USD/JPY Price Forecast: Attempted recovery is likely to get sold into amid trade war woes

- A combination of supporting factors assists USD/JPY to rebound from a multi-month low.

- A positive risk tone undermines the JPY and acts as a tailwind amid a modest USD uptick.

- The fundamental backdrop, however, warrants some caution before confirming a bottom.

The USD/JPY pair stages a goodish recovery from the 141.60 region, or its lowest level since September 2024 touched earlier this Thursday, and sticks to its positive bias through the first half of the European session. The global risk sentiment gets a minor lift amid hopes of US tariff negotiations, especially after China expressed openness to trade talks under certain conditions. This, in turn, dents demand for traditional safe-haven assets, including the Japanese Yen (JPY). Adding to this, a modest US Dollar (USD) bounce from the vicinity of a multi-year low lends support to the currency pair.

The US Census Bureau reported on Wednesday that Retail Sales climbed 1.4% in March, the most in over two years. The reading followed a revised 0.2% increase in the previous month and was better than the market expectation for a 1.3% rise. Moreover, Federal Reserve Chair Jerome Powell said the US central bank was not inclined to cut interest rates in the near future, citing the potential inflationary pressure stemming from US President Donald Trump's aggressive tariffs policies. This, in turn, assists the USD to attract some buyers and acts as a tailwind for the USD/JPY pair.

Traders, however, are still betting on the possibility that the US central bank will resume its rate-cutting cycle in June and lower borrowing costs by a full percentage point by the end of this year. This might hold back the USD bulls from placing aggressive bets. Furthermore, the rapidly escalating US-China trade war might keep a lid on the market optimism. This, along with the growing acceptance that the Bank of Japan (BoJ) will hike interest rates again, should help limit deeper JPY losses and keep a lid on any meaningful appreciating move for the USD/JPY pair.

The White House announced that China will now face 245% tariffs due to its retaliatory measures after Trump's Liberation Day announcements. In fact, China last week raised duties on imports from the US to up to 125% and imposed new export licensing restrictions on seven rare earths. In response, the US government also imposed new licensing requirements and limited exports of H20 artificial intelligence chips to China. This adds to market worries that tit-for-tat tariffs – the world's two countries are imposing on one another – will hinder global economic growth.

Meanwhile, BoJ Governor Kazuo Ueda signaled the potential to pause the rate-hiking cycle and said that the central bank may need to take policy action if US tariffs hurt the Japanese economy. Moreover, Reuters reported that the BoJ is set to cut its economic growth forecasts at the April 30-May 1 meeting as US tariffs heighten risks to the fragile economic recovery. However, BoJ board member Junko Nagakawa said that if the outlook for economic activity and prices is realized, the central bank will continue to raise rates and adjust the degree of monetary accommodation.

Moreover, hopes for a US-Japan trade deal might hold back the JPY bears from placing aggressive bets and cap the USD/JPY pair. In fact, Trump said negotiators had made “big progress” in trade talks with a Japanese delegation, while Japan’s Prime Minister Shigeru Ishiba said that talks with the US were constructive and that the government will consider trade negotiations a top priority. Furthermore, Japan's Economy Minister Ryosei Akazawa said that the officials agreed to hold a second meeting this month and believed that the US wants a deal within the 90-day window.

The aforementioned fundamental backdrop warrants some caution before confirming that the USD/JPY pair has bottomed out in the near term and positioning for any further move up. Traders now look forward to the US economic docket – featuring the release of the usual Weekly Jobless Claims, the Philly Fed Manufacturing Index, and housing market data later during the early North American session. Apart from this, the Fed speaks and trade-related developments will influence the USD price dynamics, which should contribute to producing short-term trading opportunities.

