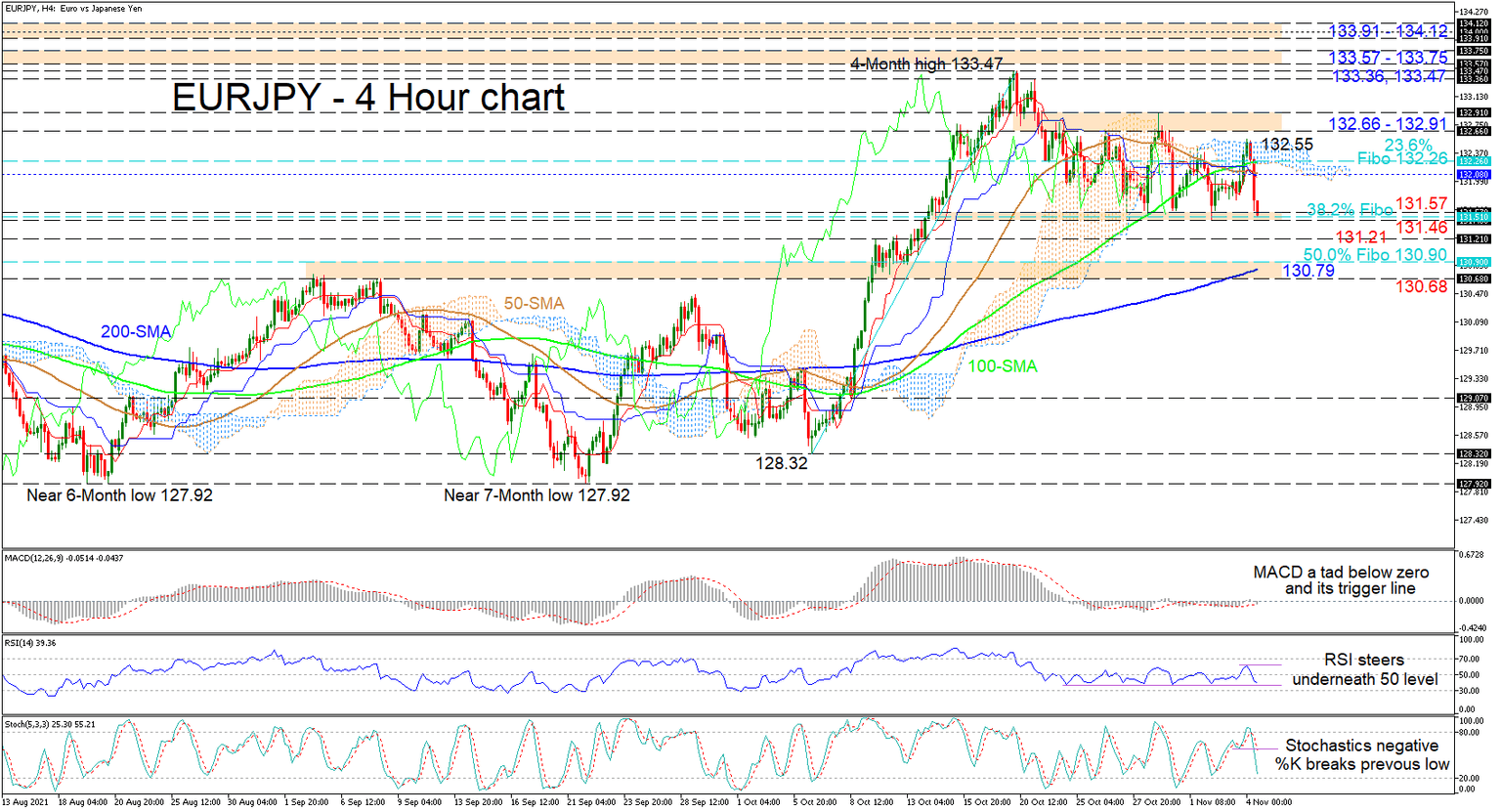

Technical analysis: EUR/JPY range bound after rally retraces below 23.6% Fibonacci

EURJPY is testing the 131.46-131.57 base of the 10-day consolidation, which is fortified by the 38.2% Fibonacci retracement of the up leg from 128.32 until the four-month high of 133.47. The pair glided into a sideways market after the rally that began off the 128.32 level surrendered some ground from the 133.47 peaks. Currently, the 50- and 100-period simple moving averages (SMAs) are not endorsing any clear price trend.

The short-term oscillators are showing that sellers are in command. The MACD is slightly beneath zero and its red trigger line. Further promoting negative price action in the pair, is the strong negative charge of the stochastic oscillator, and the RSI, which is falling in the bearish zone.

If positive impetus remains feeble, instant downside limitations could arise from the hardened floor of the trading range from 131.57 until 131.46. If sellers manage to drive the price beneath this key boundary, the price may then meet the 131.21 low before tackling another critical zone of support existing from the 50.0% Fibo of 130.90 until the 130.68 barriers, an area reinforced by the 200-period SMA at 130.79.

Alternatively, if buyers re-emerge and gain traction off the 131.46-131.57 foundation, an initial tough section of resistance could develop from the blue Kijun-sen line at 132.08 until the 23.6% Fibo of 132.26. Pushing past these multiple barriers, the 132.55 high may hinder the price from challenging the 132.66-132.91 resistance ceiling. However, conquering this, the price could propel towards the 133.36 and 133.47 peaks. From here, buyers would need to muster a more profound push to overcome the nearby resistance band of 133.57-133.75 to tackle the 133.91-134.12 obstacle, that being an area of highs identified at the beginning of June.

Summarizing, EURJPY is still neutral around the upper part of the rally despite sellers currently possessing the upper hand. A break below the 131.46-131.57 floor could boost the negative trajectory, while a jump above the 132.91 high may see buoyancy in the pair's return.

Author

Anthony Charalambous joined XM in 2019 and specializes in preparing daily technical analysis, using his years of trading experience to provide detailed forecasting for all major asset classes such as forex, indices, commodities and equities.