USD/JPY Forecast: Sellers side-lined amid the market’s optimism

USD/JPY Current price: 104.53

- Weak US employment-related data weighed on the greenback and Wall Street.

- Japanese Consumer Confidence improved in November to 33.7.

- USD/JPY is neutral-to-bullish in the near-term, critical resistance around 105.30

The USD/JPY pair peaked at 104.74, its highest in over a week, underpinned by coronavirus vaccine hopes and renewed talks about a US stimulus package. The rally stalled after softer than expected US employment-related figures, as the ADP report came in at 307K below the expected 410K. The Wall Street’s tepid tone also capped advances, although the pair is ending the day with modest gains around the 104.50 price zone.

Japan published at the beginning of the day the November Monetary Base, which improved by less than anticipated, up by 16.5% YoY. Consumer Confidence in the same month, however, surprised to the upside, improving to 33.7 from 33.6 against an expected drop to 29. This Thursday, the country will release the November Jibun Bank Services PMI, previously at 47.7.

USD/JPY short-term technical outlook

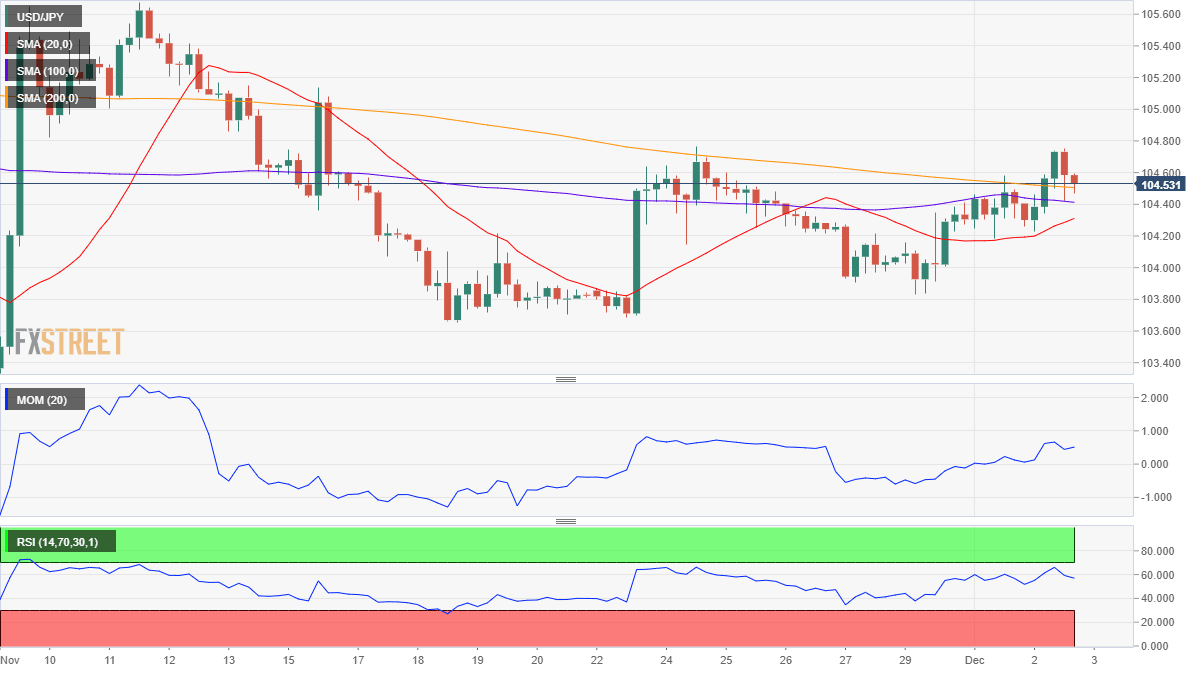

The USD/JPY pair temporarily traded above its 200 SMA in the 4-hour chart but is back below it. The 20 SMA and the 100 SMA remain directionless below the current level but close enough to indicate the absence of directional strength. In the mentioned chart, technical indicators have retreated from their intraday highs but hold within positive levels, signaling limited selling interest. A critical resistance comes at around 105.30, where the pair has a daily descendant trend line coming from March’s monthly high.

Support levels: 104.30 103.95 103.50

Resistance levels: 104.70 105.00 105.30

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.