UK jobs market stable despite growing pessimism

The latest jobs data is relatively solid, even if the outlook is looking increasingly shaky. Redundancy levels are low, but the major risk is that begins to change ahead of tax hikes in the spring. A cooler jobs market should help wage growth come gradually lower as the year goes on.

An air of pessimism is befalling the UK jobs market right now, ahead of a sizeable increase in employer’s National Insurance (social security) in April. The surveys on hiring are turning increasingly sour and there’s growing talk of redundancies as firms grapple with the combined hit of tax hikes and a near-7% increase in the National Living Wage. Bank of England policymaker Catherine Mann, explaining her vote for a bumper rate cut this month, spoke of “non-linear” falls in employment.

Despite that gloomy backdrop, the hard numbers on the jobs market currently don’t look so bad. Unemployment is broadly stable, though remember this data is highly dubious right now. But even the supposedly more reliable payroll-based numbers were more stable in January. The steady 1% fall in those numbers across 2024, once government-heavy sectors are excluded, stalled last month. More importantly, there’s no discernible increase in redundancies. So-called HR1 notifications, which companies are required to submit to the government if they are planning layoffs, are bouncing around their lows. The major question is whether that changes as the tax and Living Wage changes come through in the second quarter.

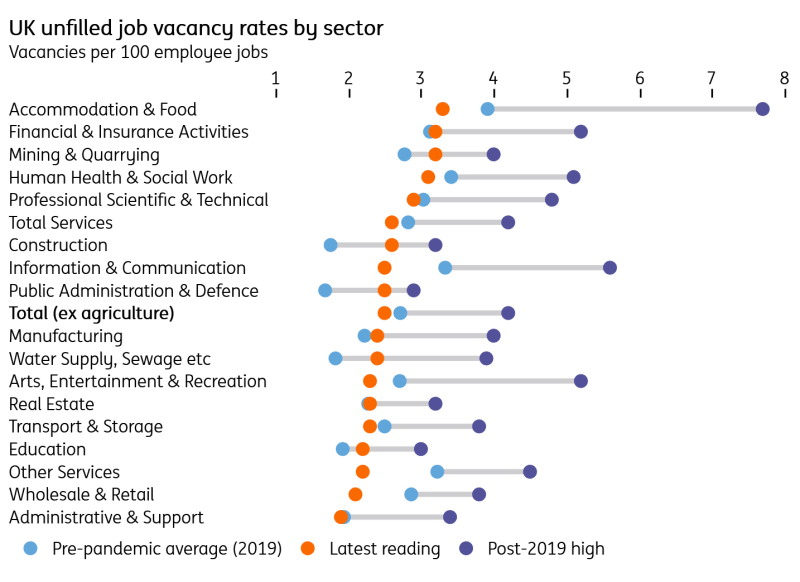

That’s not to say the jobs market hasn’t cooled materially, though. Vacancies have fallen steadily over the past couple of years, back to pre-Covid levels. On a sector basis, vacancy rates in the likes of retail and hospitality are well below the levels seen in 2019. And that makes it all the more puzzling that wage growth is still up around 6%.

Vacancy rates below pre-Covid levels in consumer services

The National Living Wage can explain some of that. According to payroll data, wage growth is strongest for those at the 25th percentile of the income spectrum. Some have argued that this is ‘ratcheting’ up the pay scale within companies, though we’ve not seen a huge amount of evidence of that beyond the strong overall wage growth figures.

Either way, with the jobs market weakening, if not in complete freefall, pay growth should slow gradually this year. The Bank of England’s Decision-Maker Panel survey points to wage growth falling below 4% over coming months. We don’t think we’ll see that in the official numbers this year, but we suspect we’ll end the year somewhere around the 4.5% area.

If we’re right – both about that and a more material fall in services inflation through the spring – then this should give the Bank more confidence to keep cutting rates. We think the path of least resistance is for four rate cuts in total this year, or once per quarter.

Read the original analysis: UK jobs market stable despite growing pessimism

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.