USD/JPY Weekly Forecast: BOJ vs the Federal Reserve

- USD/JPY reaches 114.70 on Wednesday, a four-year high.

- 10-year Treasury-JGB spread widens by 7 points.

- USD/JPY encounters profit-taking, rebounds from support on Friday.

- FXStreet Forecast Poll is uniformly bearish out to one quarter.

After a month of torrid gains that extended to a four-year high at 114.70 on Wednesday, the USD/JPY executed a modest about face on Thursday losing about 40 points and closing just below 114.00. In its initial rebound, the USD/JPY keyed on the first support encountered at 113.65, underlying the still buoyant nature of the pair. On the week, the USD/JPY was slightly lower, opening at 114.20 on Monday and finishing on Friday at 113.56.

Over the last month, from the close on September 21, the day before the Federal Reserve meeting, the USD/JPY has gained 4.2%. Tuesday’s finish at 114.38 was the highest close since October 10, 2018. In comparison, the EUR/USD had lost just under 1% to Friday’s open and the sterling had gained a bit less than 1% in the same period.

The Japanese yen has been the weakest major against the dollar over the past four weeks since the Federal Open Market Committee (FOMC) meeting on September 22 and the primary reason is sovereign yields. The differential between the Japanese Government Bond (JGB) 10-year yield and the US 10-year Treasury has ballooned 28 basis points from its position on September 21. During that time the US-10 year yield has gone from 1.324% to 1.662% while the JGB equivalent has gone from 0.042% to 0.096%. This has increased the US 10-year Treasury yield advantage 7 basis points to 1.563%.

Interest rates are not the only logic behind the dollar’s ascendancy over the yen.

The worldwide computer chip shortage is expected to hit Japan’s export industries, especially automobiles, hard over the next six-to twelve months. Car shipments could fall 40% from last year.

Japan’s national election on October 31 is almost guaranteed to return the Liberal Democratic Party (LDP) candidate, current Prime Minister Fumio Kishida, to office. He has promised new fiscal and monetary stimulus programs to revive the Japanese economy. While the efficacy of these measures for invigorating Japan’s export-driven economy is questionable, their ability to keep the yen on the defensive is not.

Japanese economic data was mixed this week. Exports and Imports rose more than forecast in September but as the annual statistics are still recovering from the collapse last year, they are not indications of a strong recovery. Yearly Exports were down 4.9% in September 2020 and Imports were off 17.1%

National consumer prices rose for the first time in 11 months in September adding 0.2% on an expectation for a 0.8% decline and following August's 0.4% decrease. Core CPI dropped 0.5% (YoY), more than double the -0.2% forecast and equal to the prior month’s drop.

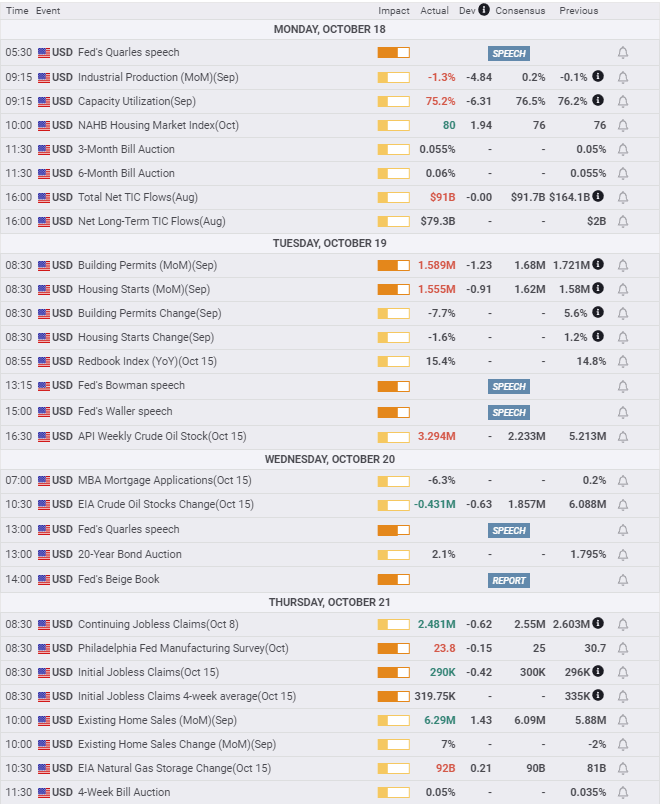

Industrial Production in the US sank 1.3% in September, far worse than the 0.2% prediction and Capacity Utilizations dropped to 75.2% from 76.2%. These coincide with the Atlanta Fed’s declining estimate for third quarter GDP now at 0.5%. It is down from over 6% in early August.

