USD/JPY Weekly Forecast: The US economy provides proof

- USD/JPY gains 1% on the week, 3.9% on the month, 7.2% on the year.

- Excellent US March payrolls help to stabilize USD/JPY near highs.

- Limited Good Friday liquidity inhibits currency market payroll response.

- Treasury rates mark time,10-year yield moves back above 1.7%.

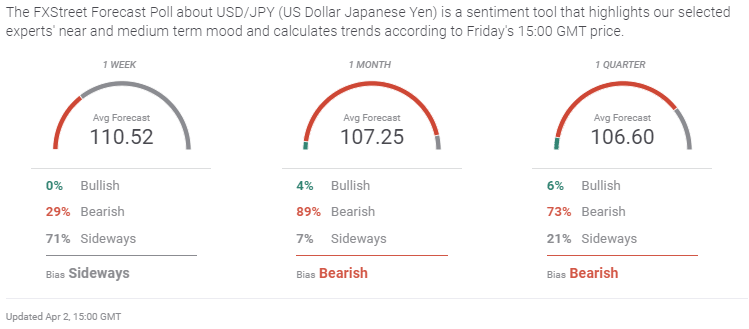

- FXStreet Forecast Poll is neutral short-term, bearish medium and long-term.

The US yield engine continued to power the USD/JPY as the differential between Treasuries and Japanese Government Bonds almost guarantees flows into the American currency

An excellent March US payroll report helped keep the USD/JPY stable at its 12-month high on Friday after a week of gains.

American employers hired 916,000 workers in March, more than 40% higher than the 647,000 forecast. First quarter employment jumped 1.55 million, a pace that would eliminate the remaining Nonfarm Payroll losses by the middle of September. Purchasing Managers’ Indexes in the manufacturing sector were also exceptionally strong, with New Orders expanding at a near record rate for the ninth month in a row.

Rapid currency movements, as the USD/JPY has seen this year, tend to build in their own reversal but the current level is not exceptional in a five-year context. The USD/JPY was above 111.000 for much of the period from November 2016 to May 2019.

Rising US interest rates have altered the fundamental equation in the dollar’s favor. Given the economic situation in the respective countries, that interest rate advantage will be with the dollar for the foreseeable future.

It is hard to see the Bank of Japan (BOJ) sanctioning a JGB rate increase, even if the Japanese credit market tried to follow the US lead. The BOJ is the country’s largest buyer and holder of government securities.

Once again, the best that can be said about most Japanese statistics is that they were not as bad as expected. Retail Trade (sales) dropped less than predicted in February as did Housing Starts. The Tankan Large Manufacturing Index for the first quarter was higher than predicted as was All Industry Capex, probably the most encouraging statistic this week.

USD/JPY outlook

The rapidity of the USD/JPY rise this year and its position shy of 111.00 resistance leaves it vulnerable for a tactical pullback.The area down to 110.25 is essentially open for profit-taking. Equally possible is a period of consolidation between the two figures of 110.00 and 111.00.

Interest rates will remain the driver of the pair. With the strategic situation unchanged any substantial drop should be considered an opportunity to establish a long position, especially below 110.00.

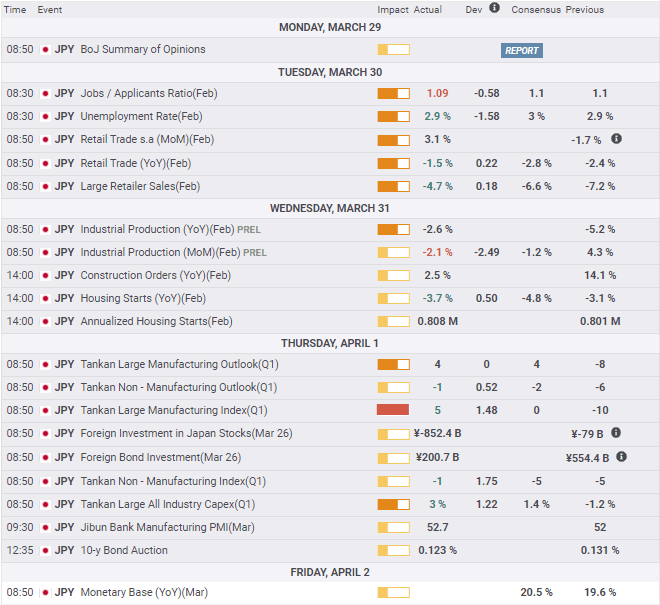

Japan statistics March 29-April 2 (local dates)

The Tankan Surveys for the first quarter were slightly better than expected and all were improvements on the previous quarter. All Industry Capital Investment was double its forecast, a positive business sign for the future.

