USD/CAD Weekly Forecast: Slip, sliding away

- The USD/CAD pair rebounds modestly from a 32-month low.

- Dollar gains after weak US and Canadian payroll reports.

- WTI closes the week at highest since February 21.

- FXStreet Forecast Poll sees a recovery in USD/CAD.

North American labor markets lost employment in December for the first time since April even as business planning in the US focused on the future and crude oil broke through $50 for the first time since late February. These cross currents left the Dollar Canada largely directionless at the bottom of its three-year range.

American national payrolls shed 140,000 employees last month and Canada's dropped 62,600, badly missing the respective 71,000 and -27,500 forecasts. The US November Nonfarm Payrolls did gain 91,000 to 336,000 on revision. The Unemployment Rate in the US was stable at 6.7% while the gauge from Ottawa rose 0.1% to 8.7%.

The USD/CAD closed the week at 1.2700, just 24 points from Monday's start at 1.2724 and weakest finish for the pair since February 20, 2018. The intra-day low of 1.2630 on Wednesday was the lowest since the 19th of the same month.

Saudi Arabia's announcement on Tuesday of a voluntary one million barrels-a day-production cut, which came after Iran's seizure of a South Korean ship in the Persian Gulf, sent West Texas Intermediate ( WTI) shooting 5.2% higher on the day despite the drag on global demand and economic activity from the pandemic. The global economy's basic commodity finished the week at $52.50 its highest close since February 21 last year.

WTI

Canada's business community is not as positive on the recovery as its colleagues south of the border. The Ivey Purchasing Managers' Index for December dropped to 46.7 from 52.7 in November, a substantial miss on the 54.7 forecast. It was the first time below the 50 expansion-contraction line since 39.1 in May.

The opposite was true in the US where Manufacturing PMI from the Institute for Supply Management (ISM) rose to 60.7 in December from 57.5, far ahead of the 56.6 prediction. The New Orders Index rose to 67.9 from 65.4 and the Employment Index climbed to 51.5 from 48.4. Attitudes in the much larger service sector were equally buoyant. The overall index went to 57.2 from 55.9 and the New Orders Index rose to 58.5 from 57.2. Only the Employment Index unexpectedly dropped to 48.1 from 51.5, 50.7 had been forecast.

USD/CAD outlook

Trend pressure continued to drive the USD/CAD lower with the now-standard array of plentiful and well-reinforced resistance lines and scare and weak support. The basic scenario has been unchanged for six months with the US dollar declining below the March pandemic start point of 1.3400 in mid-July and then failing to reverse at that level in September and October/November.

Currency markets are conditioned on the pandemic economy and the paralysis of central bank interest rates at or below the zero bound. Until traders are confident that equality is ending, the dollar will be unable to shake the weakness of the last half year. The first signal of a change may have been this week as the US 10-year Treasury closed above 1% for the first time since March.

Markets are looking for statistical evidence that the business optimism is justified.

Friday's US December Retail Sales, the most important month in the commercial calendar, could help the USD/CAD if it is notably better than the -0.2% prediction for the overall and 0.2% for the Control Group. But in the meantime, the USD/CAD will spend the week in slippage.

There are no Canadian statistics this week.

Canada statistics January 4-January 8

The Employment Change Report for December was the most influential Canadian data though it did not impact the USD/CAD as the markets are dominated by the US employment data released at the same time. The unexpected drop in the Ivey PMI did no damage to the loonie even though the US ISM equivalent was considerably better than forecast.

Monday

Markit Manufacturing PMI for December rose to 57.9 from 55.8 prior.

Tuesday

November's Raw Material Price Index increased 0.6% after October's 0.5% gain. Industrial Products Prices fell 0.6% in November following a 0.4% drop in October.

Thursday

Imports in November fell to $C50.1B from $C50.27B. Exports rose to $C46.76B in November from $C46.54B. The International Merchandise Trade (balance) decreased to -$C3.34 B in November from -$C3.73 B. The Ivey Purchasing Managers' Index fell to 46.7 in December from 52.7, 54.7 had been forecast.

Friday

Net Change in Employment lost 62,600 positions in December after gaining 62,100 in November. The forecast was -27,500. The Unemployment Rate rose to 8.6% from 8.5% in November. The Participation Rate decreased to 64.9% from 65.1%. Average Hourly Wages rose 5.43% in December following 4.84% in November.

US statistics January 4-January 8

The Manufacturing Purchasing Managers' Index from the Institute for Supply Management (ISM) rose to 60.7 in December from 57.5, far ahead of the 56.6 forecast. The New Orders Index climbed to 67.9 in December from 65.1. The Employment Index rose to 51.5 from 48.4.

