US Dollar falls after Fed’s 25 bps cut — Is a larger downtrend ahead?

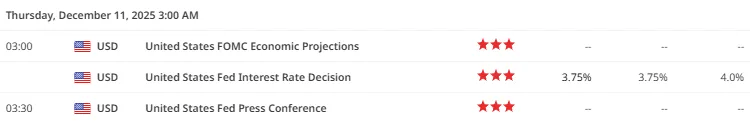

- The Fed’s 25 bps cut confirmed that monetary easing has officially resumed, shifting the macro tone decisively against the US dollar.

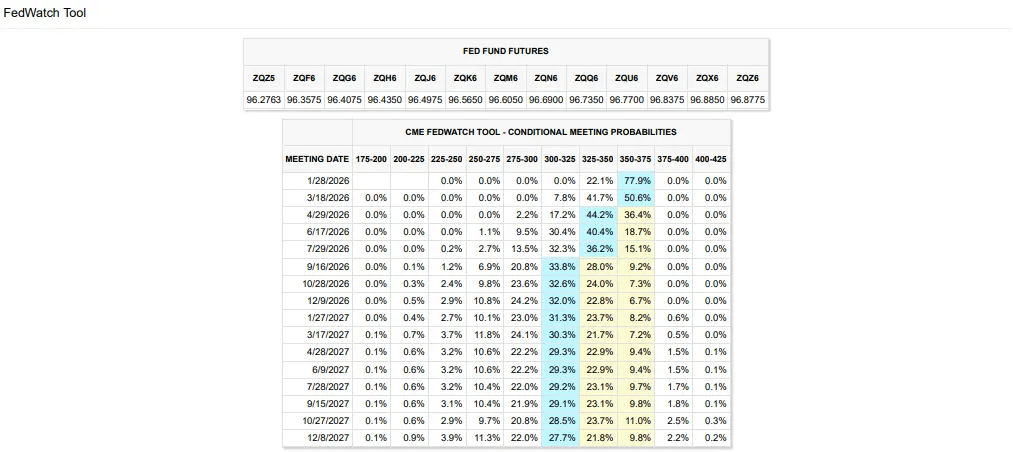

- The market immediately repriced toward deeper 2026 easing, pushing Treasury yields lower and pressuring the DXY into a clean downside break.

