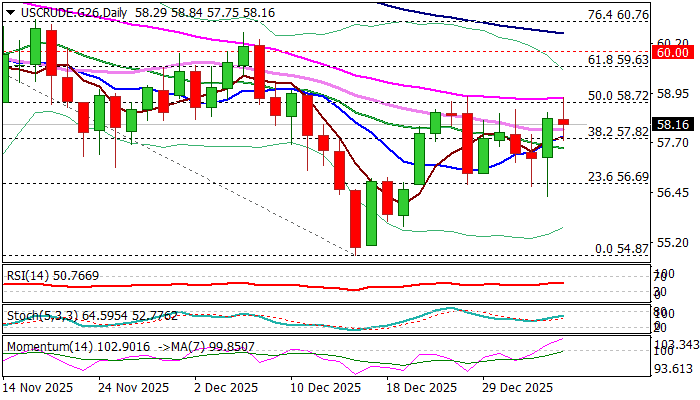

Technical picture on daily chart shows slight improvement (strengthening positive momentum / 10/20 DMA bull-cross) with pivotal barrier at $58.72 (50% retracement of $62.58/$54.87 descend, reinforced by 55DMA) being attacked again, but so far without firm break.

Repeated failure here, along with pressure from nearby falling thick daily Ichimoku cloud ($59.39/$618.18) would weaken near-term outlook and keep the downside vulnerable, as the price will remain within near-term consolidation range after recovery attempts from 2025 low ($54.87) have been repeatedly rejected.

However, near-term structure is expected to remain slightly bullishly aligned while the price holds above $57.82 (10DMA / broken Fibo 38.2%), while drop below $57.55 (20DMA) would risk deeper drop.

Res: 58.80; 59.63; 60.00; 60.48

Sup: 57.82; 57.55; 57.00; 56.69

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.