Weekly FX chartbook: Mixed jobs data will make Fed’s 50bps cut harder

Key points

-

USD: Payrolls report argues for the Fed to cut rates by 25bps next week.

-

EUR: ECB’s rate cut may come with a neutral tone.

-

JPY: Safe-haven appeal remains intact but bigger gains need larger US recession concerns.

-

AUD: Commodity sell-off undermines RBA’s hawkish posturing.

-

CNH: China’s deflation and US election risks add to headwinds.

USD: Trump-Harris debate and CPI in focus

The August jobs report was mixed, with nonfarm payroll growth falling short of expectations at 142k (vs. 160k expected) but a lower unemployment rate of 4.2% (from 4.3%). Although the participation rate held steady at 62.7%, downward revisions to previous months’ payrolls, with July at 89k and June at 142k, pointed to a softening labor market. This left the debate between a 25bps or 50bps rate cut unresolved, though markets are currently pricing in 34bps for the Fed's next meeting. Fed Governor Waller’s comments further emphasized this uncertainty, noting he would support front-loading cuts if necessary but highlighted that the labor market is softening without significant deterioration. This makes it likely that the Fed will opt for a 25bps cut to avoid signaling panic, though they may keep the door open for more aggressive cuts later in the year, possibly in November or December, or even an inter-meeting move.

Attention now turns to the upcoming US Presidential debate on September 10 which will be the first between Trump and Harris and could lead to increased sensitivity to polling shifts afterward. Neither of the candidates’ policy plans are likely to hint at moves to rein in the ballooning fiscal deficit, and this could be marginally USD-positive. On the data front, August CPI is due on September 11 and will be a key focus, with core inflation expected to hold steady at 3.2% YoY. A weaker-than-expected print could bolster market expectations of a 50bps cut, but a steady reading may leave the 25bps vs. 50bps debate unresolved. Overall, the USD is expected to trade sideways to higher, as current Fed easing expectations still appear excessive. We continue to watch for catalysts, as listed in this article, to drive further weakness in the greenback.

EUR: ECB’s lack of forward guidance could weigh

The ECB meeting on Thursday is expected to deliver a 25bps rate cut, a move fully priced in by the market. However, the focus will shift to the ECB’s guidance on future policy and new economic projections. While recent ECB commentary suggests broad consensus around the September cut, the path after remains uncertain. ECB officials have mostly indicated confidence in a September cut but are less clear on further easing, with Simkus particularly downplaying the likelihood of an October cut. Although inflation at 2.2% in August brings the ECB closer to its 2% target, disinflation in services has stalled, posing a challenge to the central bank's future course.

Attention will be on updated growth and inflation forecasts, as well as any discussions around the neutral rate, which could signal how much more room the ECB has to cut rates. While the ECB’s outlook could maintain a hawkish or neutral tone, the risk of prolonged restrictive policy dampening growth prospects should keep EUR bulls cautious. Additionally, external factors such as dismal economic data from China or US election focus could heighten market volatility and drive safe-haven flows into the USD. This adds further downside risks to the EUR and any rallies could remain restrained. To read our detailed ECB preview, go to this article.

AUD: Plunging commodities taking a toll

The AUD remains under pressure as falling commodity prices, particularly in iron ore and copper, weigh on sentiment. Iron ore has hit a 22-month low, falling below $99 due to China’s real estate slowdown, while copper inventories are at multi-year highs. These declines reflect broader global growth concerns, particularly in China and the US. China's lack of significant economic support measures and ongoing deflation risks (CPI inflation in August was only 0.6% YoY) continue to hurt demand, especially in the commodity sector. Meanwhile, in the US, the focus has shifted from inflation to growth concerns, further dampening demand for commodities.

Despite the Reserve Bank of Australia being the most hawkish among G10 central banks, doubts remain about its ability to hold off on rate cuts if global growth slows. The market is pricing in downside risks for AUDUSD, with the cost of hedging against further declines falling, as traders expect more downward pressure in the near term.

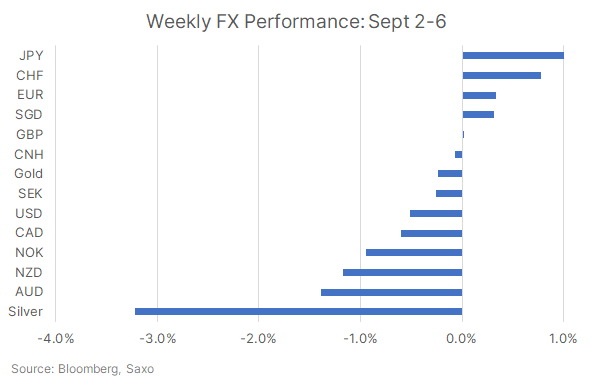

Risk off mood filtered into the FX market, plunging commodity currencies such as AUD and NZD while haven flows were seen into JPY and CHF.

Our FX Scorecard shows bullish momentum is being sustained in JPY and CHF, while being reversed in GBP. Bearish momentum in risk-on currencies as well as precious metals, meanwhile, continues to build.

The CFTC positioning data for the week of 3 Sept saw more USD selling by speculators and net short positioning extending to levels last seen in August 2023. Most of this shift was led by short covering in CAD while long positions also built further in GBP, JPY and EUR.

Read the original analysis: Weekly FX chartbook: Mixed jobs data will make Fed’s 50bps cut harder

Author

Saxo Research Team

Saxo Bank

Saxo is an award-winning investment firm trusted by 1,200,000+ clients worldwide. Saxo provides the leading online trading platform connecting investors and traders to global financial markets.