The UK is screwing up politically even worse than the US

Outlook:

Today we get the leading indicators, Q2 current account, and the University of Michigan preliminary Sept consumer sentiment and inflation expectations. We blow off the U Mich surveys—they use a tiny base of less than 25,000 persons, making you wonder why they are so respected. (The reason is first-class statistical technique. Also of questionable value is the current account, which includes capital flows as well as trade. Traders just don't watch this one, although a big enough rise in the deficit might be dollar negative and set off that "twin deficit" jibber-jabber again.

The explanations for the dollar's behavior since the Powell press conference are so twisty and turny that even an old hand is bewildered. One narrative has it that the Fed was indeed more dovish but not extremely more dovish, which was needed to keep those already short dollars staying short and going shorter. If there is no compelling reason to sell, maybe you should buy, and that accounts for the dollar's gains overnight Wednesday and into Thursday. Well, plausible, and that is how some traders actually think, but is it the majority? Well, maybe. Traders wanted curve control, and that entails a distribution of QE to the long end. There are, however, factors.

Here's another idea: the UK is screwing up politically even worse than the US. The US will get another stimulus bill, but there's almost no way out for the UK of the clash between the domestic protection bill and the Withdrawal treaty. Boris can tap dance all he wants, but a hard Brexit is all but assured. An EU official said a deal is still possible that drove sterling up for a while, but in the end, Boris' idea of brinkmanship is not a good one. Add to that the BoE thinking about thinking about negative rates, and sterling doesn't have a prayer. If you must sell sterling but also have a EUR/GBP position, why not sell both of them and get into dollars?

In a word, professional big bank re-positioning, at least in the moment. The dollar is not always the beneficiary of repositioning, of course, but all the ducks lined up this time. It's still just positioning, not a trend change based on fundamentals or shift in risk perception. Even so, we sniff a shift in risk perception. Event Risk is perhaps already starting to favor the dollar, and if not this time, next time. The far-seeing expect some Trumpian shenanigans in the form of an October Surprise. Because Trump's Shocks so often involve other countries and all other countries have currencies, it's not a stretch to think a rise in risk aversion arising from Trump should favor the dollar. The drawback to this story: it hasn't happened and there is no consensus on what it might be. We still think China is Trump's trump card but all is quiet on that front so far.

But bottom line and to return to the immediate short-term (1-3 days), on what planet is it a good idea to buy a currency with a negative real return issued by a government whose debt-to-GDP is going well over 100% and led for the next four months by an incompetent, repulsive liar? And that negative real return will last at least three and probably four years and be getting more negative all the while (as inflation does indeed come back)? We have other places with negative real return and a bad debt-to-equity ratio, namely Japan, but Japan has long-term plans and competent management. Then there's the ever-wary Germany restraining the eurozone from getting too high a debt-to-GDP ratio, somewhat offsetting the existing negative return but also facing economic contraction from Brexit, although probably less than the contraction the UK will get with hard Brexit. So both Japan and the eurozone can be judged neutral on this matrix, while the US and UK are getting more negative by the day. By this reasoning, the yen and euro "should" be on the upswing.

Or maybe we are going to get synchronized debasement of every currency and should just go back to gold and barter, less inefficient now that we have the internet (if we can only keep the lights on).

Finally, there's that US debt. The Treasury TICS report on capital flows came out the other day and got no press at all. The report itself is impossible to read unless you have many hours to devote it to (or can move the data into your own spreadsheet that actually makes sense). Luckily, Wolf Street offers this summary and some dandy charts. Read that title—"Who bought the $3.3 trillion in new debt since March?" In the 12 months through February, we added $1.4 trillion to the debt. In the next six months to July 31, we added another $3.3 trillion for a total of $25.8 T. In 2012, it was a little over $15 T.

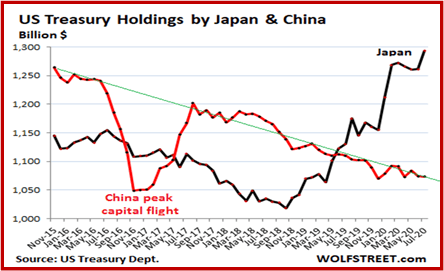

Here goes: foreign investors now hold $7.087 trillion but this keeps their share pretty much the same as the year before at 26.7%. Japan has $1.29 T and is adding steadily. China has been cutting its holding to $1.29 trillion as of July, something it has been doing since 2015. Japan and China together hold 8.9% of total US debt.

The next ten foreign holders are London, Hong Kong, Luxembourg, Switzerland, the Caymans—all fronts for Middle East oil money and other nefarious types. Real countries with US holdings are Brazil, Taiwan, India and a few questionable ones like Ireland (think Apple) and Belgium. WoldStreet notes that Germany and Mexico, two countries with a big trade surplus with the US, don't make the top ten list. The rest of it is Us--Social Security, pension funds, commercial banks, insurance companies, hedge funds, some rich individuals, and miscellaneous cash-rich corporations—and oh, yes, the Fed. See the breakdown:

Well, so what? Again we have to fall back on Keynes—when demand is low and low interest rates fail to goose activity, it's the job and duty of government to bridge the gap. Government spending creates jobs that have a multiplier effect, although these days we have to exclude restaurants and bars. Whether you like it or not, and the Bundesbank does not like it, that has become so much the standard recipe that its grotesque stepchild, "modern monetary theory," says we no longer have to care about debt-to-GDP—it can be any number we like, as long as the vast majority of the debt buyers are domestic.

The "twin deficit" millstone is about to be hung around the US' neck in the coming months. It's a big negative especially in the context of vast money supply increase and a central bank that declares it's on hold for the next three years. We are not looking forward to a replay of the twin deficit story—we already did it and all the arguments are already known, if you're old enough and have a good memory. Far more interesting is China's launch of the effort to replace the dollar, at least in the region, for trade and a reserve currency. Since China can engineer the exchange rate and has the tailwind of the only fully recovering economy in the world, it has a chance. As noted before, it can be only a limited success because of capital controls and liquidity, but it's a Real Change.

Tidbit: In China, the yuan is firmer yet again today for the 8th week in a row, with this week delivering the biggest weekly gain. Yes, China has a big yield advantage over the US, but in the absence of free capital movement and liquidity on a par with the US, that reason can't stand alone. It's logical to deduce China wants a strong currency, presumably to attract trade financing in the local currency to replace the dollar. See the weekly chart. If that's a double top, the neckline is broken and there is no floor (and don't expect a dead cat bounce).

All this combined goes toward a forecast of a falling dollar again, if in fits and starts because of the oversold condition, unless and until we get a Shock that raises the dollar as safe-haven.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat