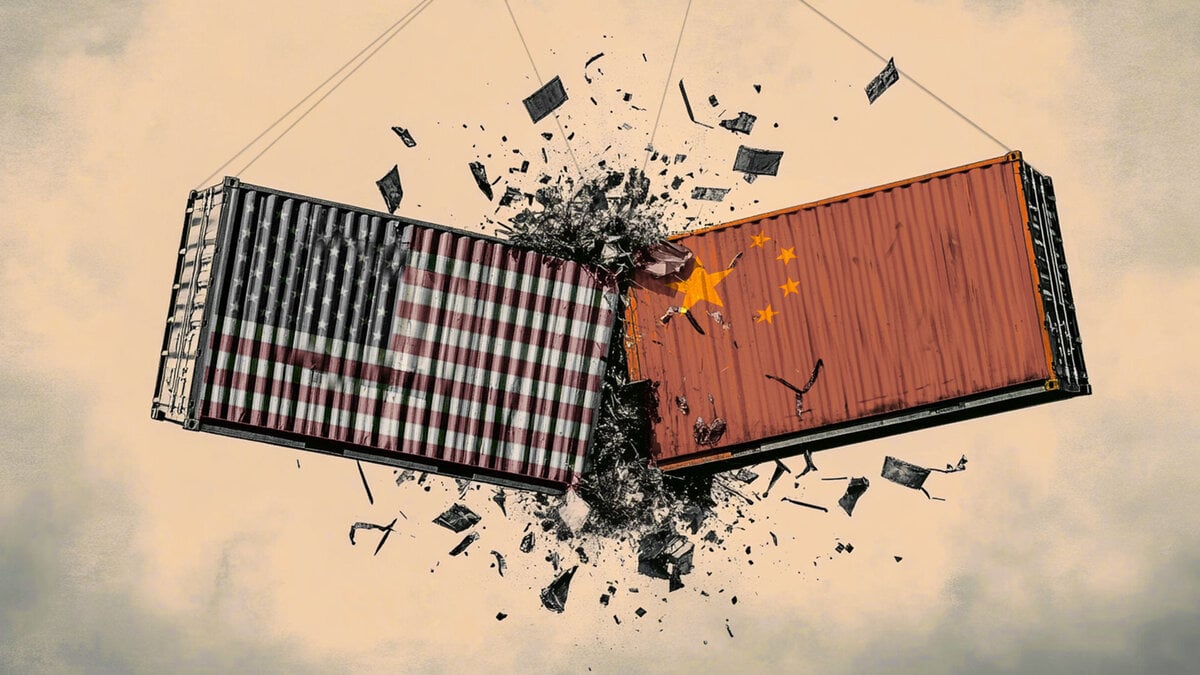

US-China breakthrough helps lift US indices following Friday’s CPI boost

- German Ifo on the rise, while gold weakness drags on the FTSE 100.

- US-China breakthrough helps lift US indices following Friday’s CPI boost.

- Canadian dollar in focus as Trump adds another 10% tariff ahead of BoC cut.

A mixed start in Europe, with little by way of significant directional bias over Friday’s closing levels. That comes despite widespread optimism over US-China trade negotiations, which signal the potential for a breakthrough ahead of Trump’s meeting with Xi later in the week. In Europe, this morning has seen a German Ifo business climate survey that brought an improved headline figure of 88.4, while the expectations metric rose to the highest level since Feb 2022. However, despite optimism over future business conditions, the worsening of current conditions (85.3) highlights a perception of a struggling economy that many hope will get better. In the UK, commodity stocks have provided a notable drag on the FTSE 100, with the decline in precious metals driving the likes of Fresnillo and Endeavour mining sharply lower in early trade.

Weekend talks between US-Chinese negotiators appears to have resulted in a significant breakthrough, with US Treasury Secretary Scott Bessent announcing that a “substantial framework” had been agreed upon, covering a wide range of issues, including, export controls, tariff suspensions, fentanyl-related tariffs, and agricultural trade. With the Trump-Xi meeting always likely to be a result of significant groundwork being made by their negotiating teams, there is an optimism that the two leaders can strike a more conciliatory tone than had been seen over recent weeks. Crucially, the reopening of trade for rare earth materials should provide a boost to the tech sector later today, with Nasdaq futures pointing towards a 1.3% bump higher at the open.

Coming off the back of Friday’s inflation release, there is an optimism that we are moving into a period that will bring both improved trade relations and lower interest rates. This week’s FOMC meeting brings with it a 97% chance of a rate cut (according to the CME), while the lower-than-expected inflation gauge of 0.3% highlights the potential for further cuts in December and January. Right now, there appears to be a willingness to look beyond short-term inflation pressures, focusing more on the weakness evident within the jobs market. Nonetheless, with data in short supply owing to the ongoing shutdown, Friday’s CPI numbers have helped drive the dollar lower on expectations that the Fed will face little reason to question the expected cuts in the months ahead.

This week looks to also bring another rate cut from the Bank of Canada, taking the overnight rate down to a three-year low of 2.25%. Coming at a time of particular concern for the Canadian economy, the bank clearly see their role as providing the backstop for a country struggling for traction given the trade war waged by their closest partner. The weekend announcement that Trump will place an additional 10% tariffs on Canadian imports does little to help the outlook for Canadian growth, with the Loonie losing ground against many of the major currencies this morning.

Author

Joshua Mahony MSTA

Scope Markets

Joshua Mahony is Chief Markets Analyst at Scope Markets. Joshua has a particular focus on macro-economics and technical analysis, built up over his 11 years of experience as a market analyst across three brokers.