USD/CHF zigzag corrective rally expected to fail [Video]

![USD/CHF zigzag corrective rally expected to fail [Video]](https://editorial.fxsstatic.com/images/i/Switzerland1_XtraLarge.png)

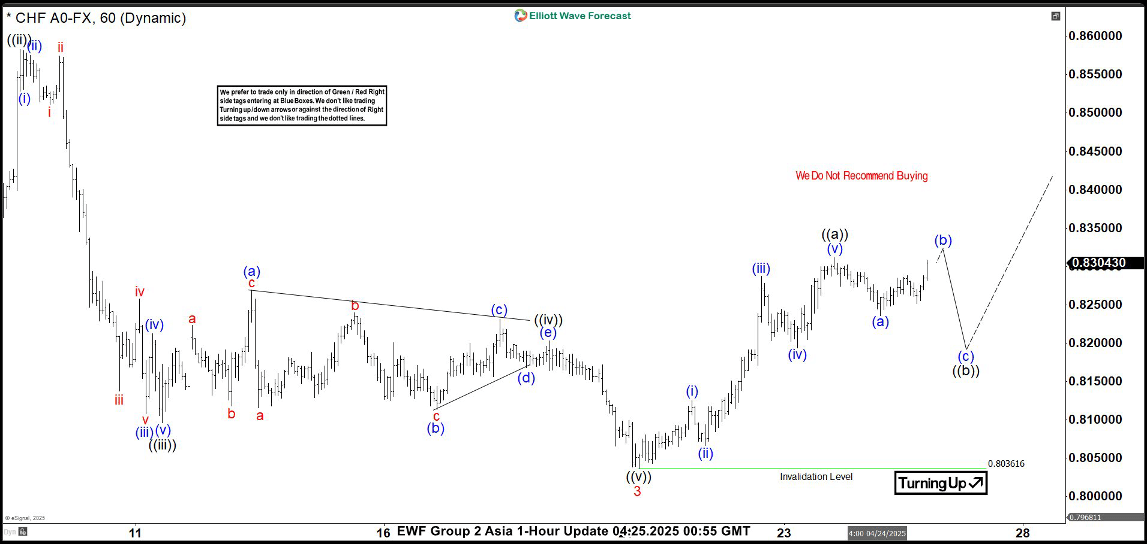

The USD/CHF currency pair has been trending downward since its high on January 13, 2026. The pair follows a pattern known as a 5-wave impulse in Elliott Wave analysis. This pattern helps traders predict price movements by breaking them into distinct waves. Starting from the peak, the first wave (wave 1) saw the pair drop to 0.8965. After this decline, a brief recovery, or wave 2, pushed the price back up to 0.9196. From there, the pair resumed its downward trajectory in wave 3, which unfolded in several stages.

In wave 3, the price first fell to 0.8356, marking the end of an internal sub-wave (wave ((i))). A small bounce to 0.8583 completed wave ((ii)). The decline continued, with wave ((iii)) reaching 0.8096, followed by a slight rally to 0.8203 for wave ((iv)). The final leg of wave 3, wave ((v)), bottomed out at 0.803, wrapping up the third wave.

Currently, USD/CHF is in an upward correction in wave 4, which is taking the shape of a zigzag pattern. From the low at 0.803, the pair climbed to 0.8124 in wave (i). Pair dipped to 0.8066 in wave (ii) then rose again to 0.8286 in wave (iii). A pullback to 0.8194 marked wave (iv), and the final push to 0.8311 completed wave ((a)), the first part of wave 4. Right now, the pair is experiencing a short-term pullback, called wave ((b)), correcting the rise that began on April 21, 2025. As long as the key support level at 0.8036 remains intact, USD/CHF is expected to resume its upward movement soon, potentially reaching higher levels before the next major trend develops.

USD/CHF 60 minute Elliott Wave chart

USD/CHF Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com