US ADP February Preview: Private job creation returns

- Private payrolls forecast to expand 350,000, NFP 438,000.

- ADP payrolls and NFP diverged sharply in January.

- Robust job creation needed for Fed’s aggressive rate projections.

Private payrolls should confirm that the US labor market continues to expand rapidly despite an unexpected decline in hiring in January.

The American clients of Automatic Data Processing (ADP) are forecast to have hired 350,000 new workers in February, more than covering the loss of 301,00 jobs the prior month. Nonfarm Payrolls, the Labor Department's national job track, is expected to show 438,000 new employees in February after 467,000 were employed in January.

The main interest of the ADP report is a precursor to the federal figures released two days later on Friday March 4.

ADP and NFP

The ADP report is limited to the private sector firms who use the company’s payroll services. It is a simple record of the month to month changes in total employees.

The Employment Situation Report, the official title of Washington's overall US employment statistics, includes government services at all levels, and an estimate for the number of workers hired by new businesses each month and not yet on the federal books.

The two main hiring gauges for the US have a relatively weak monthly correlation.

ADP

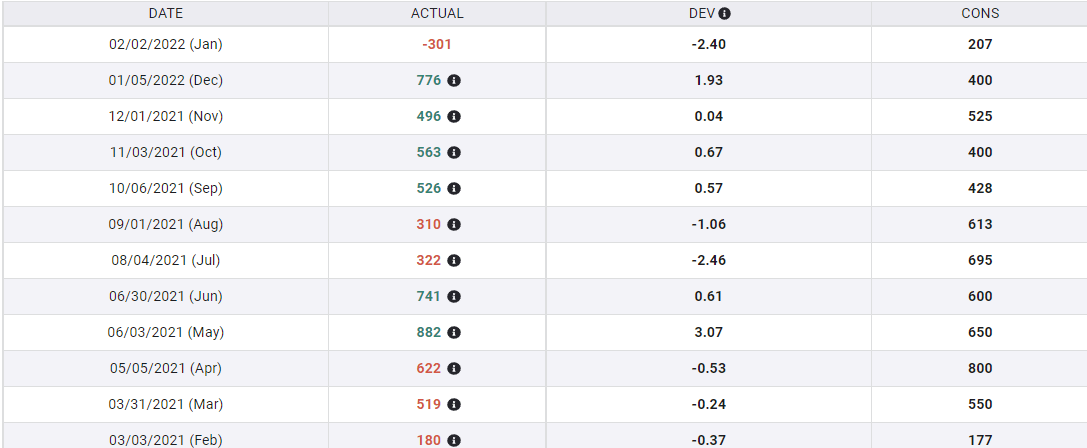

In the past 13 months the gauges have moved in the same directions in six months and opposite seven times. In January the disparity was striking. The ADP payrolls were forecast to grow 207,000. Instead they fell 301,000 after December's 776,000 gain. Nonfarm Payrolls were projected to add 150,000, they jumped 467,000, slightly down from 510,000 prior.

FXStreet

Because of this varied relationship markets will not move on the ADP results.

Labor market indicators

Initial jobless claims have reversed their January rise, though they are still some way from their late December lows. The four-week moving average rose from 199,750 in the December 24 week to 255,250 a month later on January 28. Since then claims have tailed down to 236,250 in the February 18 week.