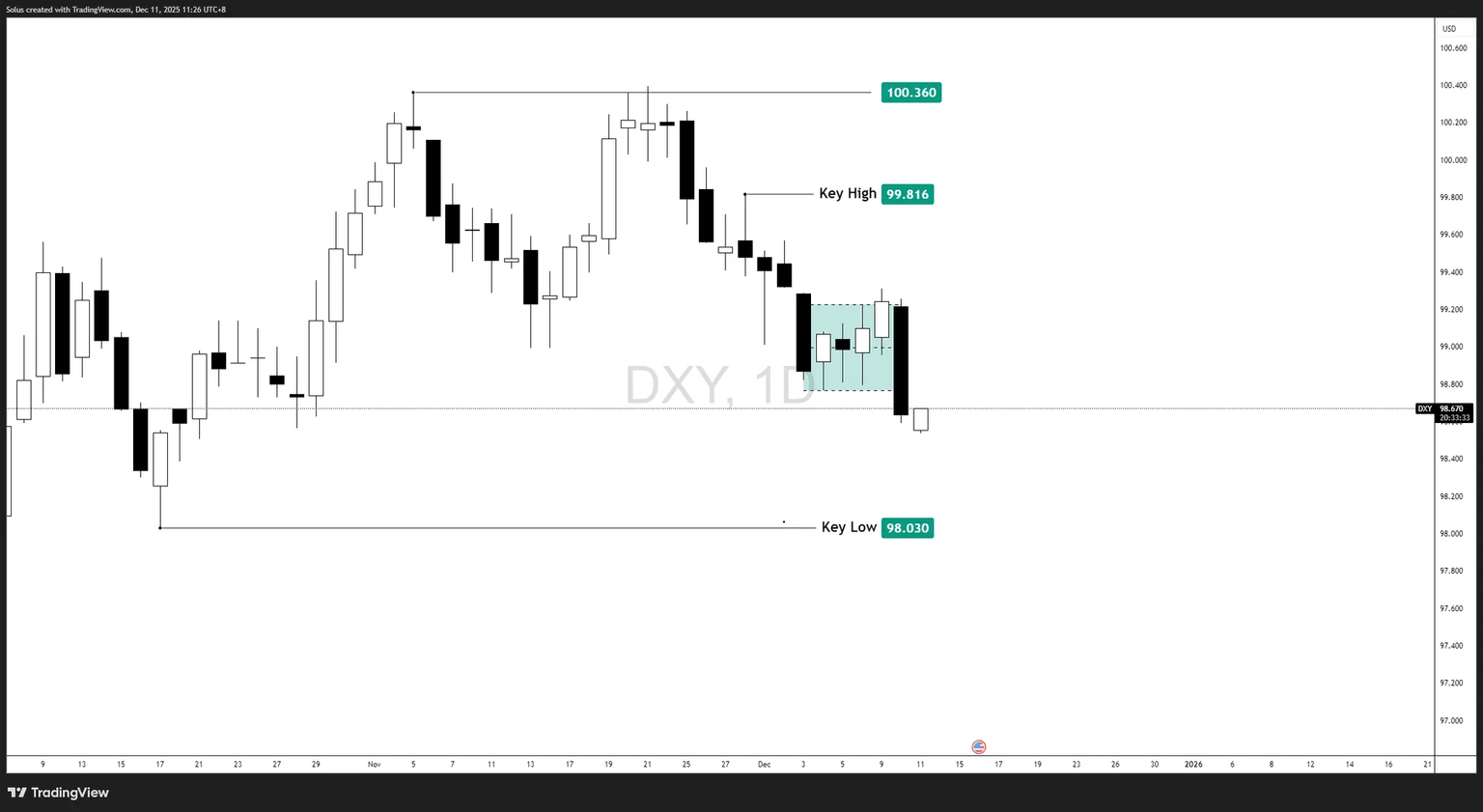

- Technically, the dollar was already vulnerable, with the latest FVG rejection and range breakdown aligning with the macro narrative for a move toward 98.03 and possibly lower.

Post-Fed cut: A Dollar that was already ready to fall

When the Federal Reserve delivered its 25 bps rate cut, the reaction in the US dollar was not simply about the cut itself — it was about what the cut represented:

The Fed finally signaled that

“The next move is likely another cut, not a hike.”

This matters because throughout October and November, the market had been trapped in a policy fog:

- The Fed cut once

- Then signaled hesitation

- Then pushed a data-dependent "pause"

- Then resumed easing guidance as labor data weakened

By the time the December cut arrived, the market had already priced in a directional shift toward a 2026 easing cycle. The cut merely validated what bond markets were anticipating.

And when rate expectations fall → the dollar falls.

Lower interest rates reduce the dollar’s yield advantage. Global investors rotate out of USD and into risk assets and higher-yielding currencies. The result is the exact price behavior now seen on DXY.

Why the Dollar’s decline was not a surprise

1. Yield curve compression

The 10-year and 2-year yields both dropped following the cut.

This flattening/softening reinforced the downside bias because:

- Lower yields = less foreign demand for USD

- Lower real yields = greater support for gold and FX majors

- Lower terminal rate expectations = long-term dollar repricing

2. Labor market weakness accelerated the narrative

The Fed emphasized cooling employment, which historically is the final pivot point before a sustained easing cycle.

Every easing cycle in the last 30 years has produced a multi-month decline in the dollar.

That blueprint is now unfolding again.

3. Fed communication turned clearly dovish

The shift in language was unmistakable:

- “Vigilant to downside risks”

- “Prepared to provide additional accommodation if needed”

- “Disinflation progress continues”

These are not hawkish-leaning statements.

They are the beginnings of a soft-landing easing stance.

Once the Fed signals this, DXY generally loses altitude.