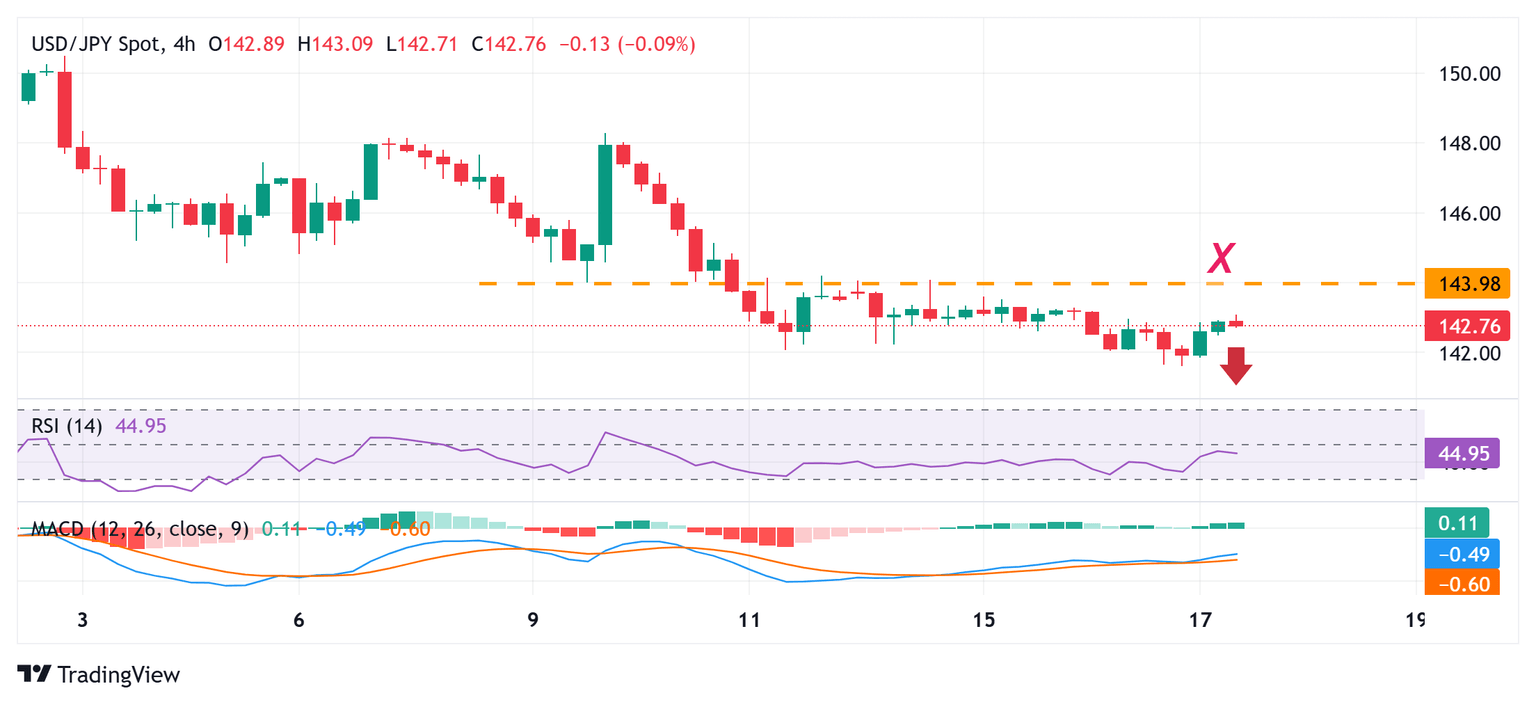

USD/JPY 4-hour chart

Technical Outlook

From a technical perspective, the overnight breakdown and close below the 142.00 mark was seen as a fresh trigger for bearish traders. Moreover, oscillators on the daily chart are holding deep in negative territory, suggesting that the path of least resistance for the USD/JPY pair is to the downside. Hence, any subsequent move up beyond the 143.00 round figure could be seen as a selling opportunity near the 143.55-143.60 region. This might cap spot prices near the 144.00 pivotal barrier, which if cleared might trigger a short-covering rally to the 144.45-144.50 horizontal barrier en route to the 145.00 psychological mark.

On the flip side, weakness back below the 142.60 area might now find some support near the 142.00 mark. This is followed by the 141.60 area, or a multi-month low touched during the Asian session this Thursday. Some follow-through selling below the latter will reaffirm the negative bias and make the USD/JPY pair vulnerable to prolong its recent well-established downtrend witnessed over the past three months or so.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.