Tuesday

Jobs/Applicants Ratio February 1.09, expected 1.11, January 1.11. Unemployment Rate for January 2.9%, expected 3%, January 2.9%. Retail Trade (sales) for February 3.1% (MoM), January 1.7%. Retail Trade (sales) February (YoY) -1.5%,, expected -2.8%, January -2.4%. Large Retailer Sales February -4.7%, expected -6.6%, January -7.2%

Wednesday

Industrial Production February (MoM) -2.1%, expected -1.2%, January 4.3%; Industrial Production (YoY) February -2.3%, January -5.2%. Construction Orders February (YoY) 2.5%, January 14.1%. Housing Starts February (YoY) -3.7%, expected -4.8%, January -3.1%. Annualized Housing Starts February 808,000, January 801,000.

Thursday

Tankan Large Manufacturing Outlook Q1 4, expected 4, Q4 -8. Tankan Large Manufacturing Index Q1 5, expected 0, Q4 -10. Tankan Non-Manufacturing Outlook Q1 -1, expected -2, Q4 -6. Tankan Non-Manufacturing Index Q1 -1, expected -5, Q4 -5. Tankan Large AllIndustry Capes Q1 3%, expected 1.45, Q4 -1.2%. Jibun Bank Manufacturing PMI March 52.7, February 52.

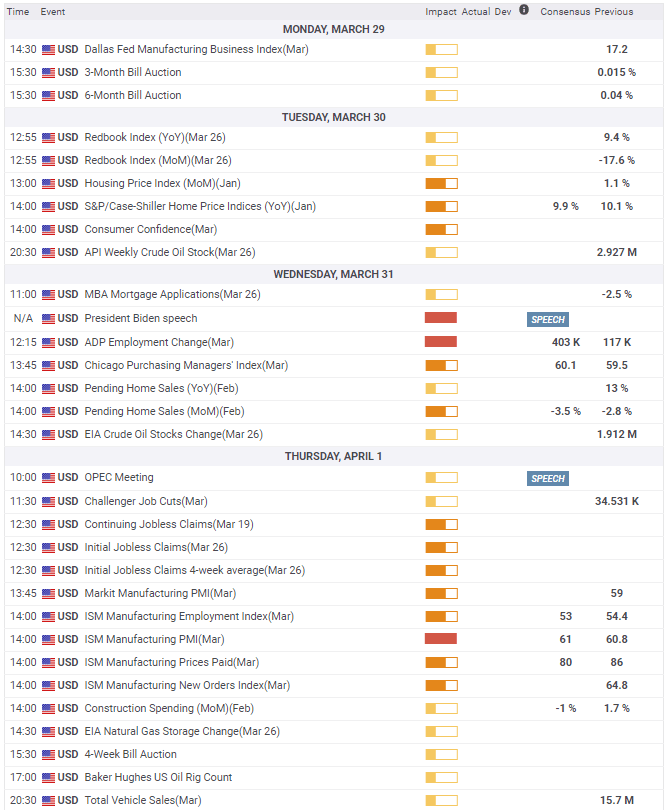

US statistics March 29-April 2

March payrolls were much better than expected as were the Manufacturing Purchasing Managers’ Indexes from the Institute for Supply Management. The New Orders Index extended its best run in a generation to a ninth month. The Employment Index jumped to its best level since February 2018, it had been forecast to fall. The Manufacturing Indexes promise a strong start for the factory sector in the second quarter and are considered a leading indicator for the overall economy.

Tuesday

Conference Board Consumer Confidence Index March 109.7, expected 96.9, February 91.3. Conference Board Present Situation Index March 110.0, February 89.6. Conference Board Expectations Index 109.6, February 90.9.

Wednesday

ADP Employment Change March 517,000, expected 550,000, February 176,000 revised from 117,000.

