US Dollar Unchanged as Market Waits for Jerome Powell Testimony

The New Zealand dollar soared today after the country’s central bank left interest rates unchanged at 1.00%. The market was expecting a 25-basis point cut. In the accompanying statement, the country’s central bank said it believed that the previous rate cut was having a positive impact on the economy. It also reiterated that a rate cut was not needed for now. Still, officials warned that the country’s trading partners were experiencing slow growth which could have negative implications for the economy. Governor Orr will address the press later today.

The sterling declined slightly after the Office of National Statistics (ONS) released the inflation number for the month of October. The CPI increased by an annualized rate of 1.5%, which was lower than September’s 1.7%. On a MoM basis, the CPI contracted by -0.2%. The core CPI, which removes the volatile food and energy products remained unchanged at 1.7%. It declined by 0.1% on a MoM basis. Meanwhile, retail prices declined from 2.4% to 2.1% while PPI input declined by -5.1%. PPI output rose by 0.8%. With inflation at a three-year low, the Bank of England has said that it would be prepared to slash interest rates. The data also comes at a time when the country is in an election mood.

The euro was relatively unchanged against the USD after the region released the industrial production data for September. Numbers showed that industrial production increased slightly during the month. On a MoM basis, production rose by 0.1% from the previous 0.4%. It declined by -1.7% on an annualized basis. This was better than the consensus estimates of -2.8%. This output was boosted by domestic-oriented consumer goods companies. These include food and beverages and non-durable consumer goods. Export-oriented industries like motor vehicles, intermediate goods, and energy continued to suffer. This was the second month of improvements.

The USD was relatively unchanged after the market received important inflation data. In October, consumer prices rose by 1.8%. This was higher than the previous 1.7%. On a MoM basis, the CPI increased by 0.4%, up from the previous 0.1%. The core CPI rose by 2.3%. This was lower than the previous 2.4%. Later today, the market will listen to Jerome Powell, who will be testifying in congress.

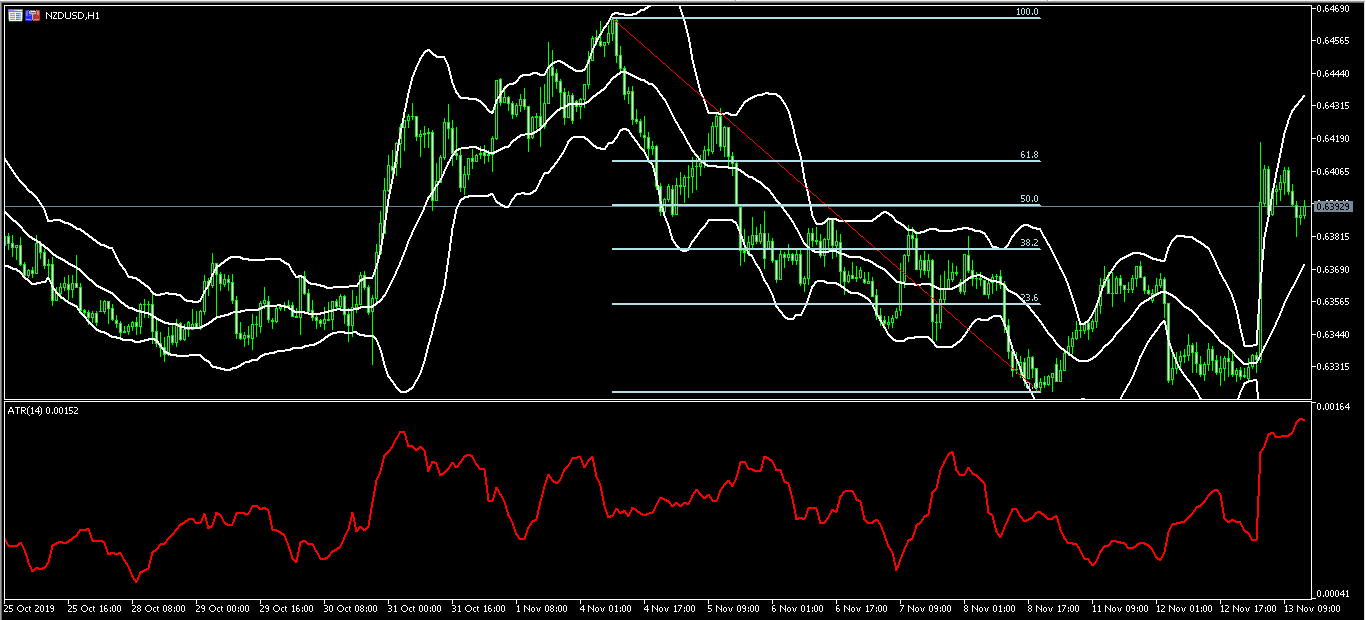

NZD/USD

The NZD/USD pair rose today after the RBNZ released its interest rates decision. The pair rose from a low of 0.6325 to a high of 0.6417. This was slightly higher than the 61.8% Fibonacci Retracement level on the hourly chart. The Bollinger Bands have widened while the average true range has soared. This is an indication of increased volatility. There is a likelihood that the pair will see some movements when Governor Orr delivers his remarks.

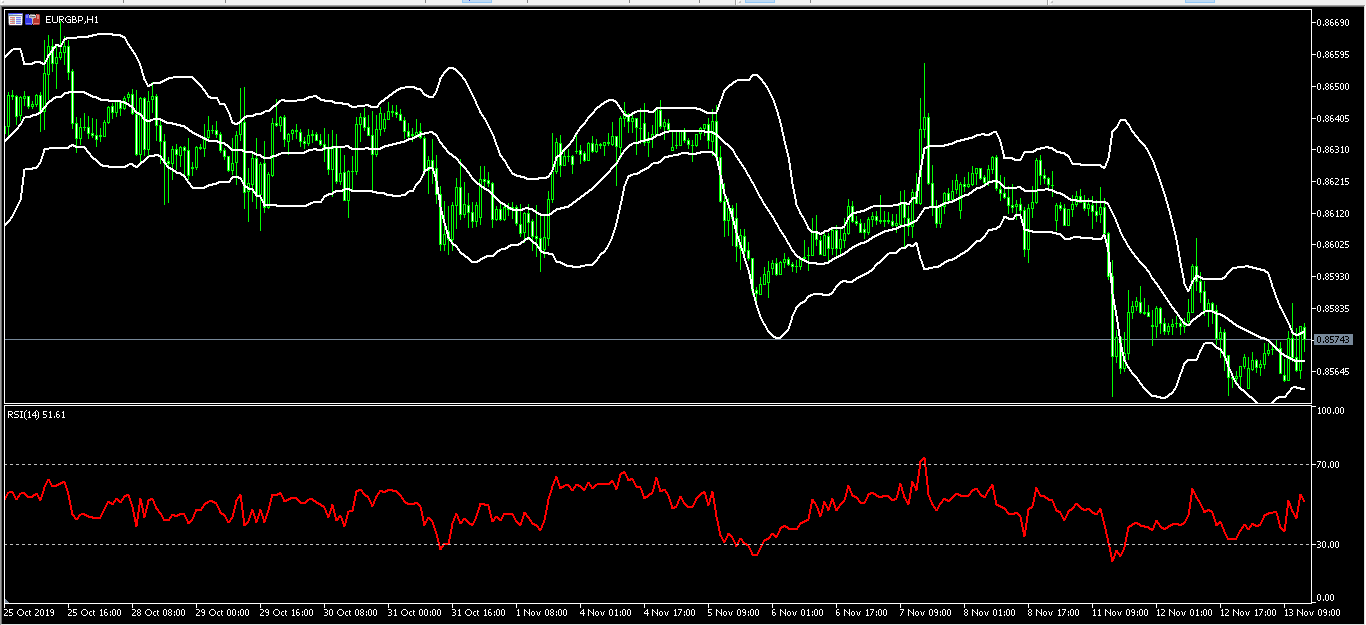

EUR/GBP

The EUR/GBP pair struggled for direction after the weak inflation data from the UK and better-than-expected data from the EU. The pair is trading at 0.8575. This is slightly higher than the weekly low of 0.8557. On the hourly chart, the price is along the upper line of the Bollinger Bands. The RSI has remained on the neutral level of about 50. The chart shows that there is some indecision, which is leading to some resistance. This means that the pair may break out in either direction.

EUR/USD

The EUR/USD pair declined slightly after the US released its inflation numbers for October. The pair dropped to a low of 1.1005. On the four-hour chart, the price is slightly above the 38.2% Fibonacci Retracement level. The price is slightly below the 14-day and 28-day moving averages. The price is along the oversold level of 30. The pair will likely remain along this level as the market waits for Jerome Powell’s speech in congress.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.