USD/JPY Forecast: Correcting overbought conditions, caution backs the yen

USD/JPY Current Price: 109.98

- The US would not remove tariffs on Chinese imports until after the 2020 presidential election.

- Japan will publish December Machinery Tool Orders this Wednesday.

- USD/JPY correcting lower, but near a multi-month high of 110.21.

The USD/JPY pair reached a fresh multi-month high of 110.21 this Tuesday, holding around the 110.00 figure by the end of the day. The pair suffered a short-lived knee-jerk and fell to a daily low of 109.84 during the American afternoon, on news indicating that the US will not remove tariffs on Chinese imports until after the 2020 presidential election. Speculative interest is on its toes ahead of the signing ceremony of phase one of the trade deal between the US and China, scheduled for this Wednesday, as no detail has been unveiled ahead of the event. The market, however, quickly returned to pre-news levels.

At the beginning of the day, Japan released the November Trade Balance, which posted a smaller than expected deficit, printing at ¥-2.5B against the ¥-412.6B forecast, while the Eco Watchers survey on the current situation came in better than anticipated at 39.8. This Wednesday, BOJ’s Governor Kuroda will be on the wires, while the country will release the preliminary estimate of December Machinery Tool Orders, previously at -37.9% YoY.

USD/JPY short-term technical outlook

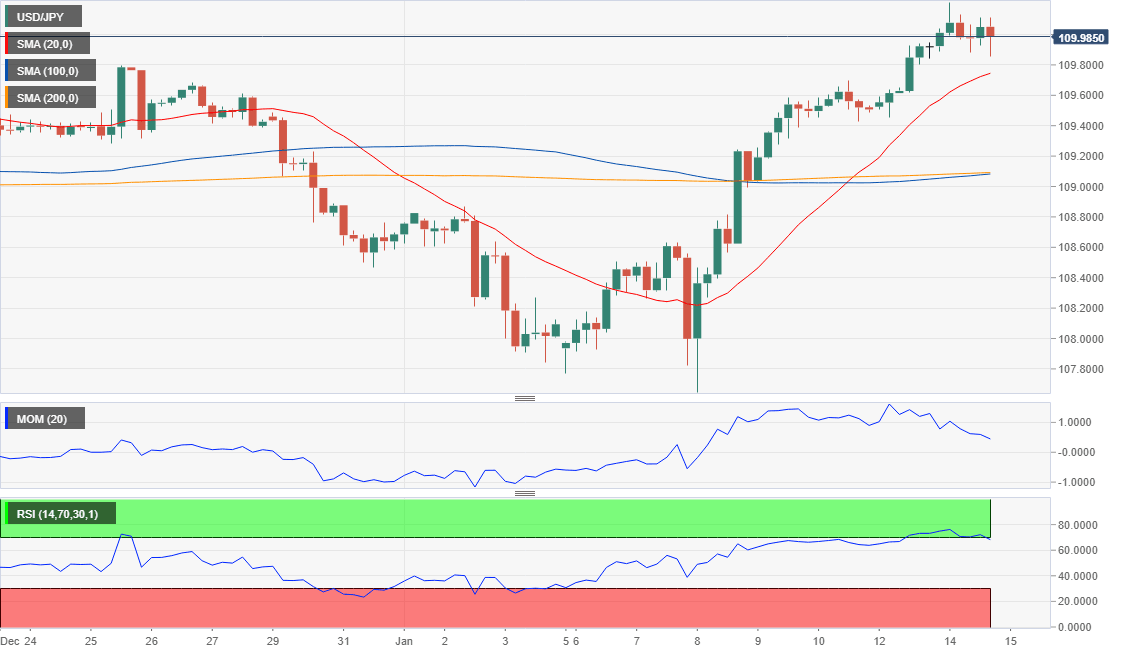

The USD/JPY pair is losing upward momentum, but far from turning bearish, as it holds a handful of pips below the mentioned multi-month high. In the 4-hour chart, the 20 SMA maintains its bullish slope well above the larger ones and below the current level, providing dynamic support at around 109.70. Technical indicators are easing, the Momentum nearing its mid-line, while the RSI is barely correcting extreme overbought conditions.

Support levels: 109.70 109.35 108.90

Resistance levels: 110.40 110.75 111.00

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.