How this lines up with

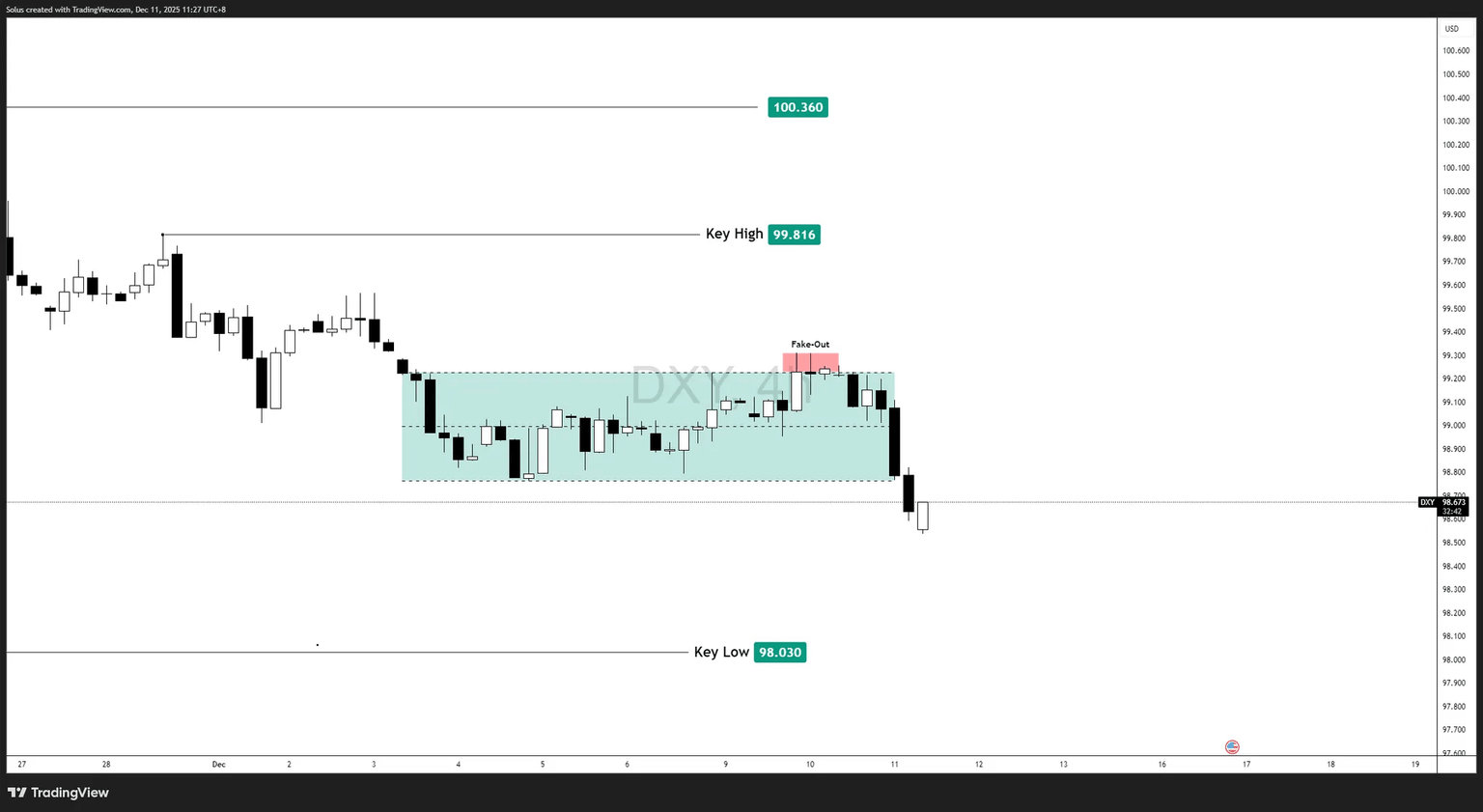

1. Fake-out above 99.816

The sweep of the key high created a classic SMC distribution setup.

Smart money filled premium sell orders at the top of the range.

2. Failure to hold the mid-range and FVG

The FVG rejection (99.011–98.821 zone) confirmed that sentiment had shifted and that the market was not ready to reclaim lost bullish structure.

This is perfectly aligned with a macro shift into dovishness.

3. Range breakdown and liquidity exposure

The decisive drop out of the December range exposed:

- First target: 98.821

- Main liquidity magnet: 98.030

This level is clean, visible, and the natural resting point of the entire structure.