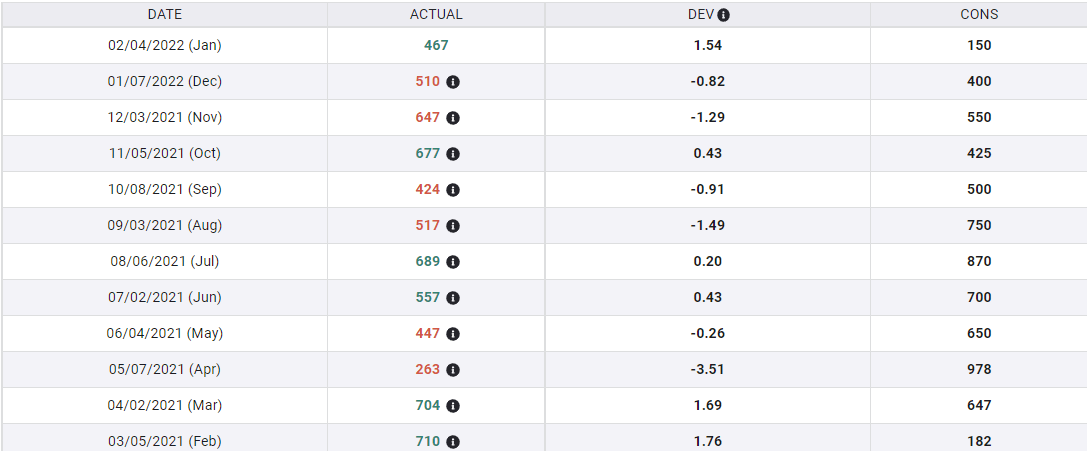

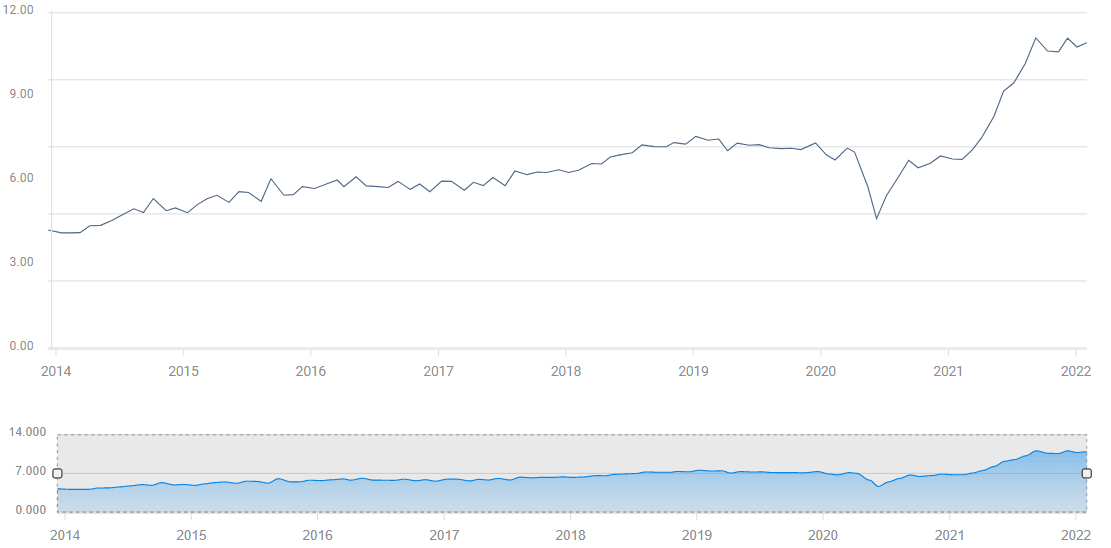

The Job Openings and Labor Turnover Survey (JOLTS) registered 10.925 million unfilled positions in December. Over the last seven months this listing has averaged 10.758 million openings per month. That is by far the highest total on record. Before the pandemic lockdown and recovery the highest single month had been 7.574 million in November 2018.

JOLTS

FXStreet

Employment Indexes in the Purchasing Managers’ Surveys from the Institute for Supply Management have had a positive aspect for the past six months in services and for 15 months in manufacturing.

The manufacturing index slipped to 52.9 in February from 54.4 in January. From September through February the average was 52.9. The services index was 54.1 in August and 52.3 in January with a 52.4 average for the six months. February is predicted to be 53.5 when issued on March 3.

These labor market statistics, especially the low layoffs in claims and the exceptional number of open positions argue for continued high levels of hiring.

ADP, Federal Reserve rate policy and markets

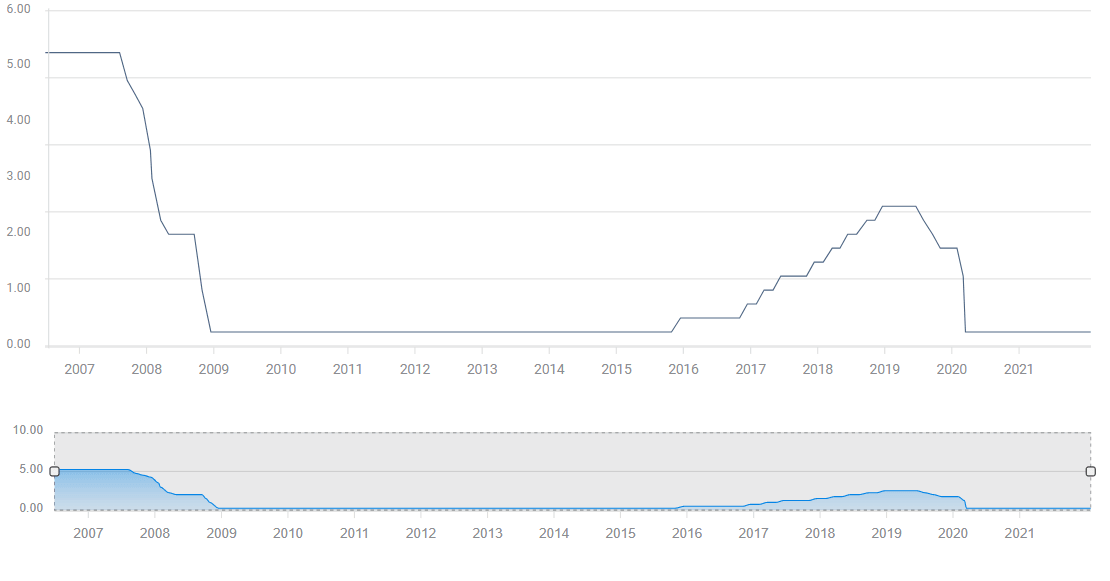

Inflation has surmounted job creation as the Fed’s chief concern and policy focus. The governors are expected to vote for the first 0.25% increase in three years at their meeting on March 16. Until the Russian threat and then invasion of Ukraine, there was considerable speculation that the bank might enact a 0.5% hike.

Fed funds

On February 15 there had been a 57.9% probability of the greater increase based on the fed futures contracts at the Chicago Mercantile Exchange (CME). On Monday evening February 28, the odds for the larger hike were just 11.4%.

While a fed funds increase is expected whatever the ADP and NFP numbers turn out, a poor performance in the national payrolls will reduce the chances for the five 0.25% hikes anticipated in the futures by the final Federal Open Market Committee (FOMC) meeting of the year on December 14.

The ADP figures will have no trading impact in the equity, credit or currency markets.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.