USD/CAD Looks Over-Extended; Downward Bias

Potential Downside on USD/CAD 4H

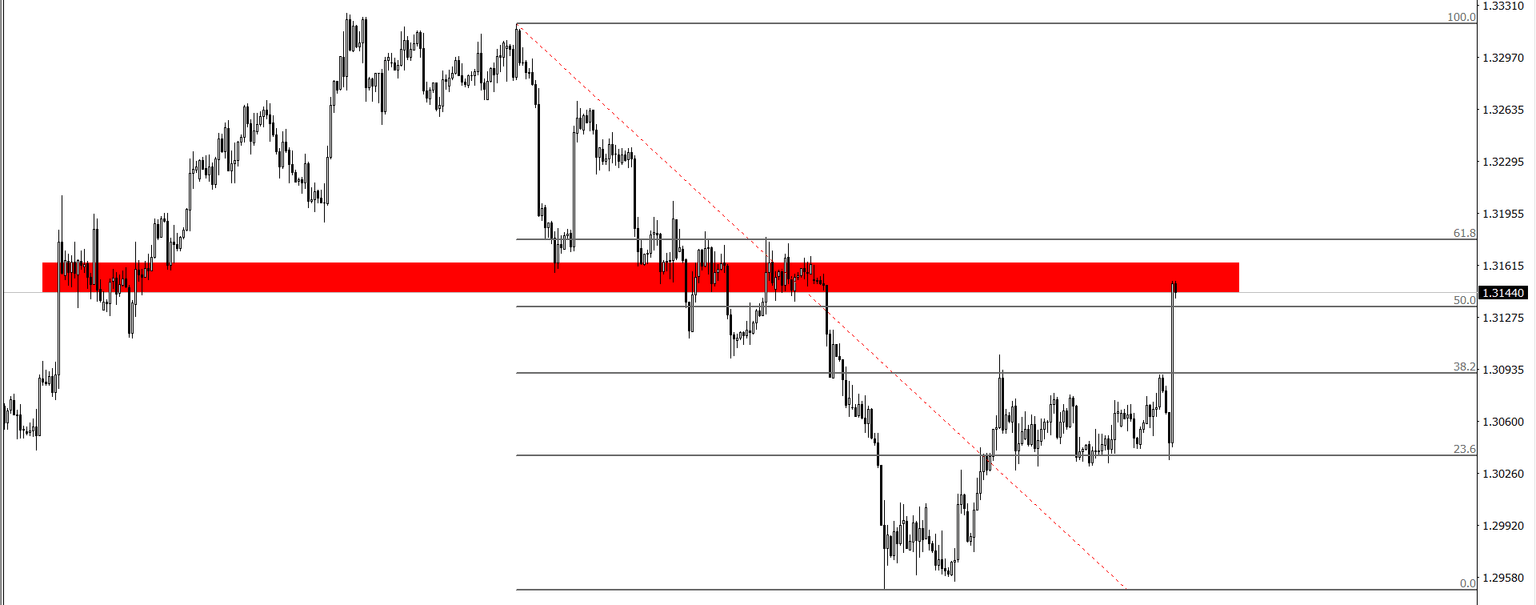

USD/CAD seems to have over-extended its rally and has now reached a supply zone which aligns with the 50% – 61.8% Fibonacci retracement of the previous price movement.

It is possible for price to range in this area prior to starting a move to the downside.

Should the momentum carry, we could see a new leg form to the upside.

Entry: Market price – 1.31450

Stop Loss Option 1 / Pivot: 1.31900

Stop Loss Option 2 / Pivot: 1.32250

Take Profit: 1.30300

Author

Vladislav Brykin

Cypher

Vladislav Brykin has been active in the financial markets, more specifically in the retail trading and fund management, since 2013. He has consulted and built products and systems for brokerages and investment firms.