Tick tock: July 9th deadline approaches fast

The week starts with renewed pressure on oil prices as OPEC decided to ramp up its production restoration plans by announcing an additional 548,000 barrels per day—well above the 411,000-increase expected. Members also said they will do the same at their September meeting. Hence, the 2.2mbpd restriction that was put in place in 2023 will be fully restored a year earlier than initially planned. There will then remain a separate tranche of 1.6mbpd in capacity—representing additional voluntary cuts by key members—before the supply cut strategy is entirely unwound.

Given that the cartel has shifted from a strategy of supporting oil prices to one focused on regaining market share, there’s little reason for them to hold that strategy in place any longer. Funny enough, the reason for faster oil restoration is ‘a steady economic outlook and current healthy market fundamentals.’ But of course, that view is questionable in the context of intensifying global trade tensions, which have led several leading institutions—including the OECD and World Bank—to revise their growth forecasts lower.

Regardless of their reasoning, the additional barrels will swell oil supply prospects for the second half of the year and inevitably weigh on prices. The knee-jerk reaction to the OPEC news was relatively soft, though. A decision of this size could’ve easily sent the barrel of US crude below the key $65 per barrel support—marking the 38.2% Fibonacci retracement level on the YTD decline and a strong support during the latest geopolitically-led spike. But the barrel of US crude opened near $66pb, briefly dipped below it, and has since been recovering early losses at the time of writing—perhaps on ongoing Middle East tensions and partly on expectations that lower prices will further pressure US shale production. As the cost of producing shale oil ranges between $50–$70pb depending on location, current levels mean some production may no longer be viable, limiting supply increases. But supply will still rise—from producers with significantly lower costs—which inevitably opens the door to cheaper oil. As such, price rallies offer interesting opportunities to sell the tops. Solid resistance is seen in the $68–$68.70 range, which includes July’s resistance and the 200-day moving average. Unless we see a fresh flare-up in Middle East tensions, bears are likely to return gradually.

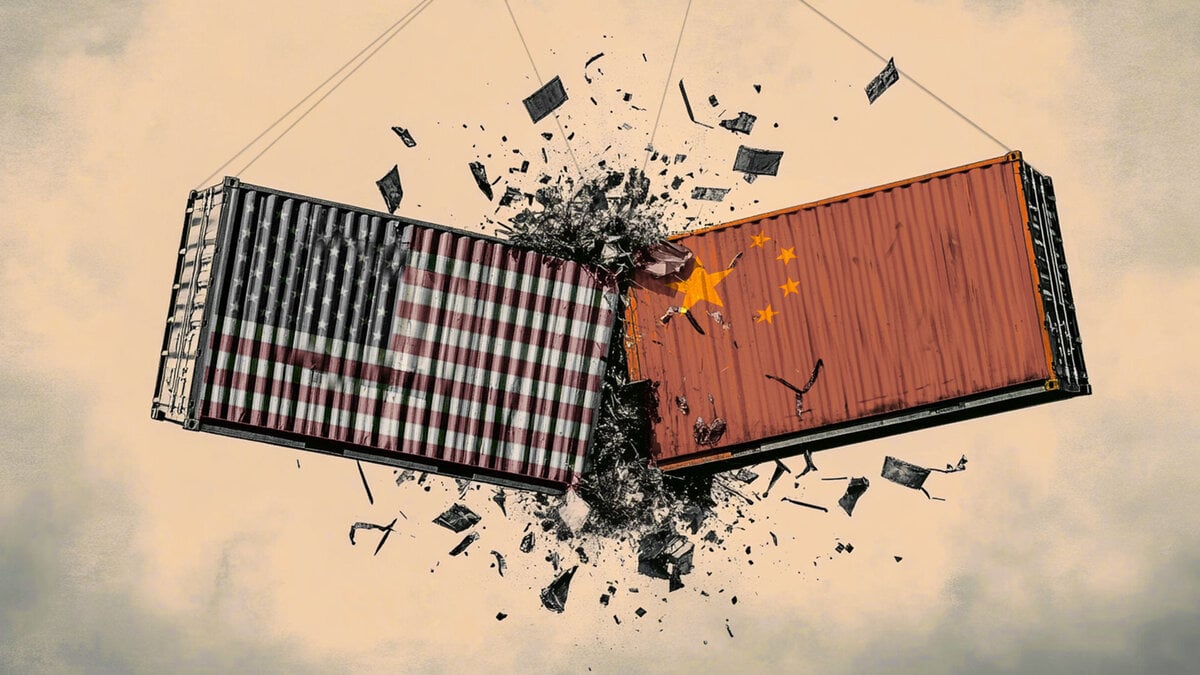

On the trade front, the weekend was packed with negotiations as the July 9th deadline approaches fast. Within two days, the Trump administration is expected to announce its tariff decision for trading partners. Bessent said some countries will receive a three-week extension. But you can never be sure that what’s said now will still be true a minute from now. And you can’t count on the tariffs announced in the next few hours staying unchanged for more than a day. That’s just the reality—and the latest headlines aren’t pointing to a smooth ride.

The BRICS meeting took place over the weekend, and Trump threatened to slap an additional 10% tariff on countries that choose to align with them. As such, the trade drama is probably not going away anytime soon. That uncertainty will continue to cloud visibility. Any disappointment or renewed volatility could easily dent appetite across equity markets—some of which trade near all-time highs without a fundamentally solid basis. The announcement of trade deals, on the other hand, could fuel a short-term rally—until earnings season tells the real story behind the tariffs. And that story might turn out gloomier than what the FOMO and TACO trades suggested in Q2…

Asian traders kicked off the week cautiously. The Nikkei is under pressure below the 40K mark, and the CSI is offered below 4000 on the back of rising EU–China tensions. US futures are in the red this morning, while European futures are slightly better bid. The S&P 500 closed last week—shortened by the holiday—at a fresh record high, the SXXP slipped below its 50-day moving average and tested the 100-day. Let’s see what kind of political meat Trump tosses on the grill this week—we’ll either get a juicy jump or a bad slump.

In FX, the US dollar is better bid despite trade tensions, and gold has slipped below its 50-DMA despite rising uncertainty. The EURUSD is consolidating below 1.18, while USDJPY is testing the 145 level, with yen bears emboldened by weaker-than-expected wage growth in May. The AUDUSD is one of the most heavily hit majors this morning—a day before the Reserve Bank of Australia (RBA) is expected to announce another 25bp cut to support the economy amid global uncertainty and slowing Chinese economy. The Reserve Bank of New Zealand (RBNZ), however, is expected to remain on hold when it meets this week.

Elsewhere, the Federal Reserve (Fed) minutes may offer insight into how the Fed is not considering rate cuts when jobs data remain strong and the inflation outlook remains uncertain. Meanwhile, the UK is set to announce a second consecutive month of GDP contraction for May, following last week’s Labour Party drama, which triggered a short spike in long-dated gilt yields. More broadly, it’s important to watch long-term bond yields, which have been drifting higher since early July—and could be preparing the ground for a broader risk-off move if upcoming data and headlines disappoint.

Author

Ipek Ozkardeskaya

Swissquote Bank Ltd

Ipek Ozkardeskaya began her financial career in 2010 in the structured products desk of the Swiss Banque Cantonale Vaudoise. She worked in HSBC Private Bank in Geneva in relation to high and ultra-high-net-worth clients.