US Retail Sales October Preview: Will curfews bring down consumer spending?

- Retail Sales forecast to moderate from strong September.

- Control Group to maintain positive GDP contribution.

- New pandemic rules are not as restrictive or as widespread as in the spring.

- Markets focused on economic revival not current viral wave.

American consumers do not seem to have gotten the doom and gloom message as the pandemic winds into its ninth month and businesses closures and public restrictions return in many parts of the country.

Retail Sales are forecast to rise a respectable 0.5% in October. The surprise jump of 1.9% in September was almost three times as strong as the 0.7% consensus estimate.

Retail Sales

The Control Group's contribution to the Bureau of Economic Analysis' consumption component of Gross Domestic Product (GDP) is expected to climb 0.5% on the month after increasing 1.4% in September. The forecast had been for 0.2% rise. Retail Sales ex-Autos are projected to add 0.6% in October. They rose 1.5% on a 0.5% prediction in September.

Retail and Control Group Sales

Surprises abound in economic data but few have been as dramatic as the plunge and rebound in US consumption in the four months from March to June.

The story is well known but worth repeating. In the lockdown months of March and April sales plummeted 22.9%. In the recovery of May and June they rose 26.6%. The adjacent months of April and May set all- time records for declines and gains.

The average 0.925% increase across the first four months of the pandemic turned out to be indicative. The following three averaged 1.133% for a 1.01% average across the seven months of the pandemic.

Control Group figures were even more resilient, down 9.2% in March and April, up 16.1% in May and June with a 0.666% average in the third quarter and a 1.27% average through the entire period.

Retail consumption is the mainstay of the US economy and the third quarter Retail Sales and Control Group averages of 1.133% and 0.666% were one of the reasons that GDP in that quarter soared 33.1%, after the 31.4% drop in the lockdown months.

Even though resurgent COVID-19 diagnoses in most of the country have prompted a return to business and social restrictions in a number of states, these impositions are not as widespread nor are they the total shutdowns except for essential services that were common in the spring. Their general thrust is to retard viral spread by limiting social interactions. After the experience of the second quarter most local authorities recognize that total shutdowns are an economic pandemic in their own right.

Nonfarm Payrolls and Initial Jobless Claims

Payrolls have recovered 54.4% of the 22.16 million jobs lost in March and April and the unemployment rate has tumbled from 14.7% to 6.9% in September.

Nonfarm Payrolls

In the November 6 week 709,000 new claims were filed for unemployment benefits, the lowest total since the pandemic began in March. Continuing Claims were 6.786 million in the last week in October.

There are millions more people receiving some form of jobless payments than are on the official Labor Department rolls. In addition the Congressional stimulus bill and various state and Federal Reserve programs have helped maintain income and spending.

Conclusion and markets

The resilience of consumer spending, which accounts for about 70% of US GDP, despite the government ordered lockdowns and unemployment has been the most surprising aspect of the COVID-19 pandemic.

Once the draconian restrictions were lifted in May the consumer returned to normal retail spending almost immediately. The level of spending in third quarter would have been respectable in any normal economic period, in the midst of the pandemic unemployment it is remarkable.

Markets had responded to the US economic recovery even before the recent medical breakthroughs. The Dow set a record on Monday at 29,950.44 as a second pharmaceutical company, Moderna, announced that its COVID-19 vaccine was 94% effective. Since last Monday's similar news from Pfizer the average has gained 1,627.04 points, 5.7% in six trading sessions.

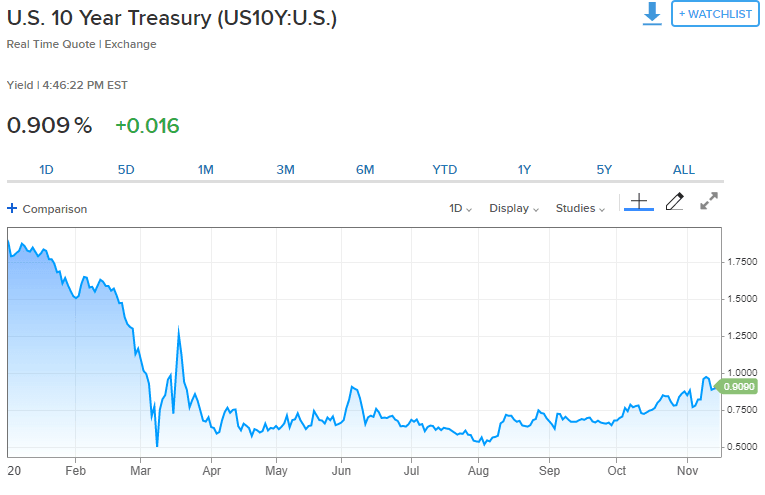

The 10-year Treasury has added 40 basis points of yield to 0.911 on Monday, since its August 4 low of 0.515%, though it is only about half of its pre-pandemic yield due to the Federal Reserve zero rate policy and bond buying program.

Dollar rates have been less responsive as the greenback had largely lost its safety-trade premium, which has not resumed in the current wave of the pandemic.

The US consumer is not likely to have pulled back on spending in October, and even households did, markets will keep their focus on the pending and soon to accelerate recovery.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.