Technical outlook

Bias: Bearish unless DXY reclaims 99.011

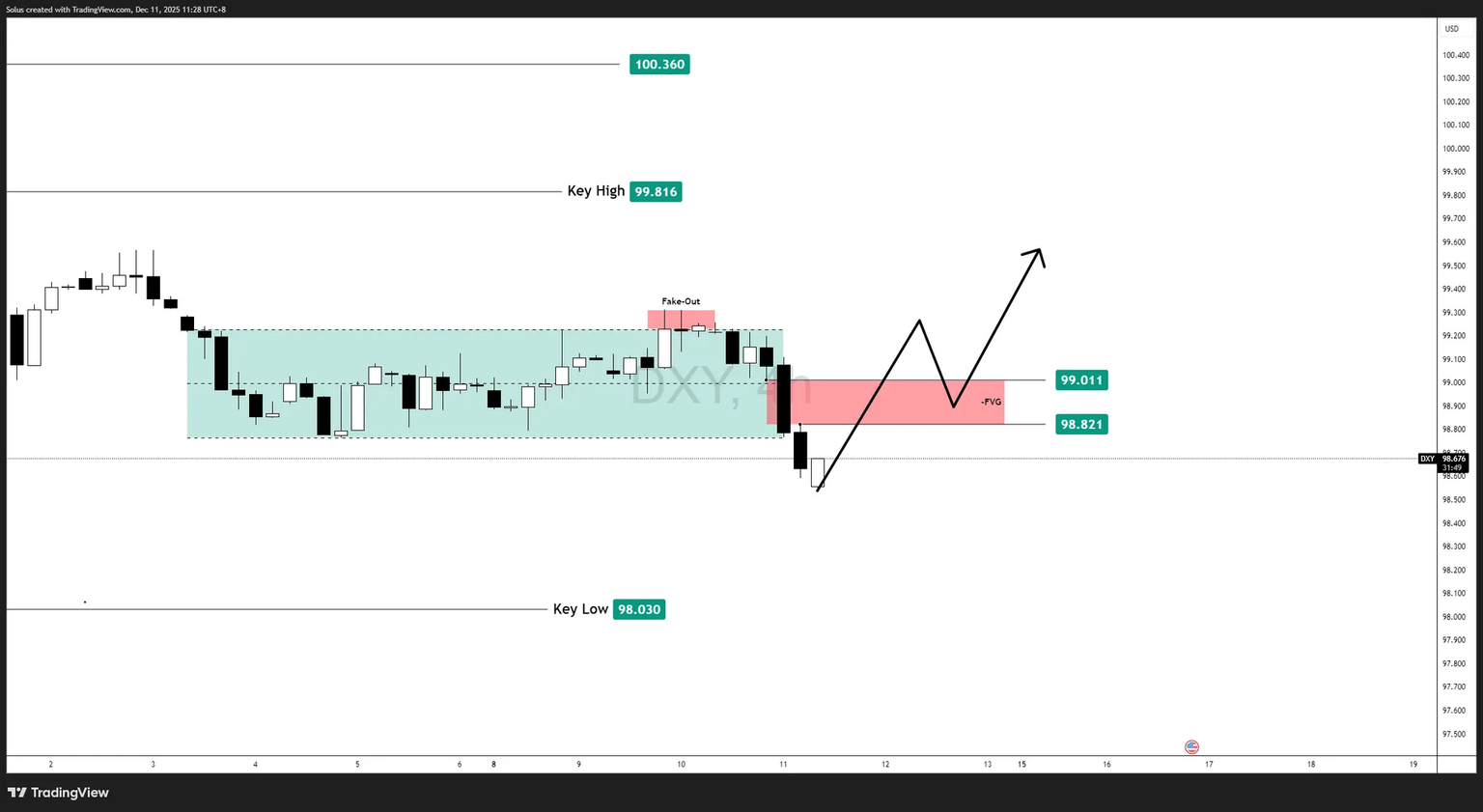

Bullish scenario

A short-term relief bounce becomes possible if DXY:

- Trades into the FVG (red zone)

- Holds above 98.821

- Produces a clean market structure shift (MSS) above the rejection wick

If this plays out, upside magnet would be:

- 99.011

- Partial fill of inefficiency

This scenario aligns with a temporary risk-off move.

