USD/JPY Weekly Forecast: A sense of deja vu

- USD/JPY recovers ground but the trend remains lower.

- Weak US December payrolls had minimal effect as already priced.

- BOJ “closely watching currency markets” provides Thursday boost.

- FXStreet Forecast Poll sees little movement despite bearish outlook.

A week of political turmoil in the United States that culminated in a riot in the halls of Congress by supporters of President Trump, had almost no impact on the currency markets as an old-fashioned warning from the Bank of Japan combined with the prospect of more stimulus spending in the United States gave the USD/JPY a modest boost back to 104.00.

Japan Prime Minister Yoshihide Suga declared a state of emergency in Tokyo and three nearby areas as COVID-19 diagnoses continued to rise in the capital. The declaration is voluntary, has no penalties and asks restaurants and bars to close at 8 pm, people to stay home and not gather in crowds.

After touching 102.59 on Wednesday, the lowest the pair has been since November 2016, excepting the one-day panic plunge to 101.18 on March 9, the BOJ's traditional notice that they were “closely watching the currency markets” checked the fall. The rebound was limited by a band of resistance that extends from 104.00 to 105.00.

Bank of Japan monetary policy has not been a major factor for the USD/JPY in the last four years. The previous BOJ cut was in December 2015, when it reduced the overnight cash rate from 0.1% to -0.1%, where it has been ever since.

Japanese public debt was 198% of GDP at the end of 2019, 1.12 quadrillion yen and will exceed 1.2 quadrillion yen in the current fiscal year, according to the Japan Times. As of September, the BOJ owned 45.1% of the total outstanding JGBs.

Japanese deflation is one of the reasons behind the steady rise in the yen against the dollar. Annual CPI in November was -0.9%, in October it was -0.4%. Those are the first back-to-back months of outright price declines from April to July 2016. Even with the BOJ's -0.1% base rate and the fed funds mid-rate of 0.125%, the combination of US CPI inflation at 1.2% in November and Japanese deflation gives Japanese Government bonds (JGBs) a better real yield.

Japanese Consumer Confidence dropped in December, it had been forecast to increase. Perhaps the reason was the large fall in annual cash earning in November making them negative for every month beginning in April. Household spending was better in November than expected, rising for the second month after falling for 12 straight months starting in October 2019.

American information was better on the business side, both services and manufacturing PMIs were stronger than forecast with continuing robust New Orders Indexes, but worse for employment with ADP and Nonfarm Payrolls reporting job destruction in December. Consumer spending in the Consumer Credit Change report from the Federal Reserve increased the most since June.

Technically, the inner descending channel that returns to early July and the outer that began with the pandemic panic in March, are intact. The lower border is now below 102.00 and falling. The market top on Friday at 104.09 scraped the upper border of the inner channel, but the close at 103.94 was again internal. The disparity between the recently traded and numerous resistance lines and the scarce and weak support has helped keep the USD/JPY moving lower. There has been no real case for a technical reversal in over a year leaving the pair subject to the vagaries of the dollar. Neither the Japanese economy nor the central bank seem to have a capacity for positive surprises.

USD/JPY outlook

The last substantial run higher on November 9, from 103.37 to 105.65, is the likely pattern for the much smaller move up on Wednesday and Thursday. After the November surge, the market dithered for three days, never breaking through the top channel, and then began to slide. That almost two-and-a-half figure increase was not treated as the grounds for a potential break but just as the measure of the next weeks' retreat.

The basic issue for the USD/JPY is that the yen side is moribund, except for the minor real interest rate advantage, and the weak dollar scenario has not changed since March. Look for a drift lower in the week ahead as traders respect the technical formation, largely for the lack of anything better.

Japan statistics January 4-January 8

Tuesday

Consumer Confidence in December fell to 31.8, the lowest level since August from 33.7. The forecast was 38.5. Labor Cash Earnings (YoY) fell 2.2% in November, half again as much as the -1.3% forecast and three times the -0.7% October result.

Thursday

Overall Household Spending (YoY) rose 1.1% in November, reversing the -1.5% prediction though down from 1.9% in October.

Friday

The Coincident Index, which tracks the entire economy in one statistic, slipped to 89.1 in November from 89.4 prior. The Leading Economic Index rose to 96.6 in November from 94.3 in October, 94.6 had been forecast.

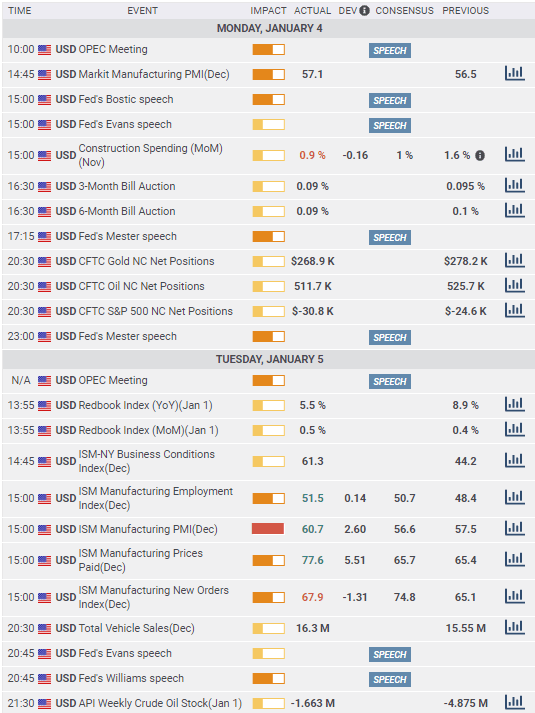

US Statistics January 4-January 8

The Manufacturing Purchasing Managers' Index from the Institute for Supply Management (ISM) rose to 60.7 in December from 57.5, far ahead of the 56.6 forecast. The New Orders Index climbed to 67.9 in December from 65.1. The Employment Index rose to 51.5 from 48.4.

