USD/JPY: can we trust the risk driven rallies yet? [Video]

![USD/JPY: can we trust the risk driven rallies yet? [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDJPY/japanese-yen-currency-and-dollar-bank-note-60447626_XtraLarge.jpg)

USD/JPY

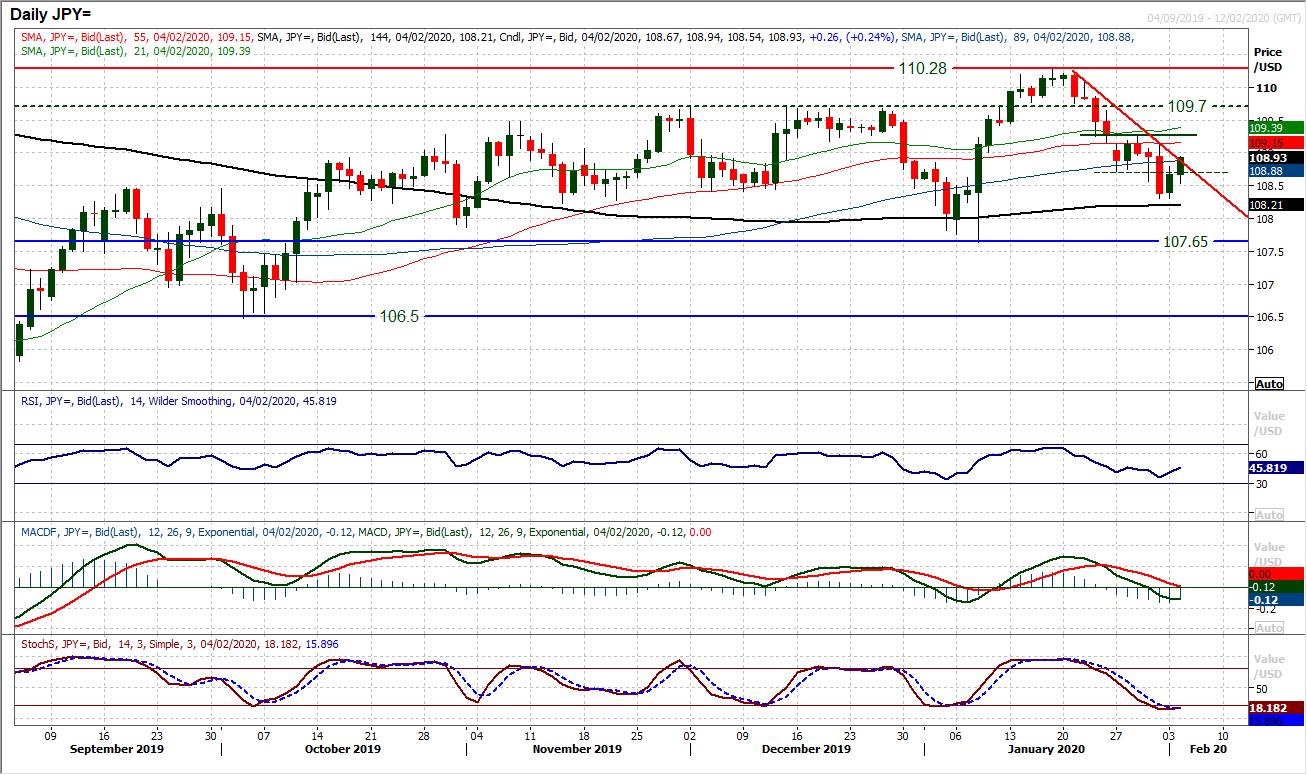

Looking at Dollar/Yen, the question is one of whether we can trust the risk driven rallies yet. If so, then the corrective outlook on USD/JPY will begin to fade and the two week downtrend will begin to break. The trend resistance is at 108.90 today and it is being tested. However, there have not been two consecutive positive candles on a closing basis in more than two weeks now, so if this can be achieved today then it could be the start of something for the bulls. Momentum indicators still edging lower in negative configuration, so given the downtrend being intact, the strategy remains one to sell into strength. However, a positive candle formation today could shift this narrative. The Stochastics are now decelerating in their decline and are back around levels where previous rallies have picked up during these waves of near term bull and bear runs over the past few months. Initial support at 108.30 held yesterday and how the market responds to the near term pivot of resistance around 108.70 and downtrend at 108.90 will be key in today’s session. A close above 108.90 would begin to open a more significant recovery, with resistance at 109.15/109.25.

Author

Richard Perry

Independent Analyst