US Nonfarm Payrolls February Preview: The inflection point

- Payrolls forecast to add 180,000 jobs in February.

- Economic and labor data points in two directions.

- ADP private payrolls, Services PMI weaker than expected.

- Manufacturing PMI, first quarter GDP predict strong growth.

- Markets are expectant of better US economic data.

Pay your money and take your choice. The American adage perfectly captures the economic situation.

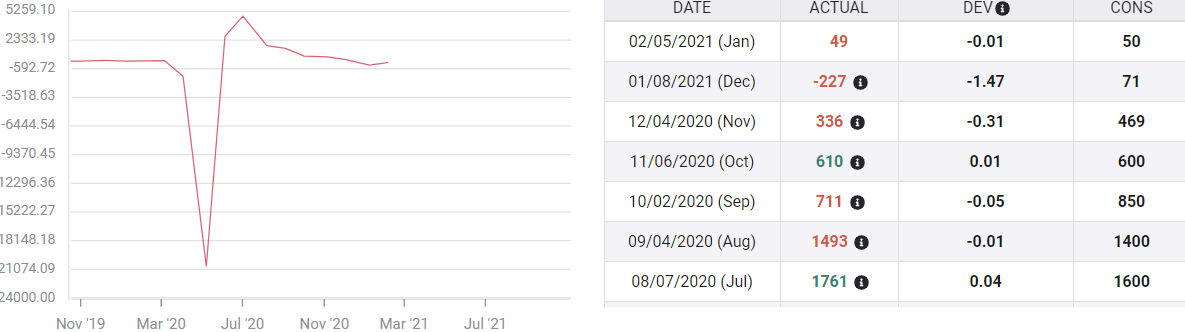

Nonfarm Payrolls are forecast to add 180,000 positions in February, far better than the 89,000 average loss in December and January, far worse than the 473,000 gain in October and November. The Unemployment Rate is expected to be unchanged at 6.3%.

Nonfarm Payrolls

FXStreet

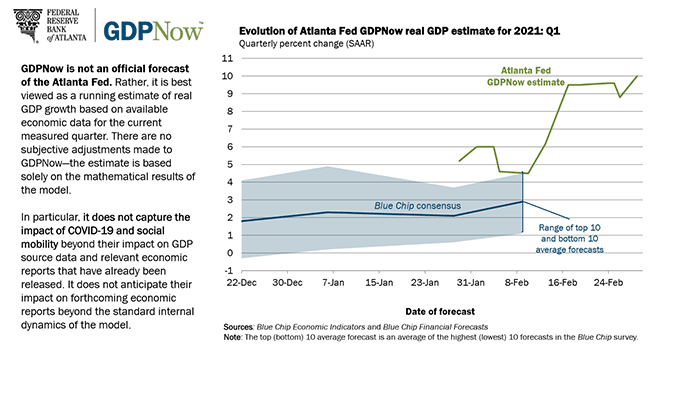

Purchasing Managers' Indexes (PMI) for manufacturing from the Institute for Supply Management (ISM) in February were much better than predicted. The GDP forecast from the Atlanta Fed is running at 10% in the first quarter. Texas and Mississippi have ended all business and social restrictions, other states and economic growth are sure to follow.

For the opposite view, ADP February payrolls missed expectations, service PMIs were lower in all categories except prices and Initial Jobless Claims at 730,000 have made no progress in three months with three-quarters of a million people laid off each week.

Let's start with PMI.

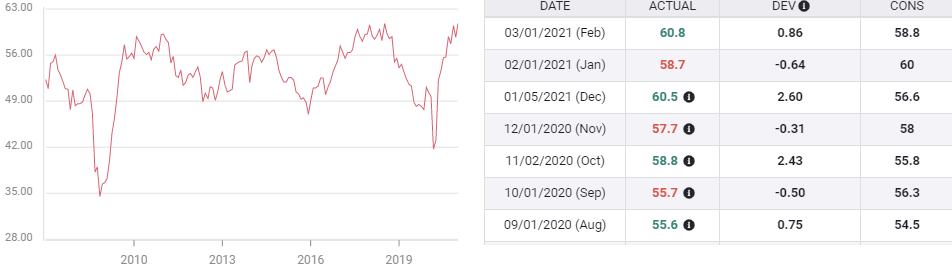

Purchasing Managers' Indexes

It is somewhat unusual for the manufacturing and service indexes to move in opposite directions in one month particularly since both have improved in tandem over the past half year.