Wednesday

ADP Employment Change report lost 123,000 positions in December. It had been forecast to gain 88,000.

Thursday

Challenger Job Cuts rose to 77,030,000 in December from 64,797,000 in November. Initial Jobless Claims slipped to 787,000 in the week of January 1 from the revised 790,000 prior. Continuing Claims fell to 5.702 million in the December 25 week from 5.198 million. Services PMI in December from ISM rose to 57.2 from 55.9, on a 54.6 forecast. The New Orders Index rose to 58.5 from 57.2, the estimate was 54.9. The Employment Index fell to 48.2 from 51.5, 50.7 was the forecast.

Friday

Nonfarm Payrolls lost 140,000 positions in December, reversing the 71,000 forecast. The November total was revised to 336,000 from 245,000. The unemployment rate (U-3) was unchanged at 6.7%. The Underemployment Rate (U-6) dropped to 11.7% from 12.0%. Average Hourly Earnings rose 0.8% in December, four times the estimate after a 0.3% gain in November. On the year they rose 5.1% on a 4.4% forecast and November result. Average Weekly Hours slipped to 34.7 from 34.8. The Labor Force Participation Rate was stable at 61.5%. Consumer Credit expanded by $15.27 billion in November, outstripping the $9 billion estimate and more than double the $7.23 billion extension in October. It was the largest gain since $19.66 billion in June.

Canada statistics January 11-January 15

No statistics of note.

US statistics January 11-January 15

Retail Sales are the most interesting statistic this week. December is an important month for commerce and a poor result could mean trouble for many struggling small businesses with dire implication for employment in the first quarter. Jobs have been the most telling statistic for the dollar.

Wednesday

The Consumer Price Index (CPI) for December is predicted to gain 0.4% on the month and 1.3% on the year following 0.2% and 1.2% in November. Core CPI is forecast to be 0.1% and 1.6% in December after 0.2% and 1.6% in November. The Federal Reserve Beige Book of economic views from the 12 Reserve Districts prepared for the January 26-27 meeting is released at 2:00 pm EST.

Thursday

Initial Jobless Claims and Continuing Claims are out at 8:30 am EST. They were 787,000 and 5.072 million in the prior week.

Friday

The Producer Price Index for December will be released at 8:30 EST. Forecasts are 0.3% and 0.8% for the headline and 0.2% and 1.3% for the core. Retail Sales in December are expected to fall 0.2% following the 1.1% drop in November. The Retail Sales Control Group is expected to rise 0.2% after a 0.5% loss in November. Industrial Production in December is forecast to be unchanged at 0.4%. Capacity Utilization will rise to 75.5% from 75.3%. Michigan Consumer Sentiment for January is projected to drop to 79.2 from 80.7.

USD/CAD technical outlook

The Relative Strength Index at 44.31 edged towards 50 but, as with the sharp rise in late December, it is not a precursor to an upward trend. The 21-day moving average at 1.2768 fronts the first resistance line at 1.2780. The 100-day at 1.3048 and the 200-day at 1.3354 trail the market by wide margins. The down channel remains the ruling formation and the main technical consideration is the abundance of resistance and paucity of support. This is a direct result of the unchanging trend of the past six months but it nonetheless stymies rallies.

Resistance: 1.2780; 1.2820; 1.2860; 1.2915; 1.3000

Support: 1.2700; 1.2670; 1.2630

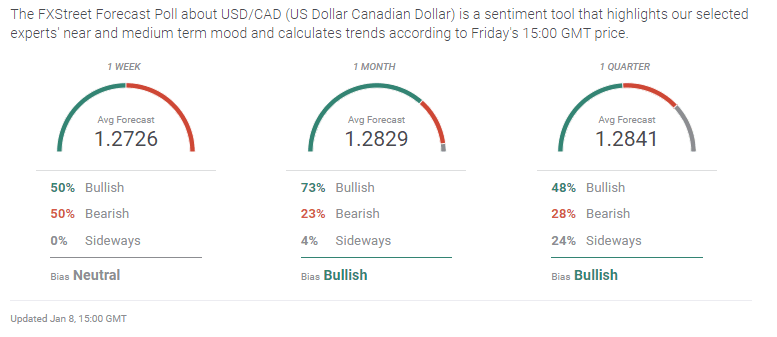

FXStreet Forecast Poll

The FXStreet Forecast Poll is an indication that the optimism of equities and commodities for an economic recovery, which is beginning to show in US Treasury yields, may be seeping into the currency markets. While a rise above 1.2900 and 1.3000 would be necessary to thwart the sinking draw of the down channel, still, this may be a sign that the thought is starting to arrive.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.