USD/JPY Price Forecast: Slides closer to 146.00 as BoJ rate hike bets overshadow trade optimism

- USD/JPY attracts sellers for the second successive day amid a combination of negative factors.

- The BoJ rate hike bets underpin the JPY and exert pressure on spot prices amid a softer USD.

- The US-China trade optimism could underpin the safe-haven JPY and limit losses for the pair.

The USD/JPY pair continues losing ground for the second straight day on Wednesday and retreats further to its highest level since April 3, around the 148.65 region touched earlier this week. The downtick is sponsored by a combination of factors and drags spot prices to the 146.00 neighborhood during the early part of the European session.

The Bank of Japan (BoJ) published the Summary of Opinions from the April 30-May 1 monetary policy meeting on Tuesday, which showed concerns that the US trade policy could hurt Japan's economic growth. Moreover, BoJ Deputy Governor Shinichi Uchida noted that Japan's economic growth is expected to slow to around its potential before resuming moderate growth. Uchida added that wages are expected to continue rising as Japan's job market is very tight and that companies are expected to keep passing on rising costs by increasing prices. Furthermore, the deputy governor reiterated that the BoJ will keep raising rates if the economy and prices improve as projected. This keeps the door open for further policy normalization by the BoJ and turns out to be a key factor underpinning the Japanese Yen (JPY).

On the economic data front, Japan's Producer Price Index (PPI) rose 0.2% in April, and the yearly rate came in at 4%, down from 4.2% in the previous month, though it did little to influence the JPY. The US Dollar (USD), on the other hand, struggles to lure buyers as the softer-than-expected US consumer inflation figures released on Tuesday reaffirmed bets for at least two 25 basis points (bps) interest rate cuts by the Federal Reserve (Fed) in 2025. The US Bureau of Labor Statistics reported that the headline Consumer Price Index (CPI) edged lower to the 2.3% YoY rate in April from 2.4% the previous, while the core gauge, which excludes volatile food and energy prices, rose 2.8% on a yearly basis, matching estimates.

Traders, however, have scaled back their expectations for a more aggressive policy easing by the Fed in the wake of the US-China trade optimism, which helped to ease recession fears. US President Donald Trump said on Monday that he does not see tariffs on Chinese imports returning to 145% after the 90-day pause. This, in turn, is holding back the USD bears from placing aggressive bets. Apart from this, a positive risk tone could act as a headwind for the safe-haven JPY and contribute to capping the USD/JPY pair. There isn't any relevant market-moving economic data due for release on Wednesday, leaving the USD and the currency pair at the mercy of scheduled speeches from influential Fed officials.

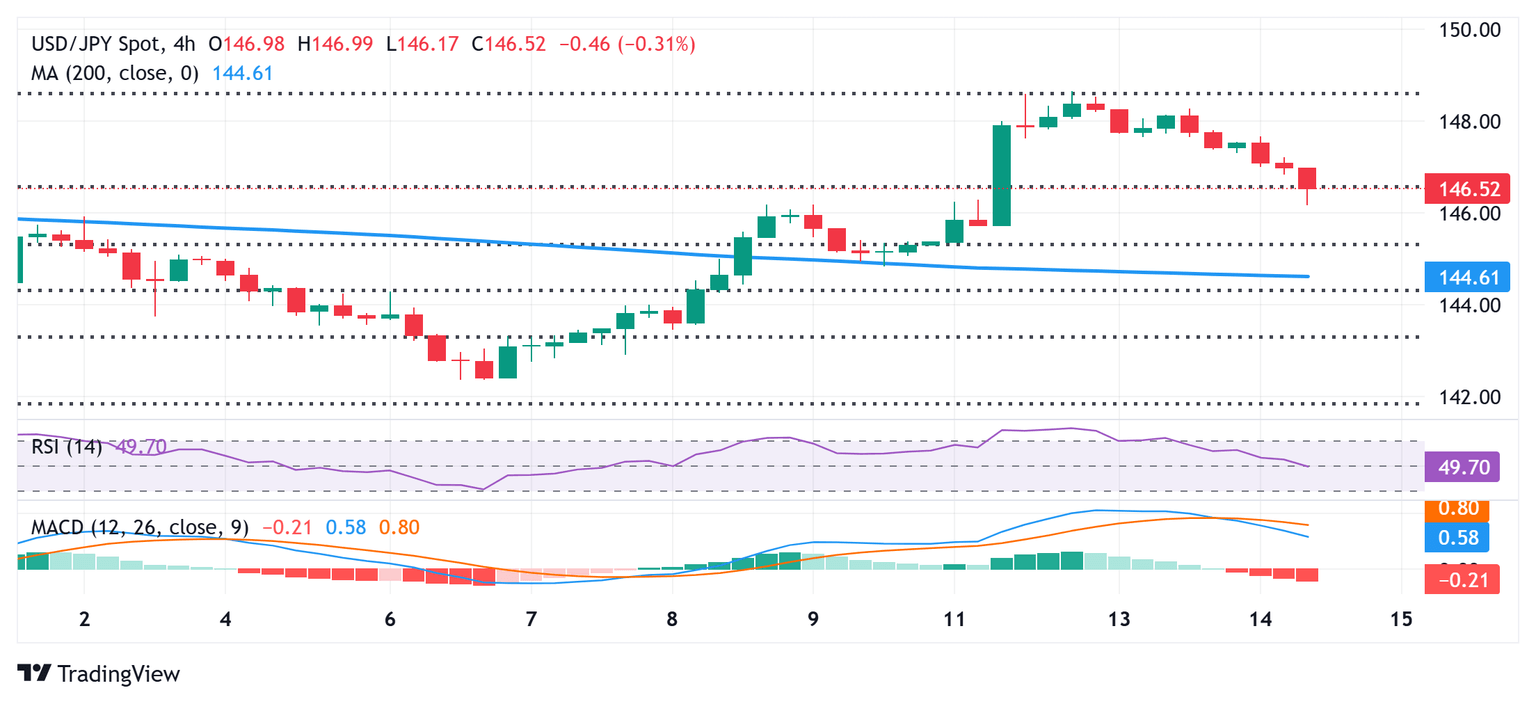

USD/JPY 4-hour chart

Technical Outlook

The recent breakout through the 200-period Simple Moving Average (SMA) on the 4-hour chart and positive oscillators on the daily chart favor bullish traders. Moreover, the further slide is likely to find decent support near the 146.00 round figure. The next relevant support is pegged near the 145.40 area (38.2% Fibo. level) ahead of the 145.00 psychological mark. This is closely followed by the 144.80-144.75 area, or the 200-period SMA on the 4-hour chart, which, if broken decisively, would negate the near-term positive bias.

On the flip side, the 147.65 zone now seems to act as an immediate hurdle ahead of the 148.00 round figure. Any further move up beyond the 148.25-148.30 hurdle might confront stiff resistance near the 148.65 area, or over a one-month peak touched on Monday. A sustained strength beyond the latter will be seen as a fresh trigger for bulls and allow the USD/JPY pair to climb further beyond the 149.00 mark, towards the 149.65-149.70 area and eventually to the 150.00 psychological mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.