Thursday

Initial Jobless Claims March 26 week 719,000, expected 680,000, prior week 658,000 revised from 684,000. Continuing Claims March 19 week 3.794 million, expected 3.775 million, prior week 3.84 million. ISM Manufacturing PMI March 64.7, expected 61.3, February 60.8. ISM Manufacturing New Orders March 68, February 64.8. ISM Manufacturing Employment Index March 59.6, expected 53, February 54.4. ISM Manufacturing Prices Paid Index March 85.6, expected 85, February 86. Construction Spending February -0.8%, expected -1%, January 1.2%.

Friday

Nonfarm Payrolls March 916,000, expected 647,000, February revised to 468,000 from 379,000. Unemployment Rate (U-3) March 6% as expected, February 6.2%. Average Hourly Earnings March (MoM) -0.1%, expected 0.2%, February 0.2%. Average Hourly Earnings March (YoY) 4.2%, expected 4.5%, February 5.2%. Average Weekly Hours March 34.9. expected 34.7, February 34.6. Underemployment Rate (U-6) March 10.7%, February 11.1%. Labor Force Participation Rate March 61.5%, February 61.4%.

FXStreet

Japan statistics April 5-April 9 (local dates)

Monday

Jibun Bank Services PMI March, February 46.3.

Tuesday

Labor Cash Earnings February (YoY), January -0.8%. Overall Household Spending February (YoY) expected -2.1%, January -6.1%.

Wednesday

Coincident Index February, January 90.3. Leading Economic Index February, January 98.5.

Thursday

Trade Balance, Balance of Payments Basis February, January -130.1 billion yen. Consumer Confidence Index March, February 33.8. Eco Watchers Survey-Outlook March, January 51.3. Eco Watchers Survey -Current March, February 41.3.

US statistics April 5-April 9

Services PMI should follow manufacturing higher with the Employment Index the most likely to garner a market response. There will be media talk about the FOMC minutes but nothing substantive will be relieved in the text.

Monday

ISM Services PMI March expected 57.4, February 55.3. ISM Services Employment Index March, February 52.7. ISM Services New Orders Index March, February 51.9. ISM Services Prices Paid March, February 71.8. Factory Orders February expected -0.3%, January 2.6%.

Tuesday IBD/TIPP Economic Optimism April, March 55.4. JOLTS Job Openings February, January 6.917 million.

Wednesday

FOMC Minutes of the March 16-17 meeting. Consumer Credit Change February expected $5 billion, January $-1.31 billion.

Thursday

Initial Jobless Claims April 2 week expected 650,000, prior 719,000. Continuing Claims March 26 week, prior 3.794 million.

Friday

Producer Price Index March (MoM) expected 0.5%, February 0.5%. Producer Price Index March (YoY) expected 3.8%, February 2.8%. Producer Price Index ex Food & Energy March (MoM) expected 0.2%, February 0.2%. Producer Price Index ex Food & Energy March (YoY) expected 2.7%, February 2.5%. IMF Meeting. Wholesale Inventories February expected 0.5%, January 0.55.

USD/JPY technical outlook

The practical, if not complete, closure of the pandemic trade in the very short space of three months puts the technical picture at odds with the fundamental. The interest rate differential favoring the dollar is going to expand as US rates, with the Federal Reserve's largely silent approval, continue to rise. March's excellent payroll report underscores the potential for the US economy to reach the Fed's 6.5% projected 2021 expansion. Growth that rapid, combined with the Biden administration's apparent determination to flood the economy with spending, whether or not it is needed or can be used efficiently, puts a fire under inflation. The Fed governors know that higher medium to long-term rates are an effective hedge against changing inflation expectations.

The area between 110.25 and 111.00 is primed for a temporary consolidation, but long-term the USD/JPY remains bid. Support at 110.25 and moreso at 110.00 is solid as are the levels down to 109.00. Resistance up to the pandemic top at 112.23 is weaker than support as its main references are from the first half of 2019.

The Relative Strength Index is overbought at 80.07 and is a prompt for profit-taking. The 21-day moving average (MV) at 109.21 will be good support if the pair drops that far. Otherwise the 100-day MV at 105.41, and the 200-day MV at 105.61 are trailers.

Resistance: 110.00, 111.25, 111.70, 112.25,

Support: 110.25, 110.00, 109.60, 109.25, 109.00

FXStreet Forecast Poll

The immediate neutral position of the FXStreet Forecast Poll recognizes the potential for a pullback given the sharp recent gains in the USD/JPY. By the same token, the one-month and one-quarter views neglect the fundamental difference the revised US rate structure has brought to the currency market.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.