USD/CAD Weekly Forecast: US consumers shock markets, but how much has really changed?

- US dollar drops on Friday as Americans' consumer outlook falls to a new pandemic low.

- Consumer Sentiment in the US is hammered by inflation and covid counts.

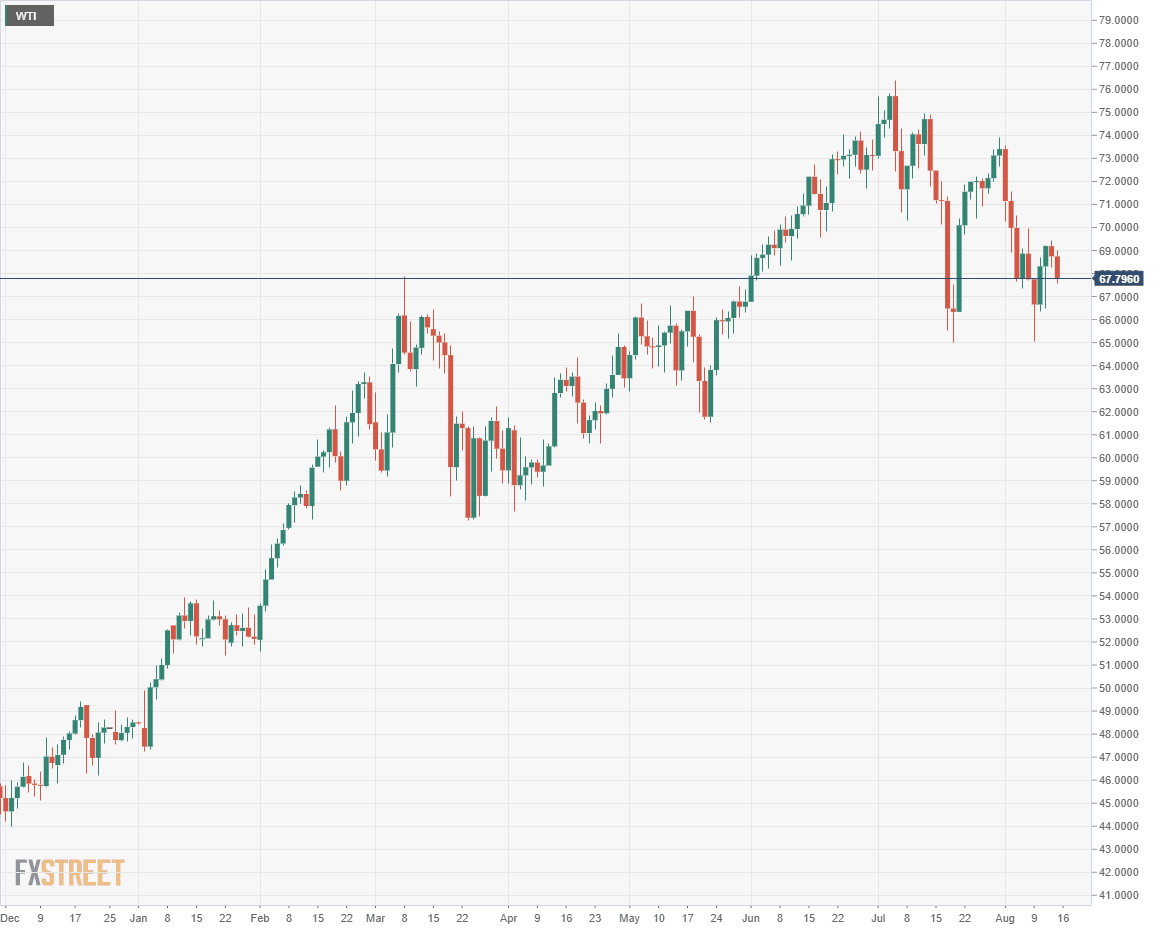

- WTI ends the week at $67.82, points from Monday’s open.

- FXStreet Forecast Poll predicts a gathering decline in the USD/CAD.

The US dollar took a general pounding on Friday as surging inflation and covid infections among the unvaccinated plunged the outlook of Americans to a new pandemic low.

Consumer Sentiment from the University of Michigan dropped to 70.2 in August, well beneath the 81.2 forecast and even below the previous pandemic nadir of 71.8 in April 2020. It was the lowest score for outlook since December 2011 and an unusually large one month drop.

“Over the past half century, the Sentiment Index has only recorded larger losses in six other surveys, all connected to sudden negative changes in the economy,” noted Richard Curtin, chief economist for the University of Michigan’s Surveys of Consumers in the statement accompanying the release.

Michigan Consumer Sentiment

Normally a background statistic, the wholly unexpected collapse of sentiment bodes poorly for next week’s important Retail Sales numbers and the consumer dependent US economy.

The USD/CAD was among the most resilient of all the US dollar pairs on Friday, losing just 13 points on the day, 41 on the week, to close at 1.2512 and managing to stay above support at 1.2500.

In contrast, the EUR/USD added 66 points to 1.1796 on Friday and gained 33 on the week.

The USD/JPY opened on Monday at 110.67 and 110.40 on Friday, giving the close at 109.60, a 67-point decline on the week and 80 points on the day.

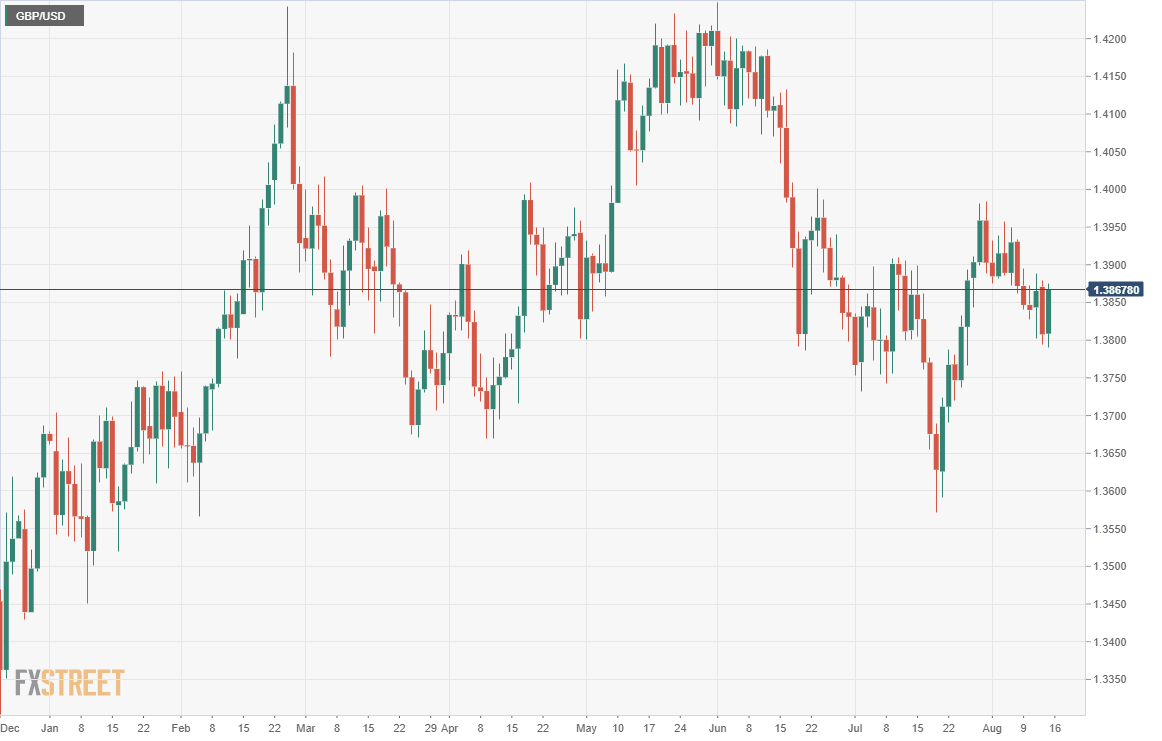

The sterling split the difference, gaining 58 points to 1.3867 on Friday but losing 5 points from Monday's open.

Treasury yields in the US fell sharply in conjunction with the dollar, reversing all of the week’s earlier gains.

West Texas Intermediate WTI) was essentially unchanged, opening at $67.75 on Monday and adding 5 cents to $67.80 for the finish.

Crude oil prices have risen 43% this year. Production has failed to keep pace with rising and anticipated demand as the pandemic restrictions on the global economy have been lifted.

President Biden’s request to OPEC for greater production is unlikely to meet with approval from the oil cartel. In one of the first moves of his administration, the President cancelled the Keystone pipeline, which was to bring Canadian crude to refineries in the US and closed all federal land to new drilling leases.

In the US, the national average price of gasoline is at $3.18 a gallon, near a seven-year high, up 46% from $2.18 a year ago, according to the American Automobile Association (AAA).

For most Americans, driving is an essential part of life, encompassing almost all activities. The Fed may exclude energy costs from its inflation reckoning, but in reality gasoline and energy costs are a major factor in consumer outlook.

There were no Canadian statistics this week.

In the US, July’s annual Core CPI at 4.3%, a bit less than the 4.5% forecast, and the unchanged headline rate at 5.4% supported the Fed’s contention that inflation increases will be transitory.

However, PPI for July was the opposite with the headline rate of 7.8% and the core gauge at 6.2%, setting records and far above their forecasts.

Companies are far more willing to pass on cost increases to customers this year than at any time in a generation, and these gains are sure to show up in CPI in the next few months.

Federal Reserve policy is also undetermined. Several bank officials, including Vice-Chair Richard Clarida, have suggested that a reduction in the amount of bond purchases may be nearing. The Fed’s contention that the recent inflation spike is temporary will be discussed at the August 26-28 annual Jackson Hole symposium, but whether the conclave will produce a consensus for the FOMC meeting a month later is highly speculative.

If plunging American Consumer Sentiment translates into lower consumer spending, the recovery, and hiring could be knocked askew.

This would create an uncomfortable dilemma for the Fed. Keep interest rates low with sustained bond purchases to support a weakening economy and let inflation run or curtail the bond program to curb inflation, let rates rise and risk tanking the stock market and the economy. If that unpleasant choice arises in the next few months, there is every indication the Fed will choose the path of economic support.

Nonetheless, there is relatively small potential for new policy developments during the August vacation season in Europe and the United States.

USD/CAD outlook

The relatively restrained response of the USD/CAD to the American consumer debacle on Friday underlined the equivocal nature of the pandemic for the USD/CAD.

Markets are unsure if the spreading Covid-19 Delta strain will bring on a new series of economic closures.

If the impact is severe, it could bring on a general flight to the safety of the US dollar.

Even if the damage is limited, the likely decline in global and US economic growth will lower oil consumption and undermine the Canadian economy, which is heavily dependent on the energy sector. In addition, if US growth falters, so does Canada’s, whose economy is closely tied to that of its far larger southern neighbor.

For the moment the bias for the USD/CAD is weakly lower.

It is possible that the global economy will not see much hindrance from the Delta strain. Consumer prices and Covid-19 in the US may have shocked sentiment but may not have much effect on spending, which in turn could continue to support the recovery.

But for the moment, the consumer surprise has shifted US economic assumptions to a weaker recovery, sustained low interest rates and thereby a lower US dollar.

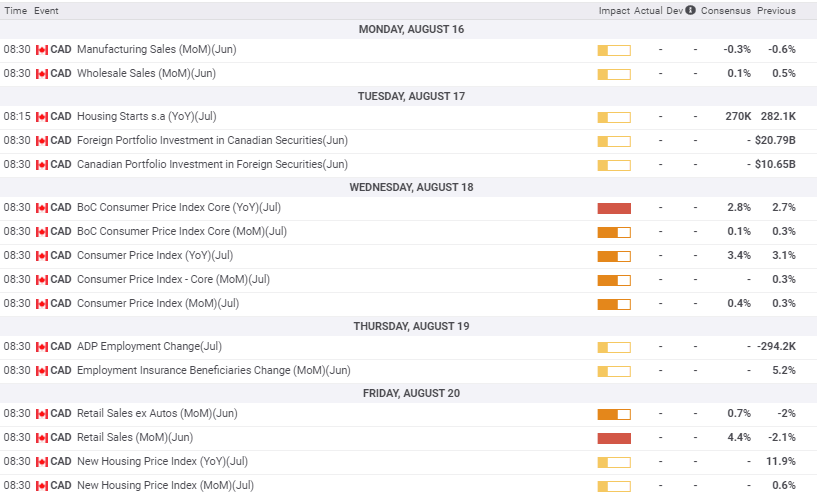

Canadian Retail Sales for June will give an indication if the economy is recovering from recent restrictions. The figures have only a minor potential for market impact as they are almost two months old. Better than expected results are good for the loonie and vice versa.

American data also centers on Retail Sales for July on Tuesday, which are forecast to show a cooling from June’s unexpectedly strong results. A good number will provide dollar support. Industrial Production for July 45 minutes later is forecast to be unchanged from June.

Canada statistics August 9–August 13

No data releases

US statistics August 9–August 13

FXStreet

Canada statistics August 16-August 20

FXStreet

US statistics August 16–August 20

USD/CAD technical outlook

The relative stasis of the USD/CAD over the past three weeks has blunted the momentum indicators. The Relative Strength Index (RSI) is neutral just above 50. True Range is at one of its lowest points of the year, and the MACD (Moving Average Convergence Divergence) has a very mild sale aspect. There is scant movement predicted, nor any recorded, from recent prior trading.

The moving averages (MA) form an interesting picture. The shortest, the 21-day MA at 1.2553, and the longest, the 200-day MA at 1.2565, are close resistance just above the market and in conjunction with the line at 1.2550. The three together are one of the prime reasons the USD/CAD has a slight downward cast. A break of these lines would push the USD/CAD easily toward 1.2600 and 1.2630. The middle two moving averages, the 50-day at 1.2428 and the 100-day at 1.2370, offer support below the 1.2450 line.

The support lines above 1.2400 are probably a bit weaker than their counterparts directly above the market given the greater volatility at their inception. The trading in late March and April that established the immediate resistance lines was considerably more deliberate.

Resistance: 1.2550, 1.2553 (21-day MA), 1.2565 (200-day MA), 1.2600, 1.2630, 1.2680

Support: 1.2500, 1.2450, 1.2428 (50-day MA), 1.2400, 1.2370 (100-day MA), 1.2325, 1.2270

FXStreet Forecast Poll

The FXStreet Forecast Poll gives consequence to the three failed upside breaks in the past month.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.

-637645527680975061.png&w=1536&q=95)

-637645528744918666.png&w=1536&q=95)

%20tech%201-637645570252434252.png&w=1536&q=95)

%20tech%202-637645570439460877.png&w=1536&q=95)

%20tech%203-637645570567814887.png&w=1536&q=95)