In January the overall manufacturing index slipped to 58.7, but December's 60.8 reading had been the best in 30 months. The six month average of 58.7 compares with the best scores of the three-year factory revival before the pandemic.

Manufacturing PMI

FXStreet

The forecast for February was status quo at 58.8, instead the reading matched the three year high at 60.8.

Component indexes in manufacturing also performed well. The New Orders Index had fallen to 61.1 in January from December's 67.5. In February it moved back to 64.8. Employment was at 52.6 in January, its highest in 19 months. A slight gain to 53 was predicted, in fact the index rose to 54.4, its strongest since March 2019.

Services indexes had mirrored manufacturing's buoyant January levels.

The overall index at 58.7 was the highest in 26 months. No change was predicted for February. In reality it dropped to 55.3, the lowest scored since May. New orders were at 61.8 in January the highest since July. The consensus estimate was 55.4, the result was 51.9, the poorest since May's 41.3.

The Services Employment Index was at an 11-month top of 55.2 in January. In February it fell to 52.7.

What can we make of the divergence in the two indexes?

The first point is basic, one month is just a data point. The general trend in both indexes and their components has been higher over the past six months. That direction is unchanged. All the indexes in both sectors remain above 50 and in expansion.

Manufacturing not services is considered the leading indicator for the overall economy. The logic of that designation, predicated on the much longer lead times required for increasing or decreasing factory production is the likely answer for the February disconnect between the two indexes.

California's December and January lockdown and reimposed restrictions in several other states, had an immediate impact on many service businesses. Managers again faced declining sales and responded with reduced optimism. The imposition had far less effect on factory managers whose orders, hiring and outlook are conditioned by the recovery expected in the second and third quarters and so their optimism was undimmed.

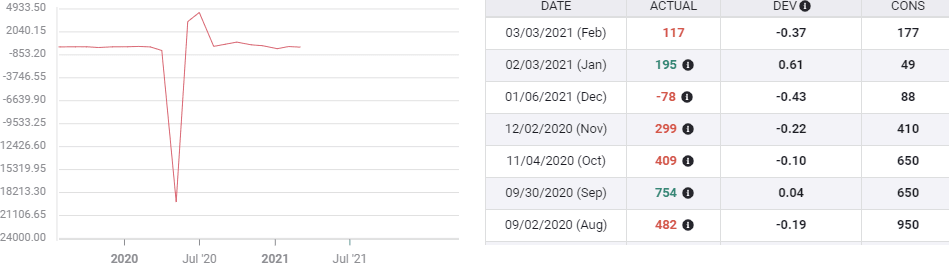

ADP Employment Change

The private clients of Automatic Data Processing (ADP) had been expected to add 177,000 new workers in February. The actual number was just 117,000, though December added 21,000 on revision to 195,000.

ADP Employment Change

Although payrolls from ADP are often cited as an indicator for the NFP numbers two days later, the monthly correlation is weak. January is an example. ADP was predicted to produce 49,000 hires. The resulting 195,000 had no bearing on Nonfarm which added a miserly 49,000 as forecast.

The trend relationship between ADP and NFP is good, it is almost impossible for the two counts to move in different directions for any appreciable time. But from one month to the next the strength or weakness of one has little to say about the other.

GDP, the Southern opening and Retail Sales

The governors of Texas and Mississippi announced this week that their states would be fully open with no mandated restrictions on businesses, social gatherings or schools. Other states are sure to follow in quick order. Official sanction after a year of government imposed restrictions will raise spirits nationwide.

Retail Sales jumped 5.3% in January fueled by the December stimulus payment of $600. With more individual and family grants to be awarded by the $1.9 trillion package before Congress, another burst of consumer spending can be expected in the months ahead.

The psychological relief from the end of the pandemic combined with the free government money more than explains the Atlanta Fed GDPNow prediction of 10% annualized growth in the first quarter.

Conclusion

Economies at inflection points, when growth speeds up, slows down or reverses, are rife with contradictory signals. Such is the case now.

Business managers have been consistently optimistic for six months but until very recently were reluctant to hire. New Orders have rocketed higher but 10 million pandemic unemployed are still without jobs.The service sector outlook dims for a month but the trend remains positive.

The US dollar and Treasury yields have rebounded from their lows, but await confirmation that the economy has launched into the New Year orbit.

Nonfarm Payrolls could belie forecasts and resume strong growth in February and markets will respond if it does. But in the long run it will not matter for expansion lies ahead.

In a few months the signs of the coming boom will seem obvious, but for now they are just points in the data fog.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.