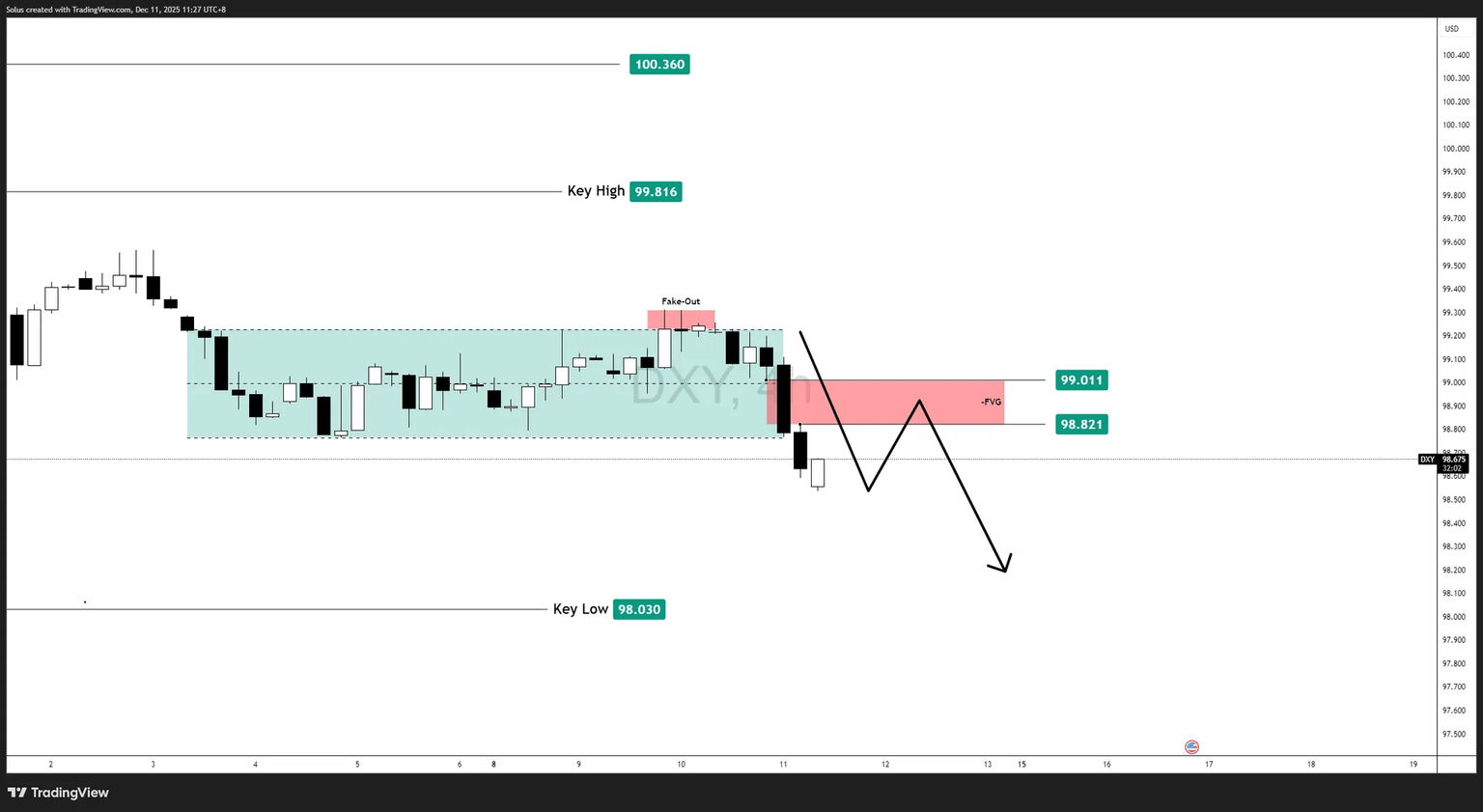

Bearish scenario (primary)

The dominant scenario is for DXY to:

- Tap into the FVG

- Reject from 98.821–99.011

- Continue downward into 98.030 liquidity

A daily close below 98.03 opens further downside toward:

- 97.50

- Even 96.80 if easing expectations deepen

This scenario matches rate-cut repricing and risk-on tone in global assets.

Final thoughts

The Fed’s 25 bps cut did not cause the dollar to fall — it unlocked the next leg of a decline that macro, yields, and technical structure had already foreshadowed.

The DXY breakdown is a clean alignment of:

- A dovish Fed

- A weakening labor market

- Market expectations for more cuts

- A clear technical range distribution

- A breakdown toward a major liquidity pool

All of these together suggest the dollar’s weakness is not a one-day reaction but potentially the early stages of a larger USD downcycle.

Author

Jasper Osita

ACY Securities

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.