US ADP Employment Change September Preview: Yes, it's all about the Fed

- ADP private payrolls expected to add 430,000 in September.

- July and August ADP payrolls produced about half the expected hires.

- September Nonfarm Payrolls key to Fed’s pending taper.

The Federal Reserve has promised a bond taper before the end of the year. There are two FOMC meetings left in 2021, November 3 and December 15. A strong September payroll report, after August’s disappointment, would help cement that announcement for November.

Private payrolls from Automatic Data Processing (ADP) have a weak monthly correlation with the Labor Department's national figures. They are, however, timely, coming two days before the government figures and they are the largest countrywide numbers aside from the Nonfarm Payroll (NFP) report itself.

The US corporate clients of ADP are forecast to have added 430,000 employees in September.

ADP and NFP

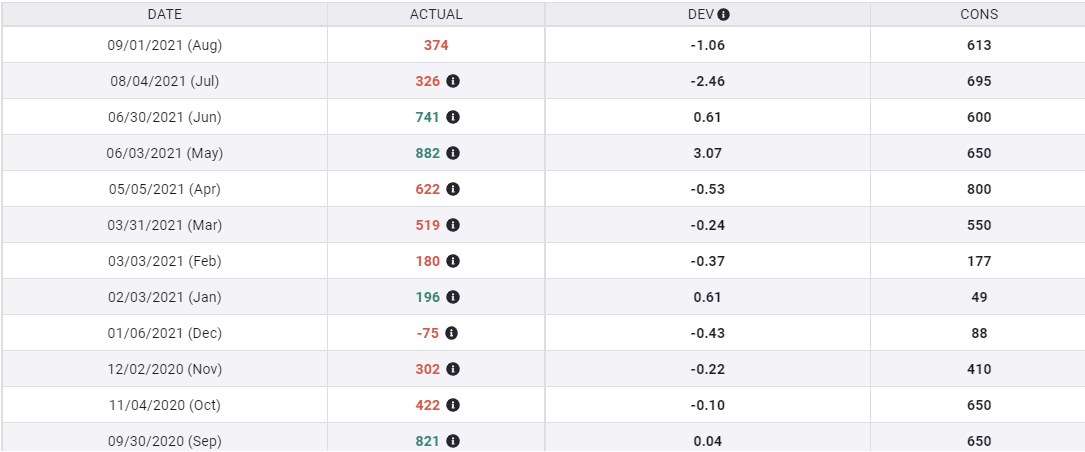

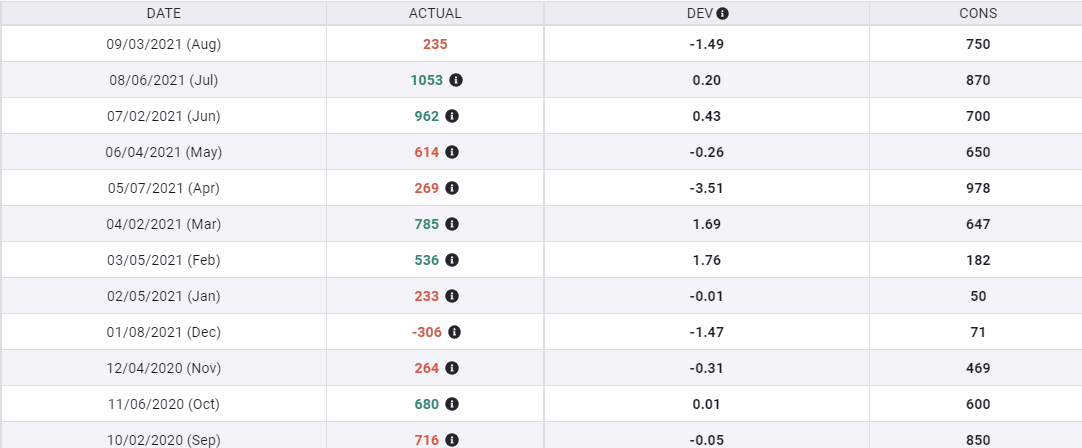

Over the past six months markets received no warning from the ADP numbers that national Nonfarm Payrolls were going to be substantially different from the consensus forecasts.

In April, NFP was projected to increase to 978,000 from March’s 785,000. Instead, the economy delivered just 269,000 new positions. The ADP Employment Change Report that month rose to 662,000 from 519,000.

ADP

In July, NFP rose to 1.053 million, the best total since August 2020, from June’s 962,000. In contrast, the ADP July figure tumbled to 326,000 from 741,000.

Finally, last month, US payrolls fell by 818,000 to 235,000. The ADP result for August rose slightly to 374,000 from the above 326,000.

NFP

FXStreet

Looking at the relation another way, in the five changes over the last six months, NFP and ADP have moved in the same direction once, in May.

Over longer periods the trend correlation between the NFP and ADP is quite good. Both reports plunged in April 2020 and saw extensive rehiring in the following three months and each dipped into the negative last December.

