Uncertainty underpinned USD on Friday [Video]

![Uncertainty underpinned USD on Friday [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/EURUSD/euro-gm510173052-86141121_XtraLarge.jpg)

The uncertainty over US fiscal stimulus and Brexit, and also rising new virus cases deteriorated the market mood. That’s why we can expect the further rally of the US dollar and the fall of riskier assets today.

Fundamentals

-

The market is waiting for some progress in fiscal stimulus talks between Democrats and Republicans. House Speaker Nancy Pelosi claimed that the stimulus package should be unveiled until January as she is going to have a meeting with Treasury Secretary Steven Mnuchin. Donald Trump proposed $1.8 trillion.

-

The US data came out mixed yesterday. Philly Fed Manufacturing Index was 32.3, better than the forecasts of 14.4. At the same time, unemployment claims rose more than analysts anticipated, signaling problems in the labor market.

-

The Brexit deadline has been prolonged. EU-UK negotiations continue, but it hasn’t been still any progress.

-

The fresh Covid-19 outbreak in Europe has forced countries to tighten up restrictions.

Technical tips

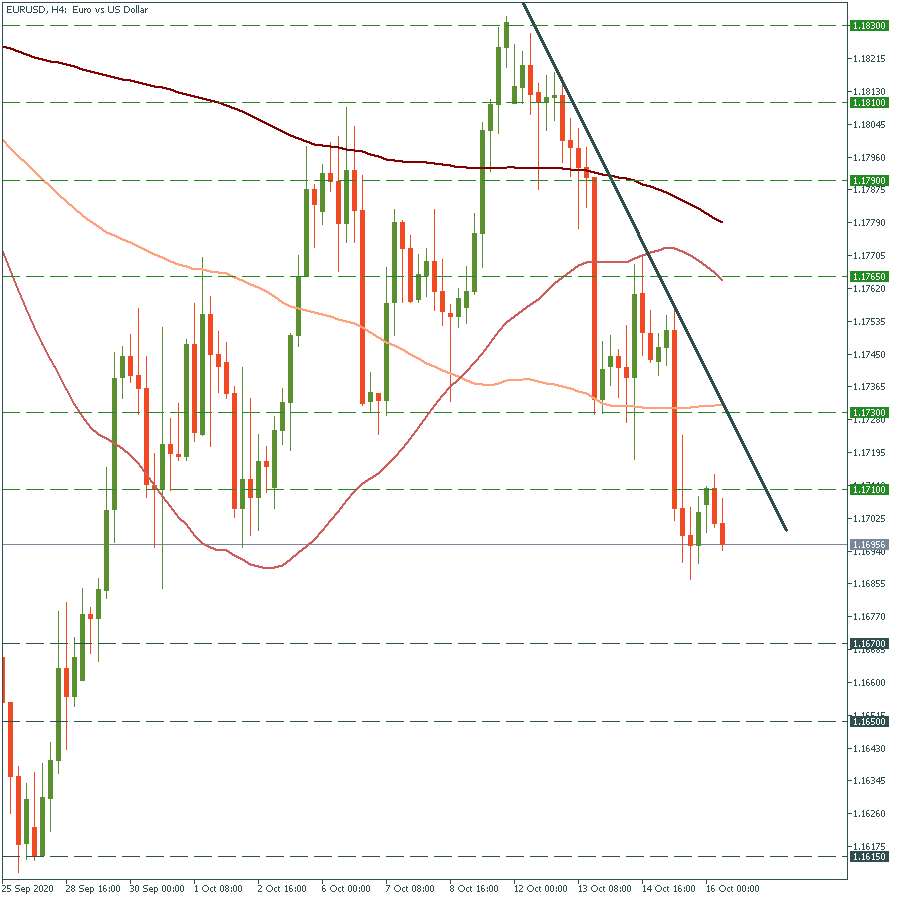

EUR/USD

EUR/USD is edging lower. According to UOB, the pair may drop to 1.1650 in the short term. Watch out for the breakout of the low of September 29 at 1.1670 as it will open doors towards the support of 1.1650. On the flip side, if it retests 1.1710, the way to the 100-period moving average of 1.1710 will be clear.