The US housing market remained effervescent, with Existing Home Sales, 90% of activity, jumping 7%. It is possible the threat of rising mortgage rates has motivated buyers to complete their purchases before the cost of buying a home increases..

The contrast between the strong, if uneven US economy, and Japan’s much slower recovery is another factor behind the gains in the USD/JPY.

USD/JPY outlook

All eyes have turned to the Federal Reserve’s November 3 meeting and the expected announcement of its bond program reductions. Treasury yields have moved steadily higher for the last month. The yield on the 10-year Treasury, the most important commercial referent, is less than 10 basis points below its March 31 high of 1.746%. An announcement from the FOMC, regardless of the initial amount or schedule, should keep US interest rates moving higher.

Japan’s sovereign yields are stagnant and are not about to mimic the gains in the US. That logic is the largest reason behind the surge in the USD/JPY.

The Bank of Japan and the Japanese government have, in the past, used the exchange rate to bolster the nation’s export industries.

Over the past quarter century the USD/JPY has varied from 145 to 77. At 114 the USD/JPY is near the midpoint of that range, as US yields rise and JGB returns plateau, the upper half of that territory is becoming more and more likely as a long term goal.

One suspects the BOJ and the Tokyo government would welcome such a devaluation. The bias in the USD/JPY is higher.

American data is expected to support the Federal Reserve case for commencing the bond taper. The Personal Consumption Expenditure Price Index for September is forecast to jump to 4.7%, the core rate to 3.6%, both records if correct. The consensus forecast for the first reading on third quarter GDP is 5.4%. The discrepancy to the Atlanta Fed GDPNow projection of 0.5% is notable and unusual. It would probably take a result near the Atlanta estimate for the Fed to delay its taper announcement.

The BOJ Interest Rate Decision, Monetary Policy Statement and Outlook Report have some potential for market impact. Prime Minister Kishida may have discussed his economic plans with BOJ officials as they likely involve bank actions. Any hints from the bank as to policy developments could weaken the yen.

Japan statistics October 18–October 22

US statistics October 18–October 22

FXStreet

Japan statistics October 25–October 29

FXStreet

US statistics October 25–October 29

FXStreet

USD/JPY technical outlook

The MACD (Moving Average Convergence Divergence) peaked on Monday, stalled on Tuesday and drifted down with the USD/JPY for the balance of the week. The Relative Strength Index executed a similar evolution, leaving overbought on Friday, having been in residence since October 11. That was the longest period in that status since late March and early April this year. Both averages remain active buy signals. True Range saw its highest moment on Thursday after small ranges on Monday, Tuesday and Wednesday and ebbed on Friday's reduction in points.

Despite the sharp turns higher of the 21-day (112.56) and 50-day (110.97) moving averages (MA) their distance from the market is testimony to the USD/JPY sprint after crossing 112.00 on October 8. The steep upward slope of these averages is their main contribution to the current technical picture.

The long gap between the 113.30 and 112.25 support lines, mirroring the open and closing rates for October 11, is a decided technical weakness should the USD/JPY drop far below 113.65 support.

The scarce resistance lines above Thursday's close at 113.88 did not prompt a further test of the upside after Tuesday's three-year record close at 114.38. Wednesday's test to 114.70 likewise indicated that, for the moment, momentum is dissipated. This is not surprising given the ascent of the last month is one of the steepest in a decade. Fundamental factors still heavily favor increases in the USD/JPY, but a breather is on order.

Resistance: 114.00, 114.35

Support: 113.65, 113.30, 112.25, 112.00, 111.55

FXStreet Forecast Poll

The rocket advance of the USD/JPY over the past month has boosted prospects for a technical reaction in the FXStreet Forecast Poll, absent a strong and continuing movement higher in US Treasury yields.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.