Wednesday

ADP Employment Change report lost 123,000 positions in December. It had been forecast to gain 88,000.

Thursday

Challenger Job Cuts rose to 77,030,000 in December from 64,797,000 in November. Initial Jobless Claims slipped to 787,000 in the week of January 1 from the revised 790,000 prior. Continuing Claims fell to 5.702 million in the December 25 week from 5.198 million. Services PMI in December from ISM rose to 57.2 from 55.9, on a 54.6 forecast. The New Orders Index rose to 58.5 from 57.2, the estimate was 54.9. The Employment Index fell to 48.2 from 51.5, 50.7 was the forecast.

Friday

Nonfarm Payrolls lost 140,000 positions in December, reversing the 71,000 forecast. The November total was revised to 336,000 from 245,000. The unemployment rate (U-3) was unchanged at 6.7%. The Underemployment Rate (U-6) dropped to 11.7% from 12.0%. Average Hourly Earnings rose 0.8% in December, four times the estimate after a 0.3% gain in November. On the year they rose 5.1% on a 4.4% forecast and November result. Average Weekly Hours slipped to 34.7 from 34.8. The Labor Force Participation Rate was stable at 61.5%. Consumer Credit expanded by $15.27 billion in November, outstripping the $9 billion estimate and more than double the $7.23 billion extension in October. It was the largest gain since $19.66 billion in June.

Japan statistics January 11-January 15

The December Producer Price Index is the most relevant statistic for the yen this week as deflation is one of the props for the currency. It is not, however, a trading event.

Tuesday

The Eco Watchers Survey that measures regional economic trends is due for December. The Outlook survey was 36.5 and the Current 45.6 in November.

Wednesday

The December Producer Price Index is forecast to be 0.2% on the month and -2.2% on the year in December. Machinery Orders are projected to fall 6.2% in November after gaining 17.1% in October. Annual orders are expected to rise 15.4% following 2.8% in October.

Friday

The Tertiary Industry Index that tracks the domestic service sector, is forecast to gain 0.3% in November after a 1% rise in October.

US statistics January 11-January 15

Retail Sales are the most interesting statistic this week. December is an important month for commerce and a poor result could mean trouble for many struggling small businesses with dire implication for employment in the first quarter. Jobs have been the most telling statistic for the dollar.

Wednesday

The Consumer Price Index (CPI) for December is predicted to gain 0.4% on the month and 1.3% on the year following 0.2% and 1.2% in November. Core CPI is forecast to be 0.1% and 1.6% in December after 0.2% and 1.6% in November. The Federal Reserve Beige Book of economic views from the 12 Reserve Districts prepared for the January 26-27 meeting is released at 2:00 pm EST.

Thursday

Initial Jobless Claims and Continuing Claims are out at 8:30 am EST. They were 787,000 and 5.072 million in the prior week.

Friday

The Producer Price Index for December will be released at 8:30 EST. Forecasts are 0.3% and 0.8% for the headline and 0.2% and 1.3% for the core. Retail Sales in December are expected to fall 0.2% following the 1.1% drop in November. The Retail Sales Control Group is expected to rise 0.2% after a 0.5% loss in November. Industrial Production in December is forecast to be unchanged at 0.4%. Capacity Utilization will rise to 75.5% from 75.3%. Michigan Consumer Sentiment for January is projected to drop to 79.2 from 80.7.

USD/JPY technical outlook

The steep ascent of the Relative Strength Index from Tuesday to Friday is a reflection of the sharp rebound, it is not a buy indicator, nor does it signal a turn in the USD/JPY. The lack of conviction in the negative moves has been obvious for several weeks. The USD/JPY falls because as yet, it has no good reason to rise, not because the case for yen strength is convincing. Until the dollar can shake off the US labor market blues the default move is lower. The numerous and well-traded resistance lines, the product of the long decline, have served to keep the pressure on the USD/JPY. The recent support lines have far less activity and are weaker but due to the expiring momentum, they have not been tested very often.

The 21-day moving average was crossed in Thursday's move and is now coincident with support at 103.50. The 100-day at 104.74 is mid-way between two resistance lines and the 200-day at 105.93 is distant.

Resistance: 104.30; 104.60; 105.00; 105.50

Support: 103.50; 103.00;102.79; 101.60

USD/JPY Forecast Poll

The uniformly bearish intent of our FXStreet Forecast Poll out to one quarter, with the highest bullish sentiment at 26%, is nonetheless a very weak endorsement of a lower USD/JPY. The bullish calls relate strictly to the current level of USD/JPY just below 104.00. They do not predict a continuing decline in the pair. Taken as an indicator of what they do not anticipate, that is a weaker USD/JPY, the calls might almost be said to be a negative endorsement for a rise.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.