USD/JPY Weekly Forecast: The Ukraine war consolidates the safety trade

- Fed Chair Powell confirms 0.25% hike at March 16 FOMC.

- Ukraine war sends WTI as high as $114.58, Brent to $115.65.

- Japan’s safety attractions balance the US dollar.

- FXStreet Forecast Poll consolidates around 115.50.

The USD/JPY has had a restrained reaction to the Ukraine invasion. The open and closing range since the Russian attack has been 115.67 on February 28 to 114.70 on March 4. Trading has been more volatile–114.41 to 115.80–but considering the provocation, that is calm compared to the EUR/USD.

Perhaps it is more accurate to say the USD/JPY has had a constrained reaction to the war. The USD/JPY has, like the USD/CHF (Swiss franc), a safety trade on each side of the pair. The US dollar and American assets, especially Treasuries, are the global choice in times of trouble. Safe-haven is not the exclusive property of the US dollar. Japan’s advanced economy, sophisticated financial system and social and political stability, have long attracted safety flows from the Asian markets.

The USD/JPY opened the week at 115.00 and despite notable volatility on Monday and Wednesday, was trading lower at 114.69 on Friday morning.

Global crude oil prices are about 20% higher since the Russian attack on Ukraine. Japan imports nearly all of its energy. In normal circumstances such a steep and rapid increase in industrial costs would exact a toll on the nation’s economic prospects and the yen as the US is much closer to self-sufficiency in energy. The lack of such a reaction is telling.

Japanese economic data was anodyne. Consumer sentiment in February fell to 35.3 from 36.7 for the lowest score since last May. The Jibun Bank manufacturing Purchasing Managers’ Index (PMI) for February was 52.7, just off from January’s 52.9 though a six-month low.

American statistics were less relevant than Federal Reserve Chair Jerome Powell’s two days of testimony in Congress. Mr. Powell reaffirmed the central bank’s commitment to launching its inflation campaign with a 0.25% hike at the March 16 meeting. Much of the questioning from legislators was about the economic risks from the Ukraine war and the likely impact of soaring oil prices on inflation. The Ukraine factor has already extracted a policy concession. Two weeks ago markets were expecting a 0.5% hik on March 16. As Mr. Powell said, we must tread carefully.

Purchasing Managers’ Indexes for manufacturing and services were better than expected in February with the exception of employment. The service employment index dropped to 48.5, its first trip below the 50 expansion/contraction mark since last July.

Nonfarm Payrolls in February at 678,000 were considerably stronger than the 400,000 consensus forecast. Initial Jobless Claims were 215,000 in the final week of February.

The Ukraine war continues to dominate markets. Fed policy, the US labor market, and even soaring oil prices are filtered through the safety needs of the conflict.

USD/JPY outlook

As long as the Ukraine war continues the USD/JPY should be pinned between the safety aspects of its components. The impact of higher energy and commodity prices on industrial economies has yet to show up in statistics. In addition to the rise in West Texas Intermediate and Brent, the Bloomberg Commodity Index, (BCOM) has climbed about 12% since the Russian attack.

This cost increase has potential to damage the Japanese economy more than that of the US. As long as fighting continues in Ukraine, with its fears, however unlikely, of a more general European conflagration, the safety trade will order the USD/JPY.

Japanese GDP for the fourth quarter is expected to rise slightly on revision to 5.6% annualized. The Business Survey Index (BSI) for the first quarter from the Ministry of Finance will give an indication of current economic conditions for Japanese businesses, as will the Eco Watchers Survey for February.

In the US, consumer prices in February are the main news. Immediate Federal Reserve policy is set, but with the headline and core rates expected to accelerate, the effect will be felt in the economic and fed funds projection due at the March 16 meeting.

Treasury rates were down sharply on Friday across the entire yield curve as risk-aversion and the safety-trade to US bonds were excited by the cotinuing combat in Ukraine and the lack of movement toward negotiation. The decline pulled USD/JPY lower.

The outlook for the USD/JPY is neutral to lower.

Japan statistics February 28–March 4

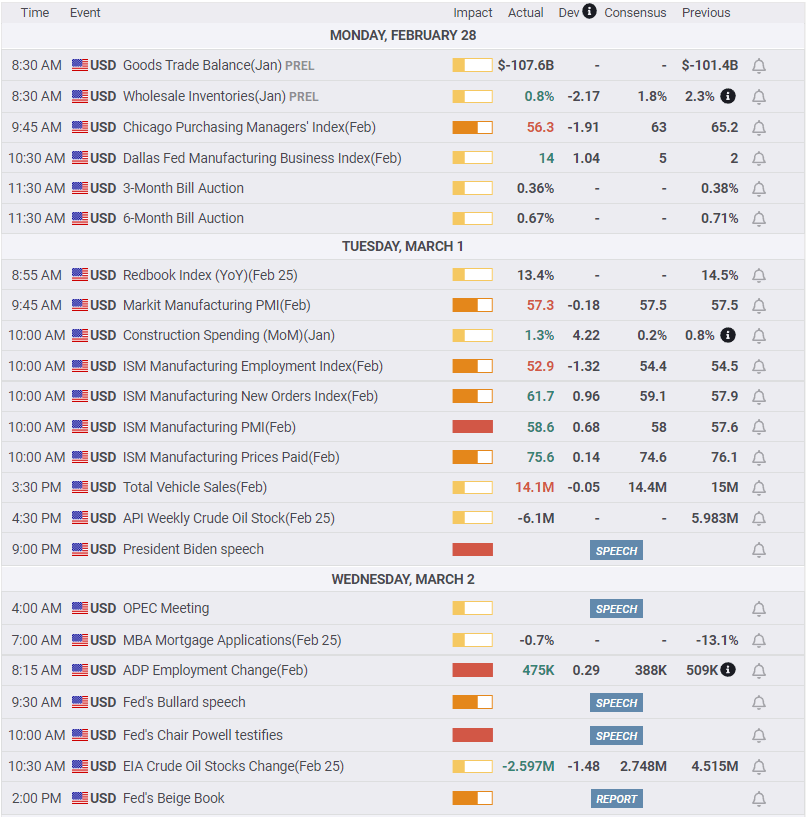

US statistics February 28–March 4

FXStreet

Japan statistics March 7–March 11

FXStreet

US statistics March 7–March 11

FXStreet

USD/JPY technical outlook

Market volatility from the Ukraine war has not translated into a USD/JPY trend. The overall trades of 114.41 to 115.81 and the opening and closing extremes of 114.72 to 115.67 since the Russian invasion are within the range of the last six weeks. The relative stasis is reflected in the MACD (Moving Average Convergence Divergence) and the Relative Strength Index (RSI) which are close to neutral and not favorable to either side of the USD/JPY. Volatility on Wednesday in the Average True Range (ATR) reached its highest point this year and can be expected to maintain a high level of event-driven fractiousness.

The cross of the 21-day moving average (MA) at 115.28 and the 50-day MA at 115.03 on Friday due to the steep drop in US Treasury rates may be fundamentally based but its technical implications are for a weaker USD/JPY. The 100-day MA at 114.46 is the next support, followed by 114.00 and 113.65 which markes the low close this year. Above there is weak resistance at 114.85 and 115.15 with more substantial 115.35.

Resistance: 114.85, 15.15, 115.35, 115.60, 116.10

Support: 114.46 (21-day MA), 114.00, 113.65, 113.25

FXStreet Forecast Poll

Though the FXStreet Forecast Poll consensus for the USD/JPY is bullish its range portrays consolidation out to one quarter.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.