USD/JPY Forecast: Bears hold the grip

USD/JPY Current price: 108.72

- US Treasury yields set the tone for USD/JPY as stocks struggle for direction.

- The American dollar is the weakest after terrible employment figures.

- USD/JPY is at risk of falling further and pierce the 108.00 level.

The USD/JPY pair trades around 108.70, up for the day and moving alongside US government bond yields. Nevertheless, the dollar is the weakest currency across the board, under pressure against most major rivals after the release of an awful employment report on Friday.

Stocks kick-started the week with a positive tone, but the momentum faded heading into London’s opening, with European indexes trading mixed. Meanwhile, the yield on the 10-year US Treasury note hovers around 1.58%, holding on to modest intraday gains. The macroeconomic calendar has no impact on the pair this Monday, as neither Japan nor the US have relevant figures to offer.

USD/JPY short-term technical outlook

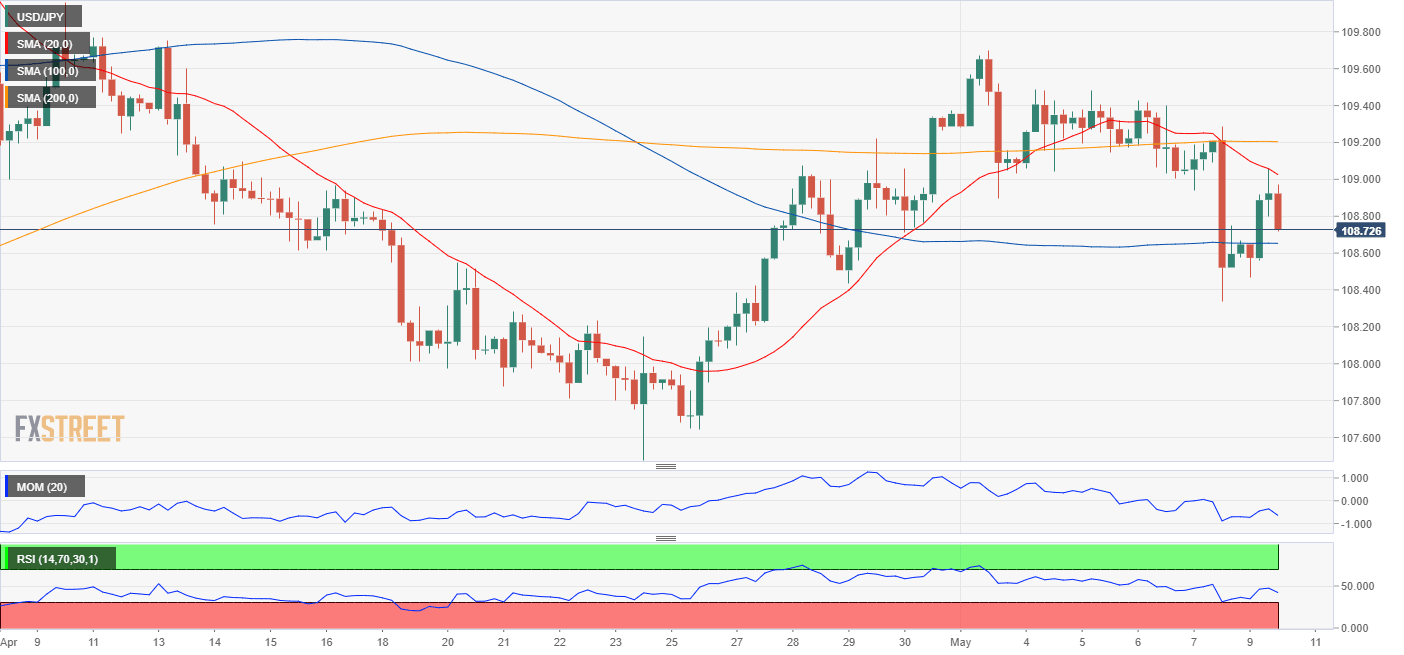

The USD/JPY pair is at risk of falling further. The 4-hour chart shows that the pair met sellers around a bearish 20 SMA, which extends its decline below the 200 SMA. A flat 100 SMA provides support at 108.65. Technical indicators have turned south within negative levels, indicating persistent selling interest.

Support levels: 108.65 108.25 107.90

Resistance levels: 109.25 109.70 110.10

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.