Gold

XAU/USD is trading inside the ascending channel. It’s moving down, but it’s likely to reverse from the intersection of the lower trendline and the $1 900 level. The move above yesterday’s high of $1 910 will drive the yellow metal to the 200-period moving average of $1 917. Support levels are $1 890 and $1 875.

GBP/USD

The British pound is falling amid Brexit uncertainties. However, the 23.6% Fibonacci retracement is strong enough to constrain the further falling of the pair. If it manages to break it, the way to lows of late September at 1.2820 will be open. Resistance levels are 1.2980 and 1.3000.

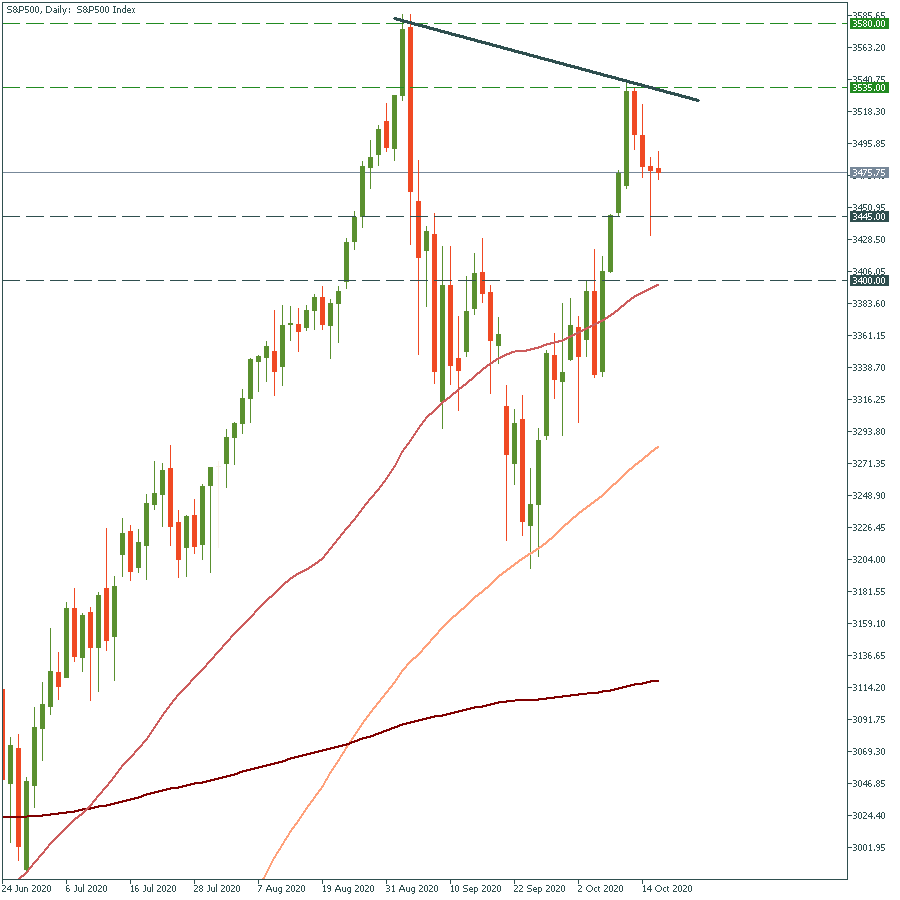

S&P 500

S&P 500 is forming a cup & handle pattern. If it breaks the resistance of 3 535, the way to the all-time high of 3 580 will be clear. After that it’s likely to rally further. However, today’s mood isn’t favorable to risk, so it’s better to keep an eye on the chart to catch the price movement up. Support levels are 3 445 and 3 400.

Author

FBS Team

FBS

FBS team is a group of professional analysts focused on Forex, stock, and commodity markets. Each expert possesses a years-long experience in fundamental and technical analysis.