US labor market

The US labor market has been presenting some puzzling statistics for several months.

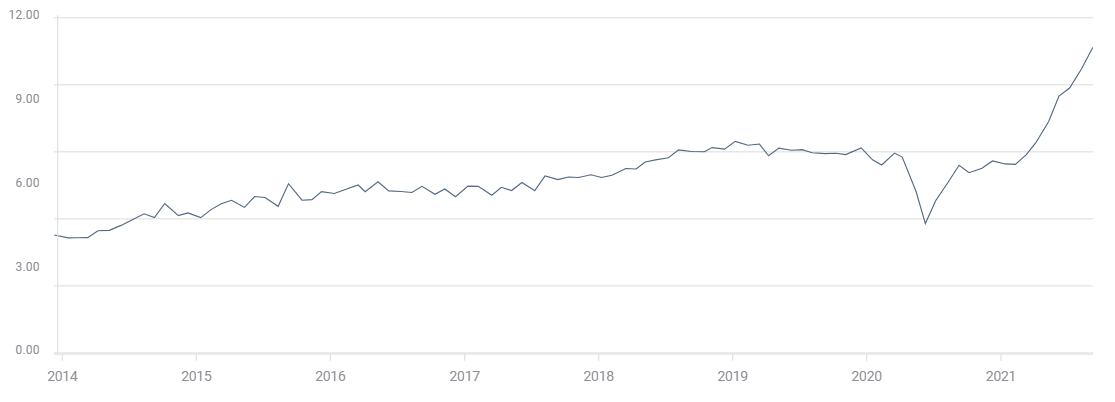

Chief among the discrepancies unanswered by standard analysis has been the record number of jobs on offer, almost 11 million in July, compared to August's anemic hiring of 235,000.

Job Openings and Labor Turnover Survey (JOLTS)

FXStreet

Initial Jobless Claims present another contrast. Despite the huge number of unfilled positions, the weak hiring in August and the expected mediocre NFP for September, Initial Jobless Claims have increased for three straight weeks. Requests for jobless benefits have gone from 312,000 in the week of September 3, a pandemic low, to 362,000.

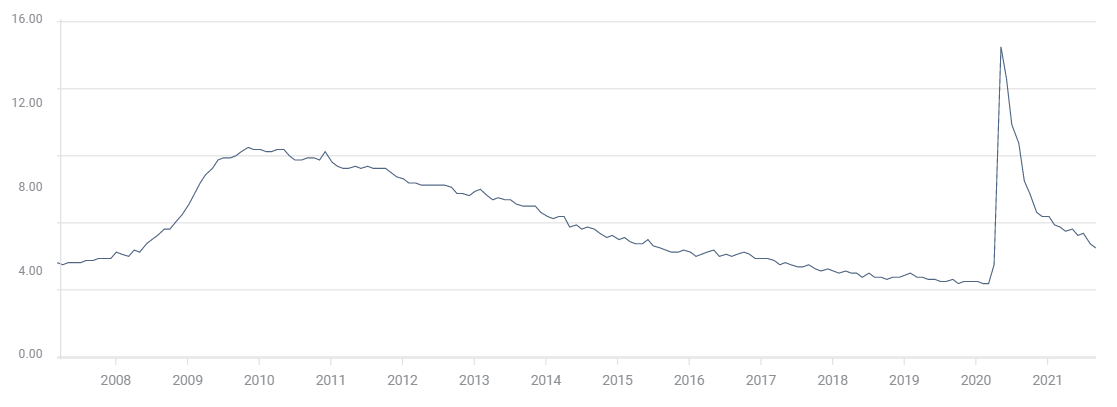

Another oddity is the unemployment rate. Ignoring the variation in hiring this year, the U-3 rate has fallen every month from 6.3% in January to 5.2% in August.

US Unemployment Rate (U-3)

FXStreet

One explanation for the apparent reluctance of workers to return to their jobs has been the extended federal unemployment benefits granted by the Biden administration. Those supplemental payments expired in the first part of September, so a large return to work might be expected. Yet the consensus NFP estimate is just 450,00, hardly a wave.

Perhaps the best answer is that the pandemic and its responses have presented such a novel economic situation that the standard statistics, their indications and analysis, have been able, at best, to give only a partial picture of what is occurring in the labor market.

Conclusion: Tapering when?

Markets are waiting for the US central bank to confirm its bond program taper. Anything that points in that direction will support Treasury rates and the dollar.

Labor market conundrums may be interesting to economists but markets trade on traditional information and its impact on policy.

The Fed may be uncertain about the advisability of extended unemployment insurance. The governors may not understand why more people have not returned to work, or whether rising wages will attract workers.

They do know that strong NFP results will make the taper far easier to explain and justify.

The ADP report may not be a reliable indicator for US payrolls, but as in the newspaper cliche, sometimes you have to go with